Evidence suggests that the “Zero Hour Debt” line has been reached. Get out of the U.S. dollar [U.S. treasuries] and buy physical gold [or equities] before it’s too late. It is the only way to protect yourself against a massive U.S. dollar devaluation to come in the next few months. [Let me explain why that is the case.] Words: 719; Charts: 5

out of the U.S. dollar [U.S. treasuries] and buy physical gold [or equities] before it’s too late. It is the only way to protect yourself against a massive U.S. dollar devaluation to come in the next few months. [Let me explain why that is the case.] Words: 719; Charts: 5

So writes Katchum in a recent post* on his blog (http://katchum.blogspot.ca)entitled Zero Hour Debt Has Arrived.

This post is presented compliments of www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Katchum goes on to say in further edited excerpts:

Zero Hour Debt

…The ratio between nominal GDP Growth and Total National Debt Growth has touched the zero line (Chart 1), which means that additional debt growth is not stimulating the economy anymore. We really are reaching the end game here and will see a parabolic increase in debt.

Furthermore, GDP is not what it was a few years ago:

…While exports declined 5.7% in the fourth quarter of 2012….the unhealthy part of GDP, namely consumption, has increased 2.2% so the U.S. is walking an economic path of consumption instead of production.

Moreover, defense spending has dramatically declined 22.2% and a part of that is due to the debt ceiling, which was reached mid December 2012. As a matter of fact, we already see the effects of the decrease in defense spending at the Pentagon, where 6% of the workforce has been slashed and more budget cuts are to come after March 2013, possibly with the implementation of furloughs.

Hyperinflation

The GDP numbers of today are very significant, as it introduces the start of a period of hyperinflation. [Indeed,] James Turk…[is of the opinion that there is] a 100% probability of hyperinflation in the U.S….[saying recently on King World News:] “The politicians have finally done it, Eric. The House passed a debt ceiling bill that throws away the last semblance of any discipline on federal spending. It is now all but certain now that the dollar is headed for hyperinflation, assuming the Senate and then the President go along with the measure passed by the House a few days ago, and the indications are that they will.”

The gold market reacted as predicted on the GDP numbers with an immediate rise of 1% when the news was released (Chart 2).

Basically, there will not be any limit to the debt ceiling any more and…the debt will never be repaid. As the debt goes higher and higher, without a significant rise in GDP, the Federal Reserve will need to monetize the debt, which in turn creates a huge amount of inflation.

Fed Balance Sheet

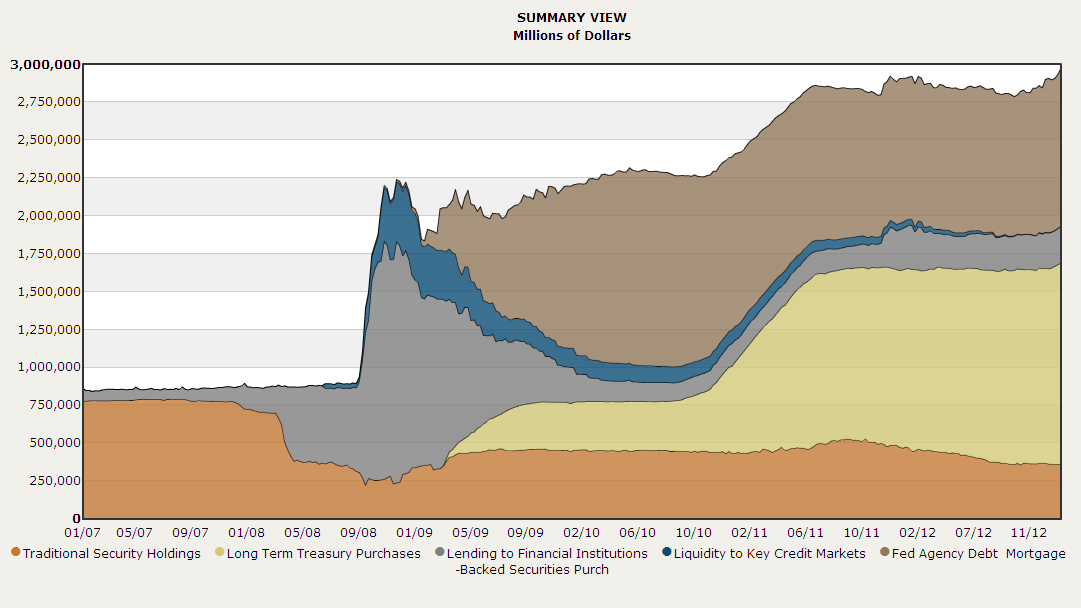

Just a week ago, the Federal Reserve balance sheet…reached $3 trillion (Chart 3)…[and] is expected to rise 30% in the next year, which means a U.S. dollar devaluation of 30% against real assets.

