Is gold really is the inflation hedge that it’s cracked up to be?…No, not really, and, in fact, we view other high-yielding real assets as much better inflation hedges.

This post by Lorimer Wilson, Managing Editor of munKNEE.com, is an edited ([ ]) and abridged (…) excerpt from an article by Jussi Askola, for the sake of clarity and brevity to provide you with a fast and easy read. Please note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

…There is nothing about gold that makes it an intrinsically great hedge: gold only works as an inflation hedge to the extent that investors believe that it is and act on that belief by buying it, and therefore, it is driven purely by investor sentiment, which can be very volatile. For example:

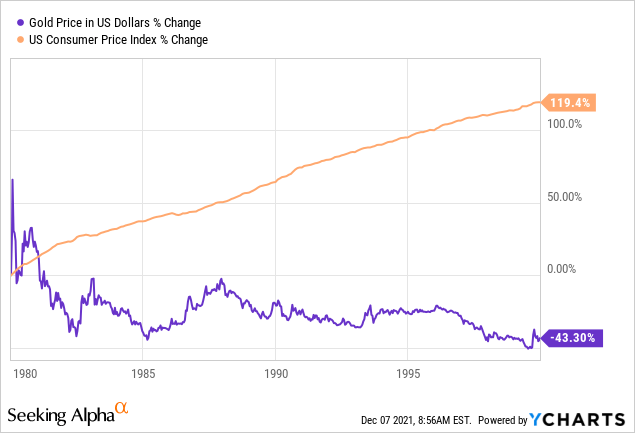

- if we look at gold’s performance between 1980-2000, it fell over 43% while inflation was rising nearly 120%.

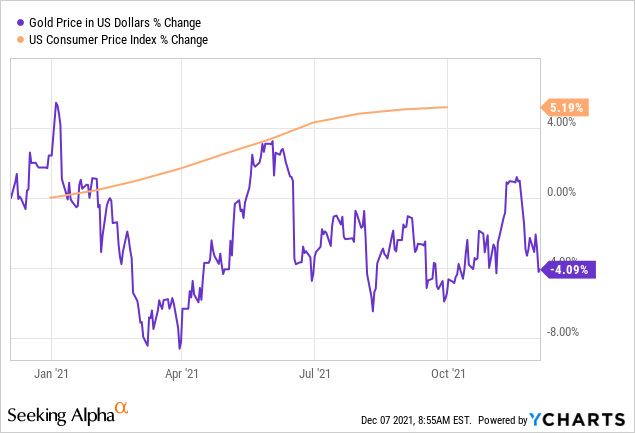

- Similarly, this year, gold has dropped in value even as inflation was surging:

Also, gold is constantly touted as a “store of value,” but if you look at these charts, it is clear that its value is very volatile and unpredictable so, if gold doesn’t protect against inflation, and isn’t much of a store of value, what exactly is the reason for owning it?

- It can perhaps serve as insurance against black swans and

- diversify a portfolio during times of market turbulence,

but I wouldn’t own it for the purpose of inflation protection. In fact, we view other high-yielding real assets like REITs and MLPs as much better inflation hedges…

Editor’s Note: Enjoying the article so far? If so, please DONATE what you can so I can continue to bring you such informative articles.

Farmland REITs

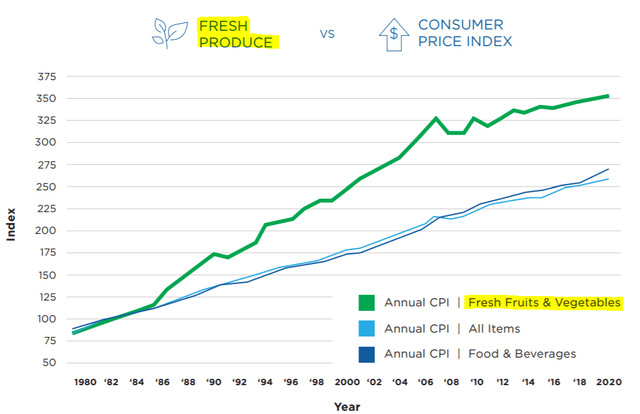

People rarely think of farmland as an inflation hedge, but it makes sense once you consider it logically. We all have to eat, and as the price of food increases with inflation, so does the value of the land that produces it. In fact, often the price of food rises even faster than the rate of inflation, resulting in inflation-beating appreciation:

Source – gladstonefarms.com

Source – gladstonefarms.com

Overall, farmland prices have historically risen a lot faster than the CPI, all while being strongly correlated with it so, if you expect the rate of inflation to increase, then farmland is a very good bet, and especially so if you can leverage it with a cheap fixed-rate mortgage.

There are only two publicly listed farmland REITs [and details regarding them can be found in the original article here]…Maybe someday there will be more publicly listed farmland REIT options, but for now, this is all we have, and given that nothing beats farmland in terms of inflation protection, you may want to invest in one of these options.

Apartment REITs

Just as farmland is a necessary staple of society, so too is personal shelter. Regardless of how the economy is doing, you just cannot go by without a roof over your head, and many people rely on apartment complexes to house them.

These apartment complexes are an excellent inflation hedge because:

- their values rise with the prices of raw materials and construction costs and, as these apartment complexes become more valuable, rents can also be increased, passing the inflation on to the tenants. In fact, rents are currently rising the fastest in over 15 years, and this surge is partly the result of the high inflation rate.

Of course, we must remember the mantra of real estate, though – location, location, location – and that’s the main reason why we like sunbelt-focused apartment REITs…[because] they focus on markets that are enjoying rapid population growth, allowing them to raise rents far faster than the rate of inflation. [The original article (see here) identifies three such possibilities and gives the rational for owning each.]…

Bottom Line

Many people unthinkingly presume that gold is a great inflation hedge but the reality is that gold is quite volatile, and doesn’t correlate especially well with rising inflation rates or the CPI. That’s why we prefer income-producing real assets like farmland and apartment communities. They have real mechanisms in place to protect you against inflation and generate substantial income too.

Editor’s Note:

Please donate what you can towards the costs involved in providing this article and those to come. Contribute by Paypal or credit card.

Thank you Dom for your recent $50 donation!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money