While many of us don’t like making price predictions, and certainly ones accompanied by a specific date, it’s hard to ignore the correlation between the U.S. monetary base and the gold price. That correlation says we’ll see $2,300 gold by January 2014 – and $2,500 by the end of 2014. [Let me explain.] Words: 567

accompanied by a specific date, it’s hard to ignore the correlation between the U.S. monetary base and the gold price. That correlation says we’ll see $2,300 gold by January 2014 – and $2,500 by the end of 2014. [Let me explain.] Words: 567

So says Jeff Clark (www.caseyresearch.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Clark goes on to say, in part:

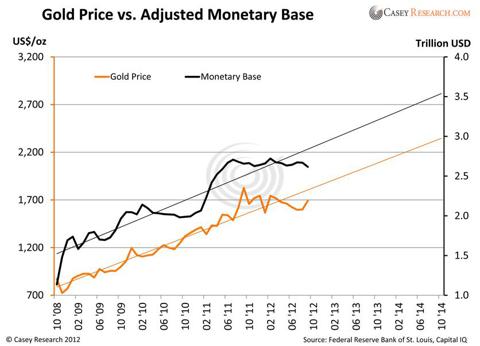

There are plenty of long-term charts that show a connection between gold and various other forms of money (and credit). Most show that one outperforms until the other catches up but let’s zero in on our current circumstances, namely the expansion of the U.S. monetary base since the financial crisis hit in 2008.

Here’s the performance of the gold price compared with the expansion of the monetary base since January 2008.

(Click on image to enlarge)

You can see the trends are very similar. In fact, the correlation coefficient is an incredible +0.94.

Since the Fed has declared “QEternity,” it’s logical to conclude that this expansion of the monetary base will continue. If it grows at the same pace through January 2014, there is a high likelihood the gold price will reach $2,300 at that point. That’s roughly a 30% rise within 15 months and by year-end 2014, gold could easily be averaging $2,500 an ounce. That’s 41% above current prices.

Who in the world is currently reading this article along with you? Click here

Some may argue that there’s no law saying this correlation must continue, that’s true, and maybe the Fed doesn’t print till 2014, that’s possible but it’s not just the U.S. central bank that’s printing money.

- European Central Bank (ECB) President Mario Draghi has declared that it will buy unlimited quantities of European sovereign debt.

- Japan’s central bank is expanding its current purchase program by around 10 trillion yen ($126 billion) to 80 trillion yen.

- The Chinese, British, and Swiss are all adding to their balance sheets.

The largest economies of the world are all grossly devaluing their currencies. This will not be consequence-free. Gold and silver will be direct beneficiaries -along with mining companies- starting with rising prices.

Don’t Delay!

– Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com

– It’s FREE and includes an “easy unsubscribe feature” should you decide to do so at any time

– Join the informed! 100,000+ articles are read every month at munKNEE.com

– All articles are posted in edited form for the sake of clarity and brevity to ensure a fast and easy read

– Get newly posted articles delivered automatically to your inbox

– Sign up here

There are other consequences, both good and bad, of gold hitting $2,000 and not stopping there. We think investors should be prepared for the following:

- Tight supply. As the price climbs and attracts more investors, getting your hands on bullion may become increasingly difficult. Delivery delays may become commonplace. Those who haven’t purchased a sufficient amount will have to wait in line, either figuratively or literally.

- Rising premiums. A natural consequence of tight supply is higher commissions. They won’t stay at current levels indefinitely. Premiums doubled and more in early 2009, and mark-ups for silver Eagles and Maple Leafs neared a whopping 100%.

- Swelling profits for the producers. If margins on gold production average $1,000 per ounce now, what will earnings be like when they average $1,500? At $2,000? Gold can rise much faster than operating costs, so this could happen. Imagine what this could do to dividend payouts, especially those tied to the gold price and/or earnings.

- Tipping point for a mania. There will be an inflection point where the masses enter this market. The average investor won’t want to be left behind. Will that happen when gold hits $2,000? $2,500?

Conclusion

The message from these likely outcomes is to continue accumulating gold – or to start without delay. Waiting will have consequences of its own. People say that there’s nothing certain in life except death and taxes. In my view, $2,300 gold is a close second.

