The dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks. Lately though, “de-dollarization” is being pursued by countries with agendas at odds with the US, including Russia, China, Saudi Arabia and Iran.

So says Richard (Rick) Mills of aheadoftheherd.com in an article that first appeared here.

Mills goes on to say:

As the target of US economic sanctions (for annexing Crimea, interfering in its election, and invading Ukraine), Russia sees diversification from the dollar and into gold and other currencies, as a way of skirting trade restrictions.

In 2021, China trimmed its holdings of US Treasuries for four straight months, in what analysts called a move to prevent potential adverse impact from escalating China-US tensions.

China actually started to move away from the dollar in 2014, agreeing with Brazil on a $29 billion currency swap to promote the Chinese yuan as a reserve currency. The Chinese and Russian central banks signed an agreement on yuan-ruble swaps to double trade between the two countries. The $150 billion deal is a way for Russia to move away from US dollar-dominated settlements.

A few years ago China came up with a new crude oil futures contract, priced in yuan and convertible into gold. The Shanghai-based contract allows oil exporters like Russia and Iran to dodge US sanctions against them by trading oil in yuan rather than US dollars.

More evidence of Chinese and Russian de-dollarization concerns the SWIFT system of international banking transactions.

In 2014 after Russia annexed Crimea, there were calls to cut Russia off from SWIFT. In response the Kremlin developed its own financial communications platform, SPFS. In December 2021, SPFS had 38 participants from nine countries. Four months later, the system had 399 users. Russia has been negotiating with China to join SPFS.

China has also developed an alternative to SWIFT, in 2015 launching the Cross-Border Interbank Payment System (CPS) to help internationalize the yuan.

But the move away from the dollar goes beyond America’s foremost adversaries; until very recently, it was on the agenda of the BRICS. Standing for Brazil, Russia, India, China and South Africa, the grouping represents some of the world’s major emerging economies.

According to Reuters, Brazil’s President Luiz Inacio Lula da Silva and Russian foreign minister Sergei Lavrov are among BRICS leaders that touted the idea of a common currency as the bloc aims to challenge the western dominance of global finance amid Russia’s sanctions-imposed exile after it invaded Ukraine last year.

This has pushed countries to find alternatives to the dollar, especially among non-U.S. allies.

While rumors of a BRICS currency being on the group’s August summit agenda were recently quashed by South Africa’s top BRICS diplomat, the official said that Brazil, Russia, China and South Africa will continue to de-dollarize.

“What we have said and we continue to deepen is trading in local currencies and settlement in local currencies,” Anil Sooklal told a media briefing. “The days of a dollar-centric world is over, that’s a reality. We have a multipolar global trading system today,” he added.

De-dollarization

There are, indeed, numerous examples of de-dollarization which serve to back up this statement.

Over the past year or so, Fortune writes, Russia, China and Brazil have turned to greater use of non-dollar currencies in their cross-border transactions. Iraq, Saudi Arabia and the United Arab Emirates are actively exploring dollar alternatives. And central banks have sought to shift more of their currency reserves away from the dollar and into gold. (more on this below — Rick)

These countries not only want to reduce their dependence on the dollar because they fear being the target of Western sanctions. Rising interest rates and the recent debt ceiling crisis in the United States have also raised concerns about their dollar-denominated debt, and the demise of the dollar should the world’s largest economy ever default.

Jim O’Neill, the former chief economist at Goldman Sachs, has reportedly called on the BRICS bloc to expand and challenge the dominance of the US dollar.

O’Neill sees the dollar’s dominance as a burden to nations with dollar-denominated debt — especially with the Federal Reserve raising interest rates from around zero to 4.75-5% within a year — which is why the BRICS should counter it.

Note that BRICS, even before it accepts new members, comprise nearly half (42%) of the world’s population.

Commodity-producing countries have started conducting trade in currencies other than the greenback. For example, India has begun purchasing Russian oil in UAE dirham and roubles, China paid for $88 billion worth of Russian oil, coal and metal in yuan, and Chinese state-owned oil company CNOOC and France’s TotalEnergies in March completed their first yuan-settled LNG trade.

Before that, China bought LNG from the UAE using its own currency.

Most importantly, Saudi Arabia is reportedly open to breaking the petrodollar and to sell oil in yuan. According to the Wall Street Journal,

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said.

Last month, state-owned Saudi Aramco completed its $3.4 billion stake purchase in Rongsheng Petrochemical Co. Ltd. to increase its presence in China.

