Gold represents the spirit of affluence but can gold still deliver wealth and prosperity to the modern investor? The answer is yes, absolutely! Gold can play a vital role in a robust, high-performing portfolio…[but] these results are not guaranteed. To bolster your wealth with gold, you need to understand how it functions as an asset. Let’s look at gold’s key characteristics, and how they can help the modern investor achieve financial freedom.

1. Gold is a Hedge

Since 1971, when President Nixon removed the U.S. dollar from the gold standard, gold has kept pace with the major stock market indices. Gold is a high-performing asset, but investors typically don’t buy it expecting to 10x their money. Investors buy gold to balance their exposure to more risky assets, such as stocks.

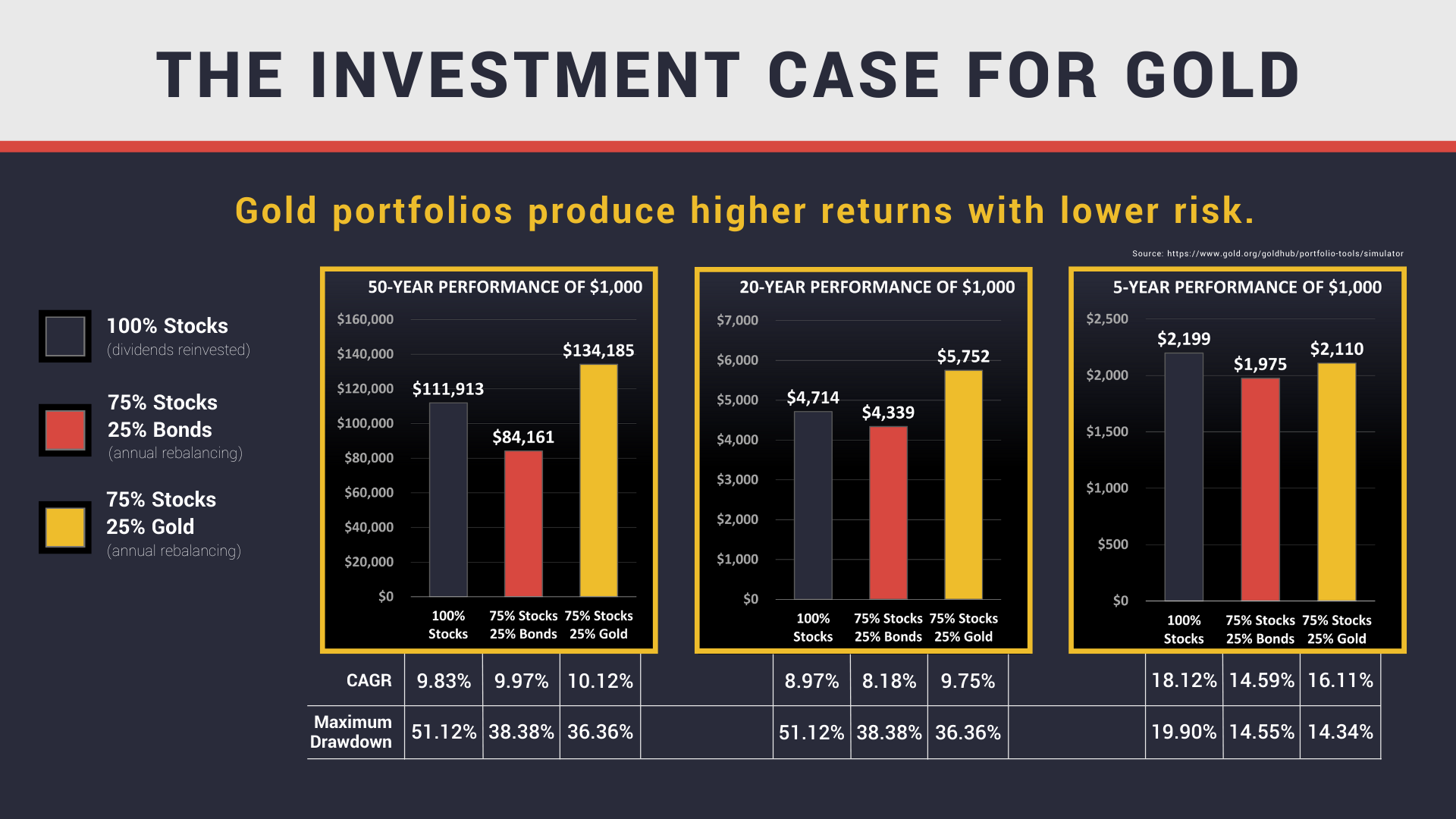

Non-correlation between asset classes is a vital characteristic of a healthy portfolio. It doesn’t matter how much you make in a bull market if you lose it all in the next bear market. Gold is uncorrelated with most other asset classes. When stocks are doing well, gold tends to lag. When stocks crash or stagnate, gold tends to go up.

When integrated with stocks, bonds, real estate, and other financial assets, gold reduces maximum drawdowns in a portfolio. This held true during the dot-com bubble of 2000, the Great Financial Crisis of 2008, and the COVID crash of 2020.

An investor that hedges risk and diversifies will always outperform the investor that throws all his eggs in one basket.

