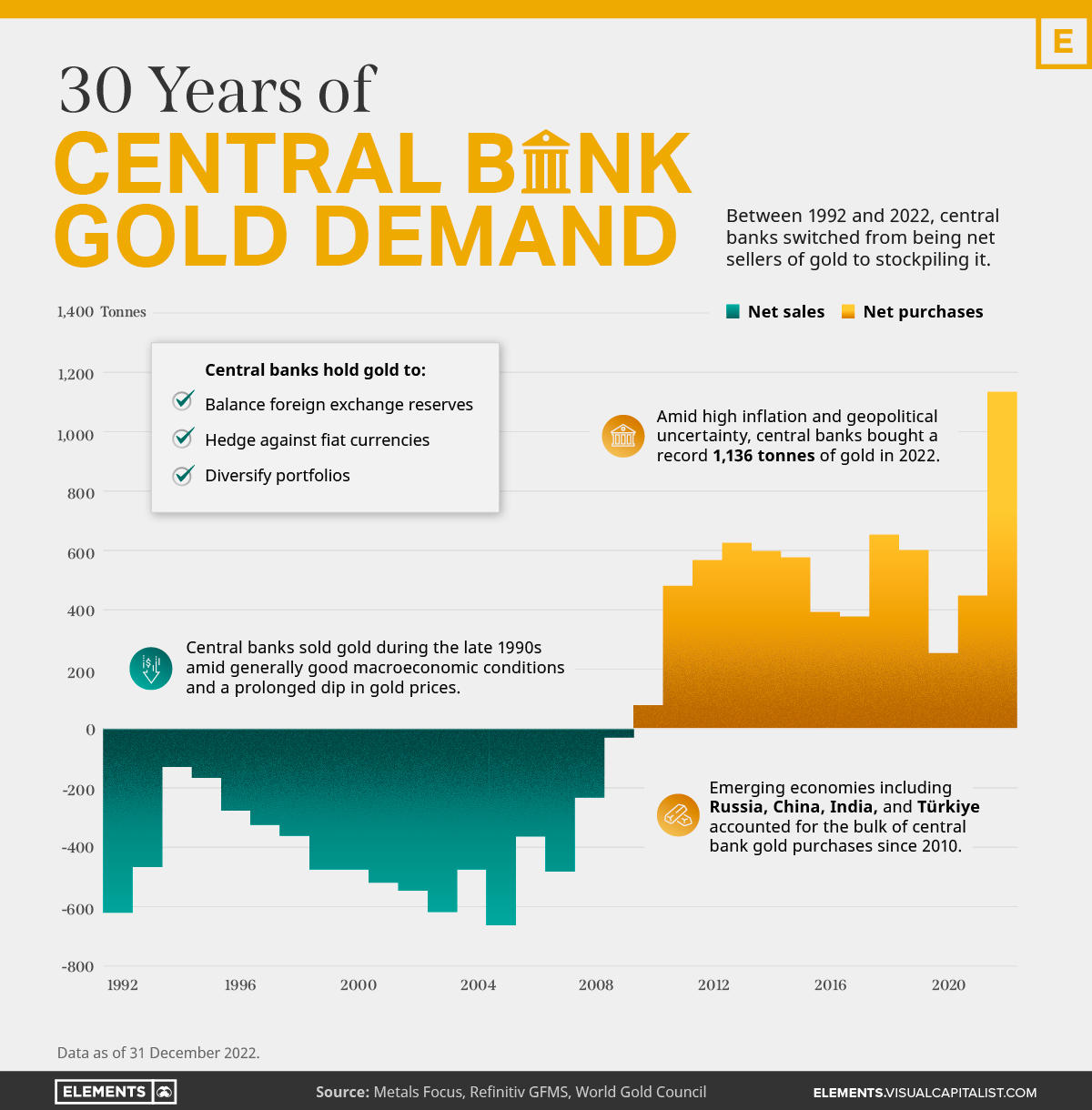

Besides investors and jewelry consumers, central banks are a major source of gold demand having snapped up gold at the fastest pace since 1967 in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. Today’s infographic (see below) uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Why Do Central Banks Buy Gold? There are three of the reasons why central banks hold gold (go here).

A look at the 10 largest official buyers of gold from the end of 1999 to end of 2021. (go here). They represent 84% of all the gold bought by central banks during this period.

Which Central Banks Bought Gold in 2022? In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. (see which countries here).

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money