*http://www.caseyresearch.com/articles/what-will-price-gold-be-january-2014

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Goldrunner: Price Target of $10,000 to $12,000 for Gold Still Holds

My Fractal Gold chart work is a direct comparison of Gold, today, to the late 70’s Gold Parabola. Thus, “timing” is taken directly from the late 70’s cycle, with price targets created from a combination of the late 70’s Gold price and different technical analysis techniques. We developed a price target back in 2006/ 2007 for Gold to reach the $10,000 to $12,000 range during this Gold Bull and we still stand by that forecast. Let me explain where we are at this point in time.

2. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

3. Update: 51 Analysts Now Maintain that Gold is Going to $5,500 – $6,500/ozt. in 2015!

Lately analyst after analyst (161 at last count) has been climbing on board the golden wagon with prognostications as to what the parabolic peak price for gold will eventually be. That being said, however, only 51 have been bold enough to include the year in which they think their peak price estimate will occur and they are listed below. Take a look at who is projecting what, by when and why. Words: 644

4. Alf Field: Gold STILL Targeted to Reach $4,500 – Preceded By Violent Upside Action

We now have a really strong probability that the correction which started at $1913 on 23 August 2011 has been completed both in terms of Elliott waves and also in terms of time elapsed. If this is correct, the gold price should soon be expressing itself in violent upside action as it moves into the third of third wave which is still targeted to reach $4,500. [Let me explain in detail (with charts) how and why my most recent analyses confirm my earlier target of $4,500.] Words: 1085

5. von Greyerz: Gold Going to $3,500-$5,000 in 12-18 Months – and $10,000 Within 3 Years!

There will be a catalyst coming soon, probably some concerted action of money printing between the Fed, IMF and the ECB. That will happen as a result of the economies, worldwide, collapsing….The catalyst could come from anywhere but the money printing will be part of the next move in gold, that’s for certain….[and it] will lead to collapsing currencies, and investors buying gold at any price…I see gold reaching $3,500 to $5,000 in the next 12 to 18 months. Within 3 years, I see the gold price reaching at least $10,000.

6. The “80-20 Rule” Suggests Gold Will Reach $8,300/ozt in Spring of 2015!

The “Pareto principle” – it’s often referred to as the “80-20 rule” – states that 80% of the effects of something come from just 20% of the causes (that is that 80% of people control 20% of the wealth, that 80% of sales come from 20% of your customers, etc.) and a new report by Erste Group, the Austrian investment bank, says this principle can be applied to bull markets as well, including the current bull market in gold, and following this line of thinking, you get an $8,300 price target for gold by the spring of 2015. Words: 285

According to a recent Elliott Wave theory analysis gold is about to go parabolic reaching $3,495 in June 2013, $6,233 in April 2014, $10,899 in Sept. 2014, $18,712 in December 2014 and culminating in a parabolic peak price of $31,672 on January 16th, 2015! See the chart below. Words: 600

8. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

9. David Nichols: Expect to See $2,750 – $3,000 Gold By June 2013 – Here’s Why

The interim peaks in gold have been spaced 21 months apart over the past 6 years and have seen gains from 80.2% to 97.3%. As such, given the fact that the low of this last correction came in at $1,524 four months ago, we can expect gold to reach a new peak price of $2,750 to $3,000 in 17 months time (i.e. June/July 2013). [Let me explain in more detail.] Words: 976

10. Leeb: Gold Going to $3,000 Before the End of 2012!

The Fed is [going to] keep interest rates at zero until the end of 2014 [and that] is as aggressive as it gets and as bullish as it gets for gold. Inflation will be let out of the bag, maybe for the next three to four years. In this environment gold and silver are the best investments around…We are really talking about the next leg higher in this bull market…This is the leg I expect to take gold to $3,000 before the end of 2012.

11. Will Gold Peak at $2,500, $8,890 or $15,000?

When considering that the conditions which propelled gold and silver to their 1980 highs are much worse today, I predict both metals will easily eclipse those previous highs. That means $2,500 gold and $150 silver at the very minimum, but more likely a parabolic ascent to $8,890 gold and $517 silver before all is said and done. Words: 1063

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Without picking a price point, I think it is safe to say that both Au and Ag will continue their upward trend and that alone is reason to consider making them both part of your holdings…

I look for Cu to become yet another metal that savvy investors begin to acquire while it too is low in price…

Good Luck