USD Collapse Is Fueling Inflation Trade Mania

We are an environment in which a U.S. dollar (USD) collapse has fueled inflation trade mania. By launching additional quantitative easing (QE) measures at a time other central banks (e.g. the ECB and the Bank of England, among others) have renounced additional easing measures or are actively raising interest rates (e.g. China and Australia), Fed Chairman Ben Bernanke has made it clear he is willing to trash the USD. Words: 797

So says Graham Summers (www.gainspainscapital.com) in an article* which Lorimer Wilson, editor of www.munKNEE.com, has reformatted into edited […] excerpts below for the sake of clarity and brevity to ensure a fast and easy read. (Please note that this paragraph must be included in any article reposting to avoid copyright infringement.) Psaras goes on to say:

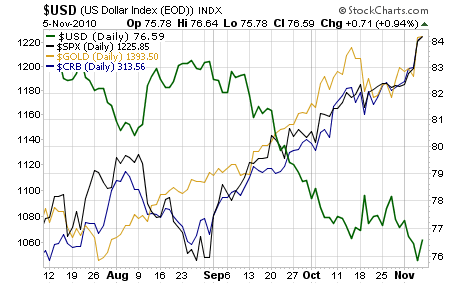

We are in an inflation trade melt-up. Everything that is an inflation hedge has exploded since late August. Gold is up 15%. Silver is up 48% (courtesy of the manipulators finally getting taken to court). Agricultural commodities are up 25%. Oil is up 20%. Against this backdrop, stocks’ 17% rally becomes slightly less insane. That’s right, stocks are up 17% since late August.

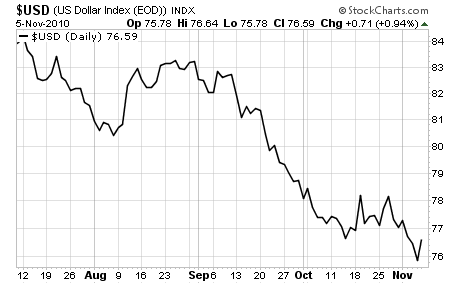

What is Happening to the USD?

What happened in late August? The Fed announced QE lite and promised QE 2 was coming. Almost to the day of this announcement, the USD rolled over and dropped some 8% (it’s down nearly 15% since June). (For today’s chart go to stockcharts.com, type in $USD and create your own chart – it’s that easy!)

Money is pulling out of the USD and flowing into hard assets and other inflation hedges. The below chart plots the USD index (green) against Gold (yellow), stocks (black), and commodities in general (blue). This picture, details in stark terms the overall trend for markets today.

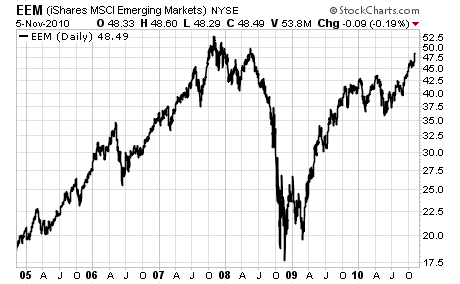

Stock Markets Are Behaving As Though the Crash of 2008 Never Happened

The most concerning thing is that there doesn’t appear to be any sign of these trends stopping. Emerging markets, which have lead the S&P 500 ever since the financial crisis began, are not only back to pre-crisis levels but are a mere 8% off from their 2007 highs. It’s almost as though 2008 never happened.

Part of this is better fundamentals, but a lot of it is money flowing out of U.S. equities and piling abroad. This is causing many emerging markets like China and Brazil to impose capital controls and other efforts meant to slow the inflows of funds.

Will the Inflation Trade Trend Continue?

It’s very hard to tell. I cannot believe China is going to let Bernanke get away with QE 2. However, until China issues a response in the form of policy, we’ll have to go by the U.S. dollar for signs of what’s to come.

Editor’s Note: Don’t forget to sign up for our FREE weekly “Top 100 Stock Market, Asset Ratio & Economic Indicators in Review”

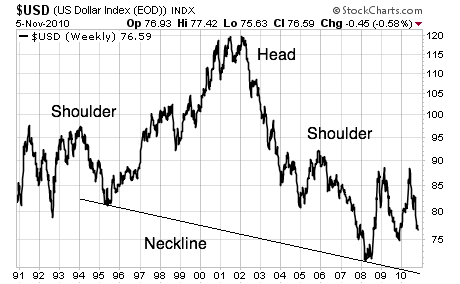

The below chart shows the USD index multi-year uptrend line (black) and support lines (green).

As you can see, the USD index is literally sitting on its multi-year trend-line. If it breaks below this, then we have support at 74. If it breaks below that, we have FINAL support at 72. Below that… well, we’ve NEVER been below that before. So PRAY we don’t go there now.

USD Index Below 72 Suggests 50% Devaluation of USD

Indeed, if QE 2 succeeds in devaluing the USD index below 72, then this will trigger a MASSIVE Head & Shoulders pattern that forecasts a 50% devaluation in the USD over the coming years.

If this neckline is violated, we’re in uncharted waters for the USD and the U.S. is in for a very, VERY rough time (think Argentina or even Weimar Germany). As I write the USD index is at 76. It won’t take much for the index to go from 76 to 71 so keep your eyes on it closely for signs of what is to come.

Conclusion

In the meantime, the inflation trades dominates everything. [As such,] the best place for money is in commodities, especially precious metals (make sure it’s bullion, NOT etfs) and agricultural commodities, as well as emerging markets.

On that note, if you have not already taken steps to prepare yourself for the inflationary storm that is coming, PLEASE DO SO NOW. (If you] do not prepare yourself in advance you will lose a LOT… possibly EVERYTHING. It doesn’t take much to turn a potential disaster into serious profits, and believe me [when I say:]

The coming collapse of the USD is going to result in an absolute DISASTER.

*http://gainspainscapital.com/index.php?option=com_content&view=article&id=182:graham-summers-weekly-market-forecast&catid=39:stocks&Itemid=70

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

- Sign up to receive every article posted via Twitter, Facebook, RSS feed or our FREE Weekly Newsletter.

- Submit a comment. Share your views on the subject with all our readers.

USD

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money