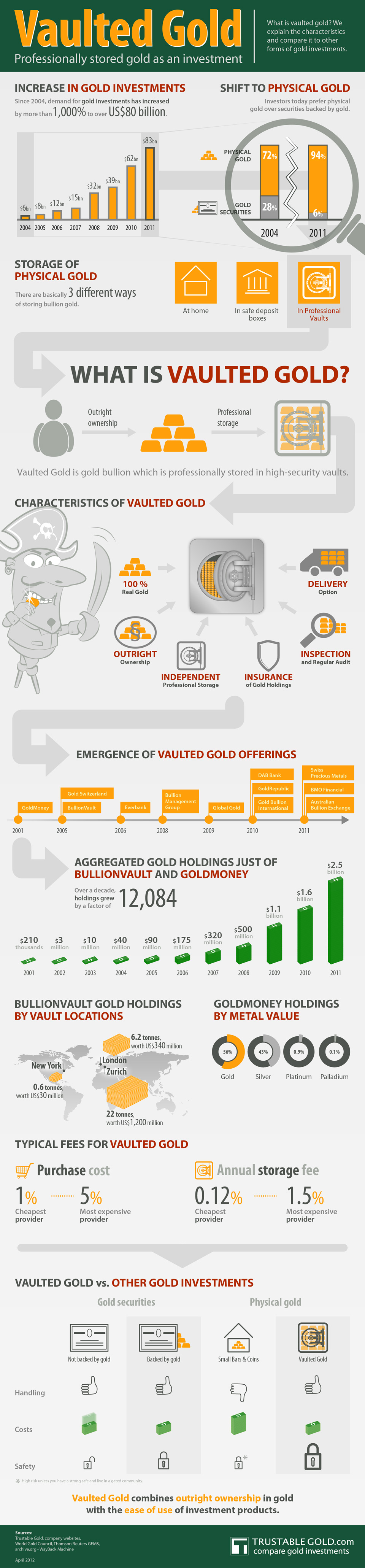

The infographic below on vaulted gold explains what vaulted gold is and visualizes key facts relating to investments in gold that is stored on behalf of investors in high-security vaults.

Below is an infographic from www.trustablegold.com for your viewing pleasure as presented by www.munKNEE.com – Your Key to Making Money!

*http://www.trustablegold.com/vaulted-gold-infographic/

Editor’s Note: Ian Campbell, author of a daily series of articles in which he challenges every reader to “think for yourself’ (see links to several of his articles below), has brought to my attention that “the charts that show the $ amount said to be invested in ‘gold investments’ (which I have taken to mean investment in a combination of physical gold and gold securities), and the % shift in those funds invested in physical gold and funds invested in ‘gold securities’, [as shown below,]… can lead one to wrong conclusions without careful thought.

An instant reaction to the chart on the right might be:

- wow, a lot of the money people were investing in gold securities in 2004 was transferred to physical gold by 2011, when

- calculations based on the numbers and %’s shown in the above two charts that of the $6 billion said to be invested in gold in 2004 $1.7 billion was invested in gold securities and $4.3 billion was invested in physical gold, while of the $83 billion said to be invested in gold in 2011 $5.0 billion was invested in gold securities and $78 billion was invested in physical gold.

A further way, then, of looking at these numbers in % terms, is that investments in:

- gold securities increased by 294% (2.94X) – (5.0/1.7), and

- in physical gold increased by 1813% (18.1X) between 2004 and 2011 – (78.0/4.3).

I have not verified whether the statistics included in these charts are accurate, but as a minimum the foregoing calculations are worth thinking about.”

Some of Ian Campbell’s Articles:

1. Campbell’s Challenge: ‘Think for Yourself’ When Reading This Article on Gold!

It doesn’t take a rocket scientist to figure out that the technical picture for gold has been rapidly deteriorating…and a look at the longer term charts makes it clear that we have just witnessed a head and shoulders formation that has dramatically failed. The chip shot on the downside for gold here is $1,500 [maybe even] $1,450. Bring a double dip scare for the economy into the picture, which I expect to see this summer, and $1,100 is a possibility. If you get a real stock market crash in 2013, as many analysts are predicting, and you’ll get another chance to buy at $750. [That being said,] long term, I still like gold and expect it to hit the old inflation adjusted high of $2,300 during the next hard asset buying binge – but remember also that long term, we are all dead. Words: 900

2. Another ‘Think for Yourself’ Challenge from Ian Campbell on Gold

Below is a synopsis of, and comments on, a very well balanced article on physical gold which is rather rare in this day and age. The article challenges everyone who owns gold, or is considering owning gold, to think for themselves, and then come to their own conclusions as to whether physical gold is, indeed, the ultimate inflation hedge that it is so often claimed to be. Words:800

Related Articles:

1. There is a MUCH Better Way to Own Gold Than Via ETFs and ETRs – Here’s How

Late last year the Royal Canadian Mint intoduced an Exchange Traded Receipt (ETR) in another long line of paper-gold investments that are now trading on securities exchanges worldwide. It, like all of the other programs, comes with a slew of fees and risks. [Why not take personal physical possession of your gold or silver, store it in an allocated and secure non-government vault, be able to have any or all of it shipped to you immediately upon request – and for dramatically less than any ETF or ETR? Let me explain how easily it is to do just that.] Words: 1601

2. Gold vs. Silver: Which is the Best Investment?

Is there a case for holding both gold and silver? Despite the intuitive case, the empirical evidence since SLV’s inception suggests investors may not be sufficiently compensated for pairing silver with gold. [I came to that conclusion by back-testing the performance of each using a variety of analytical approaches. Read on.] Words: 645

3. Update: 51 Analysts Now Maintain that Gold is Going to $5,500 – $6,500/ozt. in 2015!

Lately analyst after analyst (161 at last count) has been climbing on board the golden wagon with prognostications as to what the parabolic peak price for gold will eventually be. That being said, however, only 51 have been bold enough to include the year in which they think their peak price estimate will occur and they are listed below. Take a look at who is projecting what, by when and why. Words: 644

4. History Says Silver Could Become the Next 10-Bagger Investment! Here’s Why

If you concur with the 159 analysts (see below) that maintain that physical gold is going to go parabolic in price in the next few years to $3,000, $5,000 or even $10,000 or more then you should seriously consider buying physical silver. Why? Because the historical gold:silver ratio is so way out of wack that silver should appreciate much more than gold as it goes parabolic in the years to come. Indeed, silver could easily reach $100 – $200 per troy ounce, maybe even $300 and conceivably in excess of $400 depending on how high gold goes. The aforementioned may be hard to believe but an analysis below of the historical price relationship between silver and gold suggests that such will most likely occur if gold does, indeed, go parabolic. Take a look. Words: 1423

5. Gold & Silver: THE Answers to Escalating Financial Doom

Every fiat currency known to man has failed at one time or another – every one – and ours will be no exception! What factors are contributing to this eventuality and what can be done to protect ourselves from this impending event? [Let me explain and provide you with links to 37 supportive articles to give you a complete picture of what is unfolding and why.] Words: 2700

6. Canadians Take Note: Own Physical Gold via Canadian Mint’s New Gold ETRs

The Royal Canadian Mint has announced that it is making an initial public offering of exchange-traded receipts (ETRs) under the mint’s new Canadian Gold Reserves program. Unlike other gold investment products currently available which only enable the purchaser to own a unit or share in an entity that owns the gold, the ETRs will enable the purchaser to actually own the physical gold bullion which will be held in the custody of the mint at its facilities in Ottawa. Words: 650

7. What Do Gold Measurements “Troy” Ounce and “Karat” Really Mean?

You have no doubt read countless articles on the price of gold costing x dollars per “troy ounce” or perhaps just x dollars per “ounce” but the difference between the two measurements is significant. For that matter, what’s the difference between a 24 karat gold ring and an 18 karat gold ring? Let me explain. Words: 863

8. Before Buying a Gold-related ETF Check Out These Alternatives

There are many legitimate reasons to trade in gold and its derivatives. Gold has been proven time and time again to be an excellent “safe haven” investment, a holding that will appreciate in value during times of economic uncertainty. As such, gold may offer some valuable hedging and diversification benefits for a long-term portfolio. A number of exchange-traded products offering exposure to gold prices but not all gold ETFs are created equal. Here’s a quick rundown of factors to consider when making an investment in a gold ETF. Words: 1268

9. Surprise! A Close Look at GLD Reveals What it IS and is NOT

The most common misunderstandings regarding the primary gold ETF, SPDR Gold Trust (NYSE:GLD) is that it buys and sells gold. That is not the case. It is just a paper asset. It is not a way to buy gold and have someone else store your holdings for you. It is just an innovative way to “own gold.” [Below I outline more of just what GLD is and is not:] Words: 1470

10. All Gold & Silver ETFs Are NOT the Same: a Lease vs. Own Comparison

I have always been leery of the two big exchange traded funds, SLV and GLD, because they lease the gold and silver that they sell you. I much prefer the ETFs SGOL, CEF, PSVL and PHYS which actually own the gold and silver they sell you and store it for you segregated vaults. Words: 717

11. All Gold and Silver ETFs are NOT Created Equal! Here’s the Best

Whole oceans of ink have been spilled detailing the good and not-so-good points of the closed-end fund CEF (Central Fund of Canada) and the twin ETF’s GLD (SPDR Gold Trust) and SLV (iShares Silver Trust) funds. My goal here is to distill the salient points down to the fewest words possible to help make your due diligence task somewhat less…well…tasking. [Let’s go!] Words: 650

12. Protect Yourself From Inflation With Gold or Precious Metals Funds

Investing in some form of precious metals is the preferable way to protect oneself from rising inflation/decrease in the value of the U.S. dollar and here are 10 ETFs and ETNs and 5 mutual funds to do just that. Words: 879

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money