With what is happening with the price of gold these past few days it is imperative to take a look at the long and short of it all (the trends, that is). In doing so it shows that we are still very much in a long-term bull market but in a short-term (yes, short-term) bear market. Let’s take a look at some charts that clearly outline where we are at and where we could well be going. Words: 625

of it all (the trends, that is). In doing so it shows that we are still very much in a long-term bull market but in a short-term (yes, short-term) bear market. Let’s take a look at some charts that clearly outline where we are at and where we could well be going. Words: 625

So says Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) in an article written on behalf of www.PreciousMetalsWarrants.com (The Authority on Warrants). Please note that this paragraph must be included in any article reposting with a link* to the article source to avoid copyright infringement.

Wilson goes on to say:

Physical Gold

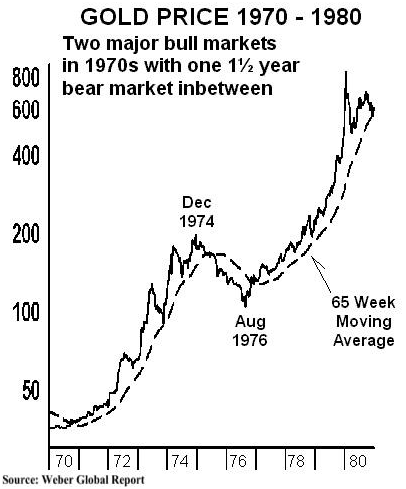

As can be seen in the graph below the 70s experienced 2 major bull markets and an 18 month bear market in between while continuing to trend upwards.

Right now, I believe we’re at a period not unlike early 1975. Then, as it is now, the uptrend is still intact. True, gold has dropped below the 28 week (200 day) simple moving average but is still above the 65 week moving average as can be seen in the weekly graph for gold as of December 14th, 2011:

A look at the chart below of the daily close of the price of gold over the past 3 months clearly shows that an excellent way to trade gold is to buy and sell on the basis of the 20 day Exponential Moving Average. EMA is a moving average that gives greater weight to more recent data (in this case the past 20 days) in an attempt to reduce the lag of (or “smooth”) the moving average.

Gold Miner Stocks

No discussion about gold would be complete without taking a look at the performance of the HUI index which consists primarily of large and mid-cap gold producers. As the graph shows below it is struggling terribly underperforming equities in general and gold by a wide margin. Be that as it may, most analysts believe it is just a matter of time time (Goldrunner writes in Goldrunner: Gold, Silver and HUI Index to Bounce Back to Major Highs by May 2012 that the HUI could almost double in the next few months – see here for his rationale) before the precious metals mining (and royalty streamers) sector closes the gap as a result of much healthier bottom lines.

Gold Miner Warrants

If you agree that the gold and silver mining sector has no where to go but up in the next few months serious consideration should be given to investing in the long-term warrants that are offered by a few of the constituents of the HUI. Warrants generally enable an investor to take a similar position in a company for approximately 60% less dollars deployed and realize gains often double that of the associated stock. No warrant ETFs exist but a look at my proprietary Gold and Silver Warrants Index entitled Gold and Silver Warrants: An Insider’s Insights (see here) and this article entitled Gold & Silver Warrants: What are They? Why Own Them? How are They Bought & Sold? (see here) will provide you with major insights into this extremely small and unknown investment option.

Conclusion

When I look at the charts above it is obvious that gold has just undergone a pre-Christmas sale of epic proportions which I think is probably the last opportunity to get in before it continues in trend upwards. The financial crisis in Europe has chased people out of gold and equities hitting gold stocks with a double whammy making for an ideal entry point at this time. The long-term gold and silver warrants have been hit hard making them the buy of the decade. That being said, who knows what nasty surprises the powers to be might throw our way in the months to come in 2012 but whatever they might be gold and silver, in all its investment forms, should do very well long-term, thank you very much.

*https://gos.ixm.mybluehost.me/2011/12/these-charts-say-it-all-gold-is-still-a-buy/

Related Articles:

1. Don’t Look a Gift Horse in the Mouth – Buy Gold Now With Both Hands! Here’s Why

Since the fundamentals still point to gold’s long-term viability… why [are] investors responding by selling gold…? I was always told not to look a gift horse in the mouth… [so] take advantage of the dip. Words: 962

2. Goldrunner: Gold, Silver and HUI Index to Bounce Back to Major Highs by May 2012

With the present major correction in gold, silver and the mining sector it is important to look at the big picture and see what the charts are saying from a technical fractal relationship with what happened back in 1979 when the last truely major bull run occurred. To date the situation is, frankly, no different than it was back then unfolding just as it should. As a result we can expect MAJOR upward price action in physical gold and silver and in their mining (producers, developers, explorers and royalty streamers alike) in the next few months on their way to their respective parabolic peaks in the years ahead. Read on. Words: 1604

3. When This Pullback in Gold is Put into Perspective It’s No Big Deal – Here’s Proof

Daily and monthly gyrations in the price of gold are nothing to fret over…The price will recover and, in time, fetch new highs…Here’s proof. Words: 264

4. Gold Tsunami: on the Cusp of $3,000+?

Gold is in a bull market and, [believe it or not,] so are the gold stocks despite their struggle as a group to outperform gold… but [neither] is anywhere close to a bubble, nor the speculative zeal we saw in 2006-2007. Thus, it begs the question” “What lies ahead and when can we expect the initial stages of a bubble?” To figure this out we first need to get an idea of how long the bull market will last and then where we are now based on various indice analyses. [Below I do just that.] Words: 785

11. Gold & Silver Warrants: An Insider’s Insights

With a tsunami of interest in the future prospects of gold and silver mining companies (and their stock prices as a result) I have been asked to publish an updated version of my one-of-a-kind proprietary index of commodity-related companies with long-term warrants (CCWI) and its sub-category of just gold and silver companies with long-term warrants (GSWI). This article gives you some insights into the ‘secret world’ of warrants and slices and dices the make-up of both indices identifying the constituents of each for your edification. Words: 1184

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money