According to the Bank of International Settlements, the yuan’s share of global forex transactions went from almost nothing 15 years ago to 7%.

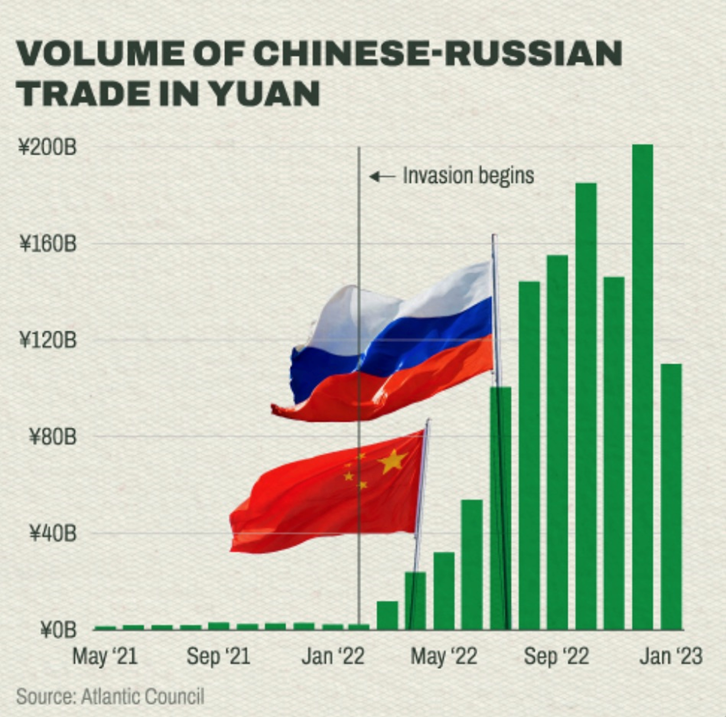

Kitco reported yuan-denominated trade flows between Russia and China surged in 2022. Earlier this year, after China’s President Xi visited Moscow, Putin said he supports using the yuan for settling trades between Russia, Asia, Africa and Latin America.

The Daily Bell notes that, as the yuan’s influence increases, other countries will start holding more of it, to trade with China, meaning less demand for dollars.

One of the best examples is the French president urging Europe to become independent from US foreign policy and to rely less on the dollar. Despite being one of America’s oldest allies, France, as mentioned above, completed its first LNG trade settled in yuan.

Malaysia, meanwhile, struck a deal with India to trade in the rupee and its Prime Minister has proposed an “Asian Monetary Fund” to reduce dependence on the US dollar, according to The Daily Bell.

The Fortune article states that, while the most ambitious path for the BRICS would be something akin to the euro, that is unlikely to happen for now, with none of the member countries showing any desire to discontinue their local currency.

Rather, the goal appears to be to create an efficient integrated payment system for cross-border transactions as the first step and then introduce a new currency.

Building blocks for this already exist. In 2010, the BRICS Interbank Cooperation Mechanism was launched to facilitate cross-border payments between BRICS banks in local currencies. BRICS nations have been developing “BRICS pay” – a payment system for transactions among the BRICS without having to convert local currency into dollars.

And there has been talk of a BRICS cryptocurrency and of strategically aligning the development of Central Bank Digital Currencies to promote currency interoperability and economic integration. Since many countries expressed an interest in joining BRICS, the group is likely to scale its de-dollarization agenda.

