The Real Driver of Gold Prices Is Negative Real Interest Rates

The return of the Euro debt contagion and drop in the bond markets across the world is pushing interest rates higher and it has investors concerned and rightly so – and nowhere has the concern been more prominent than in gold. [Let me explain.] Words: 759

So says Andrew Mickey (www.q1publishing.com) in an article* reformatted and edited […] below by Lorimer Wilson, editor of www.munKNEE.com, for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Mickey goes on to say:

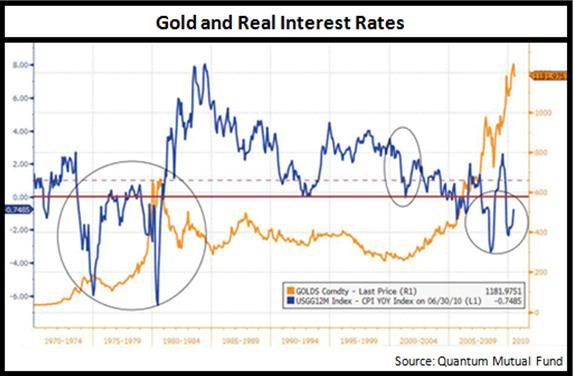

The real driver of gold prices is, has been – and will be – negative real interest rates, i.e. nominal interest rates minus inflation [See here for more on the subject]. Central bank policies of inducing negative real rates to incentivize borrowing (you get paid to borrow), keep money supply expanding, and devalue currencies have forced investors into real assets like gold and silver. It has happened before and it’s happening again [as the graph below reveals]:

Nominal rates have stayed very low throughout the last couple of years and are so low that real interest rates are negative [but] that is starting to change as interest rates are back on the rise. At this point, with gold nearing new all-time highs once again, it is a prudent move to investigate whether the recent rise in rates could slow the gold bull or completely stop it in its tracks.

The Backdrop: QE2 Backfires, Rates Rise

Rates across the board have been on the rise since the Fed announced its latest round of quantitative easing.

a) The yield on the 10-year U.S. Treasury bond climbed from 2.40% to a recent high of 2.90% – a relative rise of 20.8%.

b) The junk bond market has fared even worse. The yield… has increased from a 52-week low of 10.2% to 13.9% – a relative 36% increase.

c) Muni bonds have been hit too. Merrill Lynch reports the yield investors expect on short-term muni debt has climbed from 2.4% to 3.2% – a relative increase of 33%.

In a gold bull market which has been fueled by negative real rates, conventional thinking would suggest rate increases would, at the very least, halt the rise of gold as the negative real rates get closer to turning positive. History, however, actually says the exact opposite is true. [For more on the subject – it is called Gibson’s Paradox – read this article.]

Rising Rates: A Symptom of Inflationary Disease

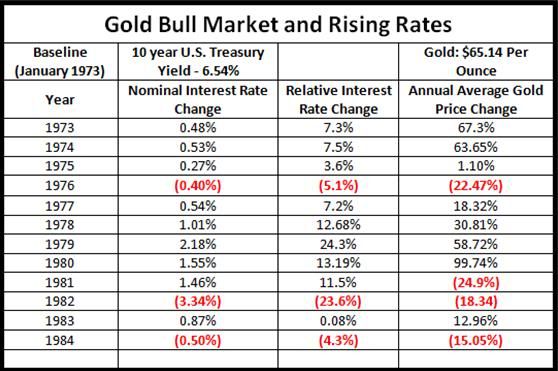

The gold bull market of the 1970s was dominated by inflation. Interest rates rose steadily to keep up with it, but real interest rates were mostly negative the entire time. The table below shows how rising rates coincided with rising gold prices:

In 13 of the 14 years tracked both interest rates and average gold prices rose. The only exception was 1981 which came after a year when average gold prices nearly doubled.

This time around we’re seeing a very similar situation. The 10-year Treasury bond yield has increased 30% and gold prices have climbed 55% since treasuries yields bottomed out in December 2008. That move is strikingly similar to 1979 when rates increased 24.3% and gold rose 58.72%.

Conclusion

At the risk of saying “this time is different” though, it really is. There’s no incoming Fed chief with plans of whipping inflation now (in fact, they’re taking steps to do the exact opposite) and the political will to induce a recession that would drive housing prices to their natural levels, put an end to the stock rally, destroy the bond market, and likely bottom out near the next election, is non-existent. So if you’re concerned about the recent rise in rates – which you should be.

Rising rates are not good for stocks, bonds, or the economy [BUT] when it comes to the gold bull market, however, interest rates are likely a symptom of growing underlying inflation and, if history is any example, their rise will coincide with gold.

Every few decades the right conditions come along to make an absolute fortune in gold and gold stocks. Right now the conditions are right!

*http://www.aheadoftheherd.com/Articles/What_Do_Rising_Rates_Mean.htm

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money