The Dow, created in 1896 by Wall Street Journal editor and Dow Jones co-founder Charles Dow…[and] named after he and his business associate, statistician Edward Jones, is comprised of 30 large American companies.

Which Companies Are In It?

…When it was first introduced, most of the companies listed in the index were from traditional heavy industries. Today, although [the] Dow Jones Industrial Average maintains the word “industrial”, the companies which comprise it have little or nothing to do with heavy industry.

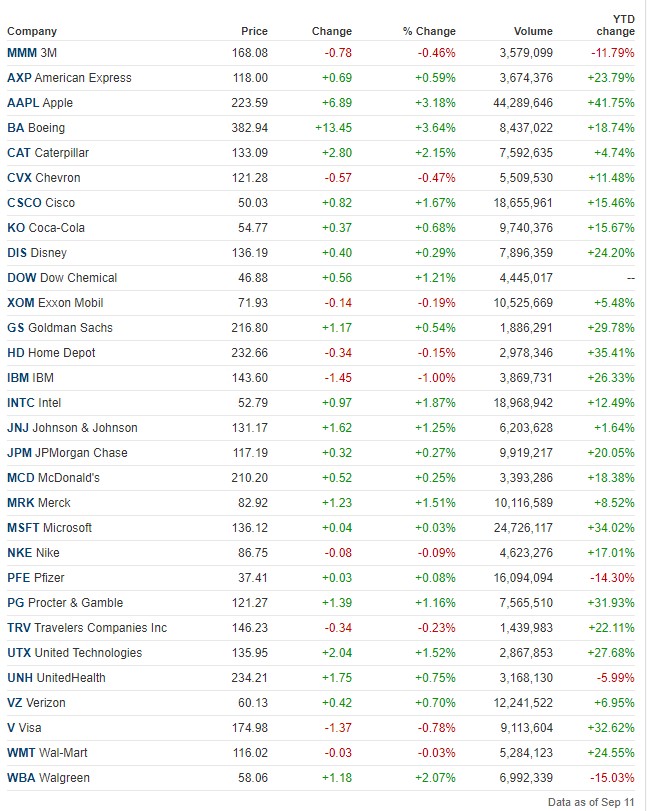

These are the 30 companies which currently make up the DJIA:

How the Dow Jones Industrial Average is Weighted

The industrial average is the sum of the price of one share of stock for each company listed on the index and, as such…does not represent the market capitalization of the companies listed in it and, therefore, is not an accurate representation of the U.S. market as a whole. Whenever one of the stocks has a split or dividend, the sum is recalculated in order to produce a consistent value for the overall index.

Since the DJIA only lists 30 companies, many critics argue that is not an accurate representation of the overall market compared with other more inclusive indexes. Another criticism is that since the DJIA is price-weighted, this gives companies with higher stock prices more influence than their lower-priced counterparts…

As all of the components of the DJIA are blue-chip stocks…the index is largely shielded from small fluctuations and market movements. This makes it one of the best references for financial activity…

The above excerpts from the original article by Gil Ben Hur have been edited ([ ]) and abridged (…) for the sake of clarity and brevity.

Related Articles From the munKNEE Vault

1. Comparison of Past & Present Performance of Dow Is Meaningless! Here’s Why

Every time the number of, or specific constituent, companies change in the Dow index any comparison of the new index value with the old index value is impossible to make with any validity whatsoever. It is like comparing the taste of a cocktail of fruits when the number of different fruits and their distinctive flavours – keep changing. Furthermore, because of the application of the ever changing Dow Divisor, we are always comparing a basket of today’s apples with a basket of yesterday’s pears.

2. S&P 500 & Dow 30 Index Performances: Illusion vs.Reality

The Dow Jones Industrial Average is a fabricated number that has little relation to the actual average performance of the stock market as a whole. For sure, it is not industrial in nature, and by no means is it an average. It’s like creating an all-star team of the very best-performing companies and broadcasting to the world that this is the average of all companies out there.

3. Take Note! The Dow 30 Was Injected With Steroids On Sept. 23rd

The Dow 30 is deceptive in what it purports to represent. The manipulation of its performance has been going on since 1928 and it gets further denigrated on September 23rd with a 3 constituent swap which will, in effect, assure that it continues to rise in the long term.

Do you know how to use the different stock indexes? The Dow, NASDAQ and S&P 500 indexes are 3 of the best measurements of trading activity and give investors a clear picture of the overall health of the economy. Each represents a different type of index, calculated and tracked in their own way, reporting real time movements of stock price and market capitalization. I created this infographic to demonstrate the unique features of these indexes and how they can help you along in investing.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money