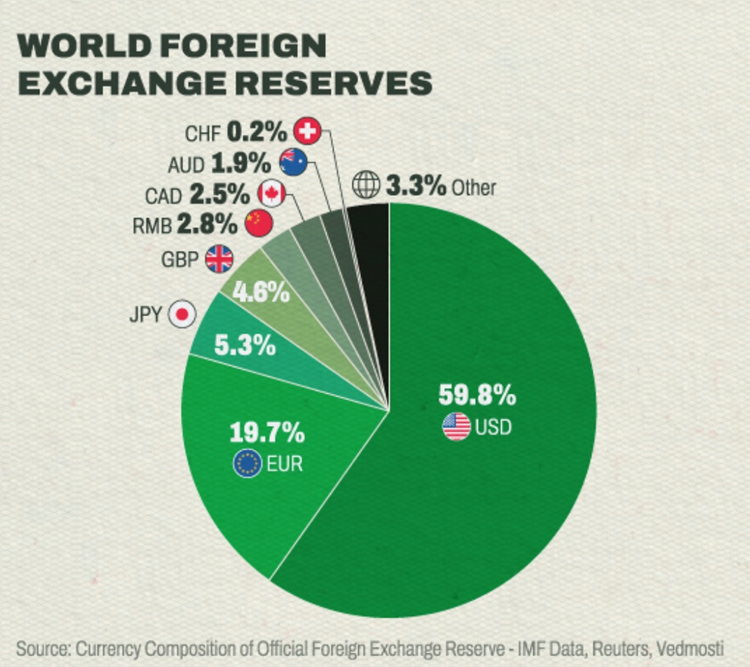

Still, one shouldn’t get carried away with the idea that the end of the dollar is nigh. Eighty-eight percent of international transactions are conducted in US dollars, with the buck accounting for 59% of global foreign exchange reserves.

Earlier we reported that de-dollarization would require a vast and complex network of exporters, importers, currency traders, debt issuers and lenders, to independently decide to use other currencies. That’s unlikely to happen. (Gold Switzerland, May 21, 2023)

Also, the dollar’s status is unpinned by the US$23 trillion Treasury market. To date, there is still no credible alternative. Germany’s bond market is a relatively small $2 trillion, and buying Chinese bonds remains tricky.

Oddly, the above-mentioned Jim O’Neill contradicts himself in a Project Syndicate article, where he argues the BRICS aren’t much of a threat to the dollar, despite being quoted by Kitco as saying the BRICS should challenge it. Among the pro-dollar arguments he makes:

- Perceived threats to the dollar’s role in the global financial system are nothing new; they have been a frequent occurrence since the 1980s. But until would-be challengers can find a credible alternative to the dollar for their own savings, the greenback’s dominance will not really be in doubt.

- Crucially, the group’s most important economies are China and India, bitter adversaries that rarely cooperate on anything. Until that changes, it is fanciful to think that the BRICS or even an expanded grouping could mount any serious challenge to the dollar.

- The potential addition of Saudi Arabia and Iran come with similar caveats. Yes, bringing on two major oil producers (in addition to Russia) increases the likelihood of some oil being priced in currencies other than the dollar. But unless edging out the dollar is an explicit, genuinely shared, and deeply held goal, such invoicing changes will be exciting only to niche financial writers. I have lost count of the times I have heard arguments about why oil could soon be priced in a new currency. First it was going to be the Deutsche Mark, then the yen, then the euro. It’s still the dollar.

- Finally, and most importantly, for any BRICS (or BRICS-Plus) member to pose a strategic challenge to the dollar, it would have to permit – indeed encourage – foreign and domestic savers and investors to decide for themselves when to buy or sell assets denominated in its currency. That means no capital controls of the kind that China has routinely deployed.

Let us review. First, a number of countries, especially the BRICs, have taken steps to de-dollarize. This includes making commodity trades in non-US dollars, arranging currency swaps, and establishing settlement mechanisms outside of SWIFT.

Second, de-dollarization was already happening before the war in Ukraine but when the United States and its allies sanctioned Russia, other countries suddenly realized they could also find themselves cut off from the Western financial system, including EU and US banks and SWIFT. More alarming, running afoul of Washington or Europe could result in them having their foreign reserves frozen, or even confiscated. The de-dollarization trend has thus accelerated.

Third, it was previously thought that an alternative currency to the dollar was going to be discussed at the BRICS summit next week in South Africa. We now know a BRICS currency isn’t on the agenda, however a top South African official has stated that trading between local currencies is likely to continue and increase.

While none of the group of five countries has shown any interest in discontinuing their home currency, a payment system for cross-border transactions would be a first step towards a common currency.

Having said all this, there are good reasons to assume that the US dollar isn’t going anywhere, at least for now. Nearly 90% of international transactions are conducted in US dollars, the buck accounting for 59% of global foreign exchange reserves, and all but a handful of commodities are bought and sold with US dollars.

Strength in the dollar is underpinned by the $23 trillion US Treasury market, and there are as yet no credible alternatives to US bonds.

Finally, for any country wanting to mount a serious challenge to the dollar, it would have to allow investors to buy or sell assets in its own currency, and forbit capital controls — something China has yet to do.

Gold-backed currency?

The idea of the BRICS establishing their own currency has stimulated some commentators to venture whether it could be backed by gold.

