In response to a recent request to identify the best one investment that provides acceptable growth without incurring unreasonable risk we applied our proprietary algorithms based on our unique ZYX Change Method and came up with a relatively unknown equity that warrants serious consideration for inclusion in your portfolio. Words: 454

So said Nigam Arora (blog.thearorareport.com) in an article* posted on Seeking Alpha which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Arora went on to say, in part:

Using our proprietary alogoriths we looked at the following:

- Economic data from 23 countries

- Macro trends

- All major currencies

- All major commodities

- Geopolitical considerations

- Technology/Science developments

- All major industries

- 3000 U.S. stocks

- 1000 International stocks and

- Trends in bonds all over the globe

and came up with what we feel is that one such investment, namely, PowerShares S&P 500 Low Volatility Portfolio ETF (SPLV).

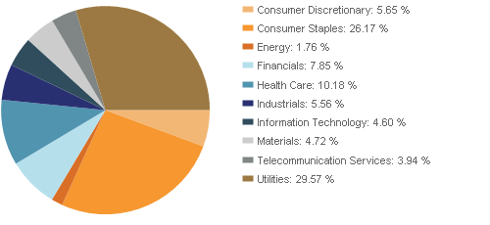

The S&P 500 consists of 500 stocks and SPLV consists of those 100 stocks out of the 500 that have realized the lowest volatility over the past 12 months. In this market environment, low volatility roughly equates to lower risk. The ETF automatically rebalances every quarter.

click to enlarge

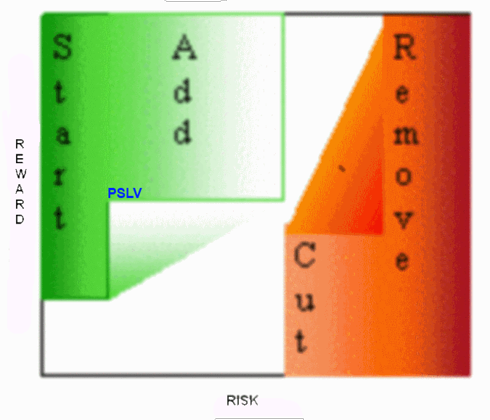

If we enter a roaring bull market based on renewed economic growth in the United States, SPLV should perform well. On the other hand, if the market deteriorates, we will be in a very defensive position. In the current environment, this is a defensive way to generate alpha, i.e., excess return without taking excess risk.Our main concern is earning excess risk-adjusted returns, i.e., we want to earn returns above the fair compensation for the risks we have undertaken. Using the ZYX Change Method, the following diagram shows the risk/reward ratio.

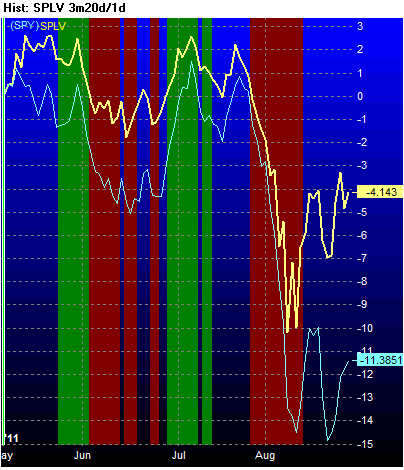

The chart below compares the price action of SPLV with SPY which holds all 500 stocks in the S&P 500 index. The reader can readily see that in this downturn, SPLV has outperformed SPY by about 7%.

*http://seekingalpha.com/article/290664-splv-the-best-equity-etf-for-these-volatile-times?source=kizur

Related Article by Nigam Arora:

1. What Should a Prudent Gold Investor Do Now?

We are in an environment where gold bugs boldly proclaim that gold is going to the moon, and gold bears strongly protest that gold is in a bubble. At such a heated stage, this article attempts to answer the question, “What is a prudent investor to do now?” Words: 575

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money