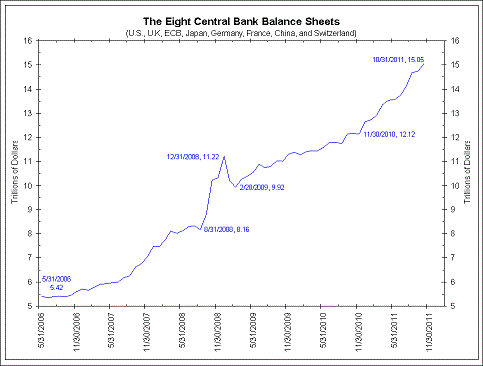

The growth in liquidity in global systems has become staggering… [reaching] a whopping $15 trillion – and rising – from the world’s eight largest central banks [alone as shown in the chart below.]…[That’s equal to almost] one-third of world equity values…which means that central banks are creating another bubble…No wonder the stock market is rising. [With so] much liquidity,…and with interest rates so low, there is no place to go but “risk on” assets. [That being said,] investors need to know how to capitalize on this short term phenomenon and how to prepare for the inevitable burst. [Let me explain further.] Words: 489

[reaching] a whopping $15 trillion – and rising – from the world’s eight largest central banks [alone as shown in the chart below.]…[That’s equal to almost] one-third of world equity values…which means that central banks are creating another bubble…No wonder the stock market is rising. [With so] much liquidity,…and with interest rates so low, there is no place to go but “risk on” assets. [That being said,] investors need to know how to capitalize on this short term phenomenon and how to prepare for the inevitable burst. [Let me explain further.] Words: 489

So says Keith Springer (www.keithspringer.info) in edited excerpts from his original article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited further below for length and clarity – see Editor’s Note at the bottom of the page. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

Springer goes on to say, in part:

Once again, rather than fix the problem so we can get on with a true recovery and adjust to slower growth from a rapidly aging population and a massively over-indebted population, the Fed are making the same mistakes of the past: creating more money through debt just like they did in 1998 stock market bubble and 2003 real estate bubble.

Investor Strategies

The good thing about bubbles, though, is that it drives asset prices higher. Investors that know how to participate in the current bubble with the least risk possible and know when to get out, will do well. There are definitely good opportunities out there for nimble investors who know what they’re doing, so be the expert or hire one.

1. Buy Precious Metals

Naturally we cannot just sit with money in the bank earning nothing, nor can we afford to stay dormant with an old fashioned buy-and-hold approach. Both are destined for disaster. If this “raining of money” does nothing else, it will debase the leading currencies and push commodities higher. Use this correction in gold and silver to buy [more – or, at least, – some]…

Who in the world is currently reading this article along with you? Click here

2. Enter Stock Market Now

[While] all this excess liquidity, and the possibility of a QE3, is a positive for stocks, we are entering correction season…Although many people are waiting for a pullback to get invested, it is certainly very possible that it just won’t come until the market is much higher. Of course, we continue to recommend to simply, Invest for Need, Not for Greed, which is the art of getting the very best returns necessary, with the least risk possible.3. Take a Tactical vs. Buy-and-Hold Approach

Investors must continue to avoid buy-and-hold (buy-and-hope) and enter investing in a “Tactical” approach. Once we get through this little corrective period and get into the next earnings releases, we’ll probably see new highs. Growth investors can buy…. [well researched stocks and ETFs while] moderate investors can focus on preferreds on corporate bonds, where yields are the best.

*http://www.keithspringer.info/its-raining-money

Editor’s Note: The above article has been has edited ([ ]), abridged, and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Why spend time surfing the internet looking for informative and well-written articles when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read. Sign-up for Automatic Receipt of Articles in your Inbox and follow us on FACEBOOK | and/or TWITTER .

Related Articles:

1. 5 Essential Strategies for Prospering in Today’s Markets

[I have identified] five “Great Deceptions” lurking out there that, individually and collectively, have the potential to wreck your portfolio. [That being said,] I also have five protective strategies to help you avoid getting slammed. Words: 9982. Should Stocks Be the Cornerstone of Your Portfolio?