While a BRICS currency right now is off the agenda, that doesn’t mean it couldn’t happen at a later date. As Forbes author Nathan Lewis reminds us, since the US dollar went off the gold standard in 1971, various governments have attempted to move back toward an international arrangement based on gold. In 2019, Malaysia’s prime minister Mahathir Mohammad proposed a Pan-Asian currency based on gold…

In 2009, Libya’s Muammar Gaddafi proposed a Pan-African currency, the gold dinar, echoing the gold dinar coins of the Arab Caliphates that once ruled North Africa. But, unrest in Libya in 2011 put an end to such ambitions.

Also in 2009, the head of China’s central bank, Zhou Xiaochuan, wrote: “An international reserve currency should first be anchored to a stable benchmark and issued according to a clear set of rules…

Although Xiaochuan did not say how these goals might be achieved, we can assume it would be done exactly the same way that Mao Zedong ended hyperinflation in China in 1950: By fixing the yuan to gold.

In Moscow, leading intellectual Sergey Glazyev recently proposed a “Gold Ruble 3.0,” referencing the gold-based rubles of both the Czarist era, and then the Soviet Union. Russian media reported that Russia and Iran are in talks to establish a gold-based cryptocurrency for international trade.

Central Bank Digital Currencies

At this point we should introduce the concept of a Central Bank Digital Currency (CBDC), given that in today’s modern financial system, it is likely that an alternative reserve currency which either replaces or exists alongside the dollar, is digital in nature. Could such a currency be backed by a hard asset, i.e. gold? Read on to find out.

The idea behind central bank digital currencies (CBDCs) is to implement a payment system that has both the transactional convenience of digital currencies and the financial security of fiat currencies. CBDCs would essentially serve as a digital form of a government-issued currency that isn’t pegged to any physical commodity. (although it could be — Rick)

As many as 114 countries, representing more than 95% of global GDP, are exploring CBDCs right now, according to the Atlantic Council, a US-based think tank.

So far, 11 countries have launched a digital currency, with Jamaica being the latest to do so and the first to be ratified formally as legal tender. China, which has already started large-scale trials of its “e-yuan”, is expected to expand to most of the country this year.

As we discussed before, CBDCs, like fiat money, are supported by trust, so it would make sense for them to be backed by hard assets.

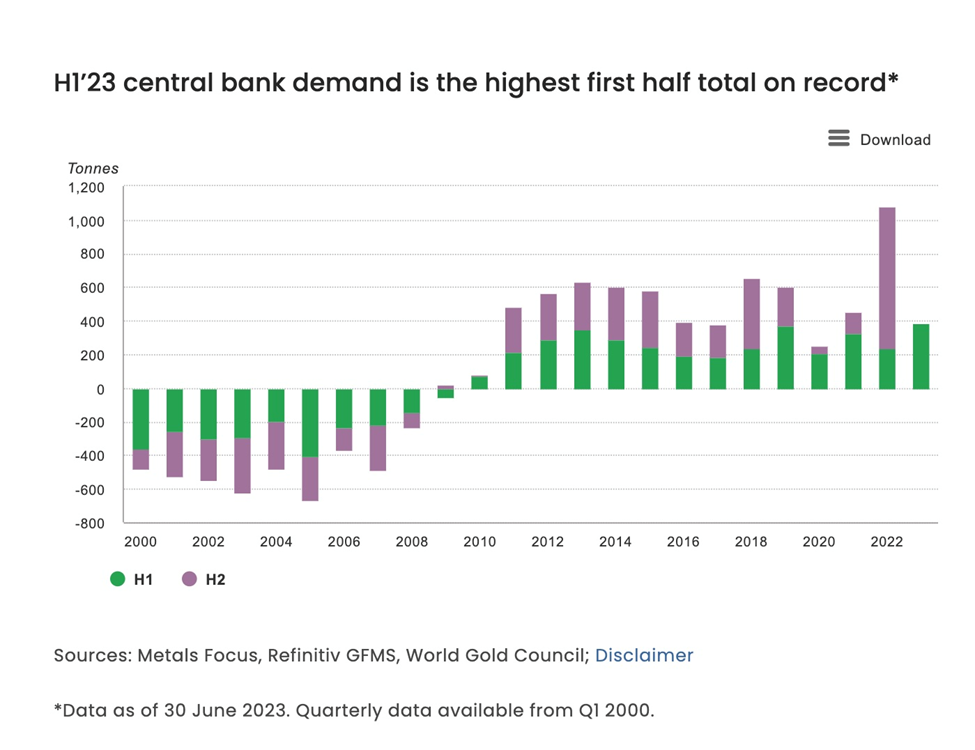

China appears to be the first nation to realize this and is rushing to accumulate as much gold as it can. The People’s Bank of China reported adding 103 tonnes during the first half of 2023, extending its monthly buying streak to eight months.