U.S. Treasuries

With this devaluation in the U.S. dollar it is increasingly obvious that U.S. treasuries are an asset to avoid at all costs. Yesterday, the 10 year treasury yield had reached a 9 month high of 2% and is climbing as we speak (Chart 4).

Gold

Gold on the other hand is going into bullish territory. I pointed out in a recent post that the price of bitcoin has reached all time highs and I predict that the gold price will reach $1800/ounce in the short term based on the correlation between the bitcoin price and the gold price.

Copper

Another sign of rising inflation is the increasingly positive prospects in the copper market…The contango report for copper shows an immediate short term rise in copper price and this will spur a boost in stock prices as we know that the copper price always correlates to stocks.

Conclusion:

…The evidence suggests that the “Zero Hour Debt” line has been reached. Get out of the U.S. dollar [U.S. treasuries] and buy physical gold [or equities] before it’s too late. It is the only way to protect yourself against a massive U.S. dollar devaluation to come in the next few months.

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

* http://katchum.blogspot.ca/2013/01/zero-hour-debt-has-arrived.html

Related Articles:

1. Katchum Comments on Gold, Silver & Recession

There are literally thousands of economic blogs out there and most don’t have much to offer. One exception is a blog by “Katchum” that is dedicated to monitoring breaking global economic news on a day to day basis and, as such, provides unique insights into, and analysis of, various aspects of the financial markets, commodities and the economies of the world. Below is his latest post. If you like it why not subscribe? Words: 642; Charts: 6

2. 15 Questions & Answers Regarding Hyperinflation

It is difficult to say exactly when hyperinflation will hit a currency. However, I am convinced that the danger level is so high for most fiat money that it is worthwhile for everyone to increase their understanding of hyperinflation. This is the first part of a Hyperinflation FAQ for frequently asked questions or objections about hyperinflation. Words: 1600

I expect the eventual endgame to this whole Keynesian monetary experiment that has been going on ever since World War II [will] finally terminate in a global currency crisis. [That being said,] I’m starting to wonder if we aren’t seeing the first domino – the Japanese yen – start to topple…[It has] cut through not only the 2012 yearly cycle low, but also the 2011 yearly cycle low and never even blinked [and should it continue its steep decline] and break through the 2010 yearly cycle low [of 105.66] I think we have a serious currency crisis on our hands. Needless to say, if the world sees a major currency collapse… it’s going to spark a panic for protection – to gold and silver. Wouldn’t it be fitting that at a time when they are completely loathed by the market they are about to become most cherished? [This article analyzes the situation supported by 3 charts to make for a very interesting read.] Words: 620; Charts: 3

4. Startling Relationship Between Gold Price & U.S. Gov’t Debt Suggests What Price for Gold in 2017?

The price of gold, on a quarterly basis, is 86% correlated – yes, 86%! – to total government debt going back to 1975… and a shocking 98% over the past 15 years! [As such,] it would seem like a no-brainer investment thesis to buy gold… as a proxy for the not-otherwise-investable thesis that US total government debt will increase in the future. [But there is more – and it is disappointment for gold bugs – read on!]

5. Goldrunner: Gold & Silver Bottoming This Week & Setting Up for Parabolic Moves In Both

This week could see a very significant historical bottoming point of interest for Gold and for Silver. Big moves late in the cycle for Gold and for Silver come after long sideways movements suggesting that both precious metals are ready to go parabolic.

6. Gold Stocks Go Up Dramatically In Inauguration Years – Will Another +20% Increase Occur This Year?

President Obama will be sworn into office for a second term on January 21 and that’s good news if you own gold stocks. Why? Because gold stocks, [as represented by the XAU] have increased, on average, by 20% during inaugural years since 1985 (28% in 2005; 36% in 2003). While there’s no real rhyme or reason as to why gold stocks thrive in inauguration years – statistical anomaly or otherwise – it is yet another reason to buy gold stocks right now. Words: 312; Charts: 1

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I thought, I would make a living out of selling proxies, but here you have given me a whole new dimension to get rich… A very good one…The value of gold is skyrocketing day by day… don’t think it’s going to fall down….thanks man for the overview…Thanks a ton

Interesting article!

I’d really like to see the author compare Gold to Silver as an investment vehicle!