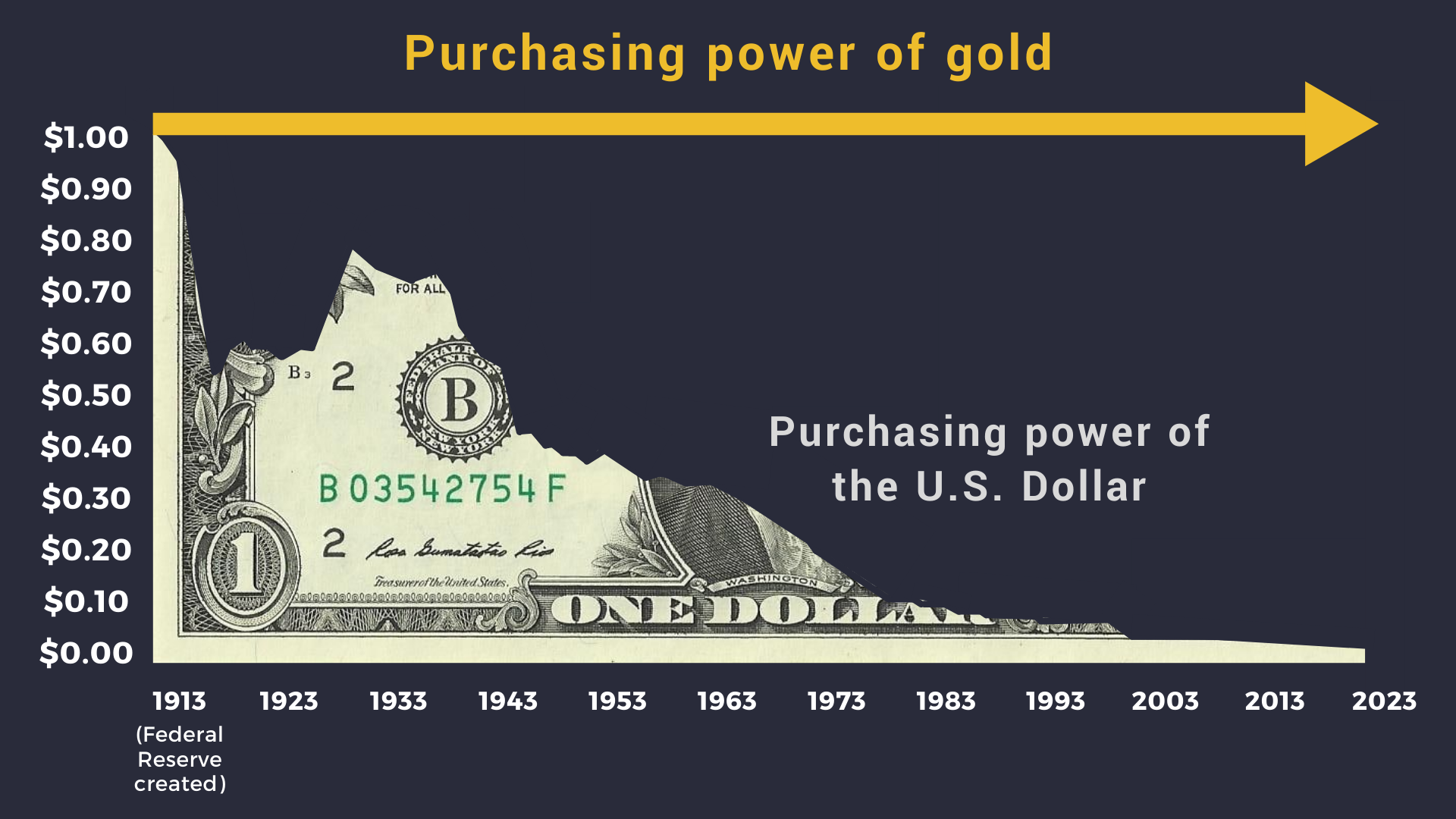

2. Gold Protects Purchasing Power

Since the creation of the Federal Reserve in 1912, the U.S. dollar has lost 98% of its purchasing power. The gold price, on the other hand, has multiplied a hundredfold. This may seem like a lot, but really gold has just maintained its purchasing power. Today, one ounce of gold purchases approximately the same goods and services it did 100 years ago.

…Gold’s ability to hold its purchasing power across time will not necessarily make you rich, but it will absolutely prevent inflation from destroying your wealth!

3. Gold is a Savings Vehicle

Today, gold’s role as a savings vehicle is more important than ever. In the late 19th/early 20th centuries, nearly all developed nations pegged their currencies to gold but most European nations detached their currencies during WWI (the U.S. did not do so until 1971) and, in doing so, their currencies lost all intrinsic value. We now live in a fiat currency world, with no restrictions on government debt, money printing, and inflation.

Central banks hold a considerable amount of their assets in gold so maybe we should pay attention to how they are allocating their nations’ reserves.

Can you get rich investing in gold?

It depends on what you mean by “rich.” There are ways to get rich investing in any asset, including gold. However, multiplying your money in the short term requires an insane amount of risk, perfect market timing, and complex trade strategies that are often impractical for individual investors.

Getting rich is a long-term game. It requires savings, risk mitigation, and prudent investing strategies. In those areas, gold thrives.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money