Last year, global central banks bought the most gold on record, a whopping 1,136 tonnes, according to the World Gold Council. The stockpiling of gold has continued at a record pace in 2023, with CBs adding another 125 tonnes during the first two months. Central bank gold buying in the first half reached an H1 record of 387 tonnes.

The Central Banks of Iran and Russia are studying the adoption of a “stable coin” for foreign trade settlements, replacing the US dollar, the ruble and the rial.

Escobar notes this gold-backed digital currency would be particularly effective in the Special Economic Zone of Astrakhan, in the Caspian Sea — the key Russia port participating in the International North-South Transportation Corridor, or INSTC.

The inference being that The success of the INSTC – progressively tied to a gold-backed CBDC – will largely hinge on whether scores of Asian, West Asian and African nations refuse to apply US-dictated sanctions on both Russia and Iran.

G-7 of the East

The amount of potential trade here is tantalizing; the Russia-Iran section of the INSTC alone amounts to $25 billion. Iranian companies, for example, are the third largest importer of Russian grain.

The energy triad is equally compelling, i.e. trade between Russia, India and Iran. According to Escobar, India’s purchases of Russian crude have increased year on year by a factor of 33.

He also references above-mentioned Russian intellectual Sergey Glazyev, author of ‘Gold Ruble 3.0’, who explains how gold can be a unique tool to fight western sanctions if prices of oil and gas, food and fertilizers, metals and solid minerals are recalculated:

“Fixing the price of oil in gold at the level of 2 barrels per 1g will give a second increase in the price of gold in dollars, calculated Credit Suisse strategist Zoltan Pozsar. This would be an adequate response to the ‘price ceilings’ introduced by the west – a kind of ‘floor,’ a solid foundation. And India and China can take the place of global commodity traders instead of Glencore or Trafigura”…

What Glazyev proposes now is for Russia to boost gold mining to as much as 3 percent of GDP: the basis for fast growth of the entire commodity sector (30 percent of Russian GDP). With the country becoming a world leader in gold production, it gets “a strong ruble, a strong budget and a strong economy.”

Meanwhile, at the heart of the [Eurasian Economic Union] discussions, Glazyev seems to be designing a new currency not only based on gold, but partly based on the oil and natural gas reserves of participating countries…

Off the record, New York banking sources admit the US dollar would be “wiped out, since it is a valueless fiat currency, should Sergey Glazyev link the new currency to gold. The reason is that the Bretton Woods system no longer has a gold base and has no intrinsic value, like the FTX crypto currency. Sergey’s plan also linking the currency to oil and natural gas seems to be a winner.”

So in fact Glazyev may be creating the whole currency structure for what Pozsar called, half in jest, the “G7 of the East”: the current 5 BRICS plus the next 2 which will be the first new members of BRICS+.

Both Glazyev and Pozsar know better than anyone that when Bretton Woods was created the US possessed most of Central Bank gold and controlled half the world’s GDP. This was the basis for the US to take over the whole global financial system.

Now vast swathes of the non-western world are paying close attention to Glazyev and the drive towards a new non-US dollar currency, complete with a new gold standard which would in time totally replace the US dollar.

Conclusion

Whether or not Glazyev’s thesis is a foregone conclusion cannot of course be known. The powerful dollar has for decades had a lock on commodities trading, allowing Washington to hinder market access for producer nations, including Russia, Venezuela and Iran.

It’s no surprise that these countries, along with China, India, Brazil and other Middle Eastern states, are the ones pressing for a non-USD option. Trade indeed is shifting.

For example, India has begun purchasing Russian oil in UAE dirham and roubles, China paid for $88 billion worth of Russian oil, coal and metal in yuan, and Chinese state-owned oil company CNOOC and France’s TotalEnergies in March completed their first yuan-settled LNG trade.

A gold-backed digital currency probably makes the most sense and it’s likely to start with the BRICS, which have already made significant de-dollarizing strides. The idea, of billions worth of goods freely moving north-south, between central Asia and Africa and Asia (cutting out the Western financial system), being traded by countries that have all bought into the de-dollarization ethos, and refusing to apply US sanctions on Russia and Iran, is both audacious and brilliant.

If the above article was of interest please subscribe to Mills’ newsletter.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money