There is a common notion that stocks, at least if held for a long-time, outperform other assets [and, as such,] should be the cornerstone of any long-term portfolio. [While that is indeed true,] it is best to focus first on how much you are able and willing to lose (i.e. what risk you are able and willing to bear) when determining the optimal allocation for your portfolio. [Only] then [should you] think about what potential investment returns you might be able to capture. [Let me explain.] Words: 1503

3. Portfolio “Diversification” Can Kill Your Portfolio Returns – Here’s Why

Most investors don’t know anything more about diversification than you “shouldn’t put all your eggs in one basket” [but] spending some time trying to understand the ways you might be shooting yourself in the foot could seriously enhance your portfolio returns and stop catastrophic risk. [There are some advantages to diversification if you REALLY know what you are doing but the shortcomings can go a long way towards killing your portfolio returns. In this article we identify what they are and how best to avoid them.] Words: 1055

4. Extreme Investing: Do Leveraged ETFs Belong in Your Portfolio?

Some analysts and commentators are warning that this year (2012) could match or surpass the dire conditions experienced in 2008 with the promise of more turbulence from the Eurozone, further political wrangles over dealing with the U.S. budget deficit and a potential host of problems in emerging market countries such as a possible Chinese banking and real estate crash. [While you] should fear plummeting stock markets…there are actually some interesting ways to play the downside or hedge your portfolio. [Let me explain.] Words: 990

5. Don’t Invest in Mutual Funds! Here’s Why

The amount of evidence stacking up that…mutual funds…do not provide value for their investors is just staggering…While there are certainly signs that the public’s tolerance of excessive fees and executive pay is falling, the likelihood of significant structural change in the finance industry is still remote. Given such a backdrop the probability remains that investors in funds will, on average, continue to underperform their benchmarks. So what is an investor to do? [Read on!] Words: 830

6. I’m Hooked on Dividends – Here’s Why

Dividends aren’t just for Warren Buffett and retirees. Dividends have the power to support your goals of becoming independently wealthy. Here are 3 reasons why. Words: 586

7. Your Portfolio Isn’t Adequately Diversified Without 7-15% in Precious Metals – Here’s Why

The traditional view of portfolio management is that three asset classes, stocks, bonds and cash, are sufficient to achieve diversification. This view is, quite simply, wrong because over the past 10 years gold, silver and platinum have singularly outperformed virtually all major widely accepted investment indexes. Precious metals should be considered an independent asset class and an allocation to precious metals, as the most uncorrelated asset group, is essential for proper portfolio diversification. [Let me explain.] Words: 2137

8. Gold Bullion, Stocks or Bonds: Which Have More Long-term Investment Risk?

In proclaiming buy-and-hold investing to be dead, the pseudo-experts masquerading as financial advisors have abandoned the fundamental principle of investing: buying undervalued assets – and then giving those assets the time necessary to mature. Instead, these charlatans have forced their clients to become short-term gamblers. Worse still, they are now consistently steering their clients toward the worst possible asset-classes, stocks and bonds, rather than the best ones [simply because they do not] understand the fundamental conceptual difference between risk and volatility. In a market populated by panicked lemmings, we cannot avoid volatility. However, we can and must reduce risk – which begins by building an allocation of history’s true safe haven asset, precious metals. [Let me explain more about what risk and volatility are and are not.] Words: 1080

9. Rosenberg: 7 Ways to Invest Given the Potential 8 Behavioral Changes Coming in 2012

The global economy is going to endure a significant deleveraging cycle as we move through 2012 – one that will affect most if not all parts of the developed world. It will be accomplished by some combination of default and write-downs, debt repayment and rising savings rates. [Below I outline 8 areas of behaviorial change to watch for in 2012 and 7 ways to invest in such a fluid economic environment.] Words: 1186

10. What Works on Wall Street? James O’Shaughnessy Tells All!

History has shown that investors who stick to disciplined, fundamental-focused strategies give themselves a good chance of beating the market over the long haul and one of the investment gurus who has compiled the most data on that topic is James O’Shaughnessy, whose book What Works on Wall Street became something of a bible for investment strategies when it was released 15 years ago. Now, O’Shaughnessy has released an updated version of his book, with a plethora of new data on various investment strategies. Using data that stretches back to before the Great Depression in some cases, O’Shaughnessy back-tests numerous strategies, and comes to some very intriguing conclusions. [Let me share some of them with you.] Words: 1345

11. Don’t Confuse “Risk” with “Volatility” – It Could Have Dire Consequences on Your Investments

[I am surprised at the large number of] investment professionals who confuse risk and volatility… regularly and thoroughly confusing these two concepts to the point where the terms are treated as being virtually synonymous. This has resulted in the flawed investment principle that reducing volatility will (and must) reduce risk. Such thinking is deeply misguided, and following it has dire consequences for investors. [Let me explain more about what risk and volatility are and are not.] Words: 110012. Size Does Matter: A Look at Market Capitalization and What It Means for Investors

People choose certain stocks for many different reasons – business location; sector strength; product innovation – but some investors choose what to buy based on company size, or market capitalization [believing that size does matter. Yes,] understanding the difference between small-cap, medium-cap and large-cap companies is the first step to making the right choice. [Let me explain.] Words: 600

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money