Are gold and gold stocks set to bottom? Not yet, according to my long-term measures of greed and fear. [I think a look at each of them below will substantiate my conclusion.] Words: 390

measures of greed and fear. [I think a look at each of them below will substantiate my conclusion.] Words: 390

So says Cam Hui (www.humblestudentofthemarkets.blogspot.ca) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Hui goes on to say, in part:

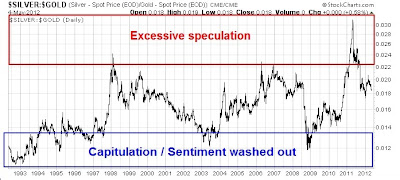

The Silver-to-Gold Ratio

Consider, for example, the silver-to-gold ratio. Silver has long been regarded as a high-beta play on gold. The chart below of this ratio shows that while sentiment has descended from levels indicating excessive bullishness, they are not at levels consistent with a long-term bottom yet

The TSX Venture-to-TSX Composite Ratio

Here in Canada, we also have a good measure of speculation levels in resource and junior resource stocks. The chart below shows the ratio of the TSX Venture Index, which is comprised mainly of junior resource companies, against the more senior and established TSX Composite.

This relative return ratio also tells the story of falling speculative fever, but readings are not at levels consistent with capitulation bottoms. (Note that the scale of this chart is 13 years, which is the amount of history available, compared to the silver/gold ratio above that has a 20 year history.)

The HUI-t0-Gold Ratio

What about the ratio of gold stocks to gold? The chart below shows the HUI to gold bullion ratio. While we are nearing levels where a meaningful bottom can be established, readings are not at screaming buy levels yet.

The above readings are suggestive of a tradable short-term bottom in gold and gold stocks is coming up, but a long- or even intermediate-term bottom may have to wait. Given that gold prices are deflating in the wake of the French and Greek elections, that short-term bottom may be fast approaching.

Automatic Delivery Available! If you enjoy this site and would like every article sent automatically to you then go HERE and sign up to receive Your Daily Intelligence Report. We provide an easy “unsubscribe” feature should you decide to opt out at any time.

Spread the word. munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

Conclusion

My inner trader tells me that I could buy here, but I need to carefully define how much risk I am willing to take. My inner investor tells me that there is value at current levels and I can accumulate positions, but there may be better entry points down the road.

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Dr. Nu Yu: Developing Trends in Gold, Silver and Mining Companies to Remain VERY Bearish! Here’s Why

This analysis is an all-encompassing look at the developing trends in gold, silver, the HUI and XAU indices, West Texas crude oil, the US Dollar Index, 30-year U.S. Treasury bonds and the U.S. and Chinese stock markets. It is not a pretty sight! Words: 1428

2. Gold Will Drop to $1,450 This Month Before a Parabolic Move to $3,950!

Based on my technical analysis gold will drop to $1,450/oz. before the end of May and then go parabolic in the next C-wave to $3,950/oz. Below is a chart of how I see the price of gold unfolding over the next while.

3. The Time to Buy Gold Is When There Is Blood In the Streets and That Time Is NOW!

As contrarian investor Baron Rothschild said, “the time to buy is when there’s blood in the streets.” Here are five reasons we believe this sell-off sets up a buying opportunity for gold. Words: 388

4. Sprott: Current HUI Level Spells O-P-P-O-R-T-U-N-I-T-Y

Before we end the year we will hit new highs in both [gold and silver]. Then the mining stocks [will] react. The big problem has been [to date has been that] there is not this momentum in the prices of bullion, which is keeping people away from the gold stocks. If we can get the price of gold and silver going back up, I’m sure people will come back into the mining stocks.

5. Richard Russell: NOW is the Time to Begin Amassing Your Future Fortune – Here’s Why and How

Great fortunes are made at super-bear market lows but you must have the money at the lows. [That is precisely] why gold is so singular and valuable. If you have gold at the bottom of the next bear market, you can exchange it for a collection of great common stocks or funds, and then sit back and relax.

6. John Embry: ‘Plunge Protection Team’ Hard at Work While Investors Puke Up Mining Stocks!

Most novice investors don’t understand the fundamentals and so they are puking up the mining stocks because they just want out but…this is when you want to buy, when sentiment is negative and fundamentals are astoundingly positive.

7. Precious Metals: Don’t Want To Play Anymore?

We suspect that many precious metals investors are saying, “We don’t want to play anymore!” and our reply is, “You mean you want to quit right now? Right at the bottom of this cycle? You must be crazy – and that is crazy with a capital C!” True, this is a very challenging market environment for resource shares, but we know what the ultimate outcome will be: higher share prices. The only question is “when” and our opinion is that we are very close in time (within days or a week or two at most) of being able to say that the lows are behind us. Let me explain. Words: 785

8. Now’s the Time to Take Advantage of Current Discount on Mining Shares – Here’s Why

Gold stocks are now trading as though peace, prosperity, balanced budgets, and the repudiation of fiat currencies were about to break out across the globe, sending the metal back to $1,000 per ounce in the very near future. Given the stagflation conditions in the developed world, however, and governments’ proclivity to use money printing in order to jump-start an economy, it may be wise to take advantage of the current discount being offered on mining shares.

9. Jeff Clark: Are Gold Stocks Still Going to Bring the Anticipated Magic? Yes, Here’s Why

We’re invested in gold stocks not just to make money, but for the chance to change our lifestyles and with their lackadaisical [dare I say dismal] year-to-date performance, one may begin to wonder if they’re still going to bring the magic. [Here are my views on the subject.] Words: 740

10. John Embry: PM Stocks One of the Greatest Buying Opportunities of ALL Time!

If we’re not at a bottom [in gold and silver and precious metals stocks], we’re very close to it. The sentiment is dismal and you can see that particularly in the stocks which are almost tragic. I’m shocked quite frankly at the valuations and how low they are. In the fullness of time, this will be seen as one of the great buying opportunities of all-time.

11. Get Positioned: “Gold Rush” Will Cause Gold Stocks to SOAR – Here’s Why

Whatever their reasons, the number of investors wanting exposure to gold is increasing. Many who ignored it a decade ago are now buying. Those who started buying, say, five years ago, continue purchasing it today in spite of paying twice what they paid then. Slowly but surely, it’s becoming more important to more people…but what happens when it becomes a must-own asset to a substantial majority instead of a small minority? Sure, the price will rise, probably parabolically, but putting aside speculation on the price of gold for now, have you thought about what happens if you have trouble finding any actual, physical gold to buy? [Let’s explore that possibility and what that would mean for gold stocks in such an eventuality.] Words: 870

12. James Turk: Gold Stocks Are Making History – Here’s Why

We’re making history here. Gold stocks have never been this undervalued before. We’ve had a 12 year bull market in gold, but we’ve also had a 15 year bear market in the mining shares…It’s very rare in market history to see an outlier like this. This is an extraordinary event. Years from now we are going to look back and shake our heads in disbelief at how undervalued gold stocks were in 2012.

13. Is it Time to Load Up on Gold Stocks?

By almost any measure, gold stocks are undervalued but should we load up? Gold mining companies are earning record margins. Stock prices, however, have not responded in similar fashion but when the broader investing community begins to take notice, investors will snap up these highly profitable stocks and push prices higher. The “catch up” in gold stocks could be tremendous but the question, of course, is timing. We don’t know when gold stocks will begin to catch up and the data don’t suggest they must rise right now or that they’ve hit bottom so should we load up just now? Words: 590

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money