[The adage “sell in May and go away” refers to selling one’s stocks in May, going into cash, and then waiting until November before buying back into the market. That] has worked the past two years…[This time round, however,] we believe there is a high probability that you would be buying at a higher price [in November] than… [what if you were to sell out] in May of 2012. [Let us explain why we are of that view.] Words: 406

going into cash, and then waiting until November before buying back into the market. That] has worked the past two years…[This time round, however,] we believe there is a high probability that you would be buying at a higher price [in November] than… [what if you were to sell out] in May of 2012. [Let us explain why we are of that view.] Words: 406

So says Todd Feldman (www.bfiadvisors.com) in edited excerpts from his original article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Feldman goes on to say, in part:

We are forecasting that the high for 2012 will occur in the summer…[with] a high probability of a correction by the end of 2012 to the beginning of January. Therefore, we are suggesting the opposite for this year, buy in May and sell in October.

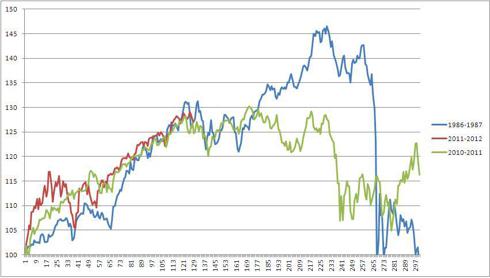

Why do we predict such an outcome? We use our own behavioral indicators to detect inflection points and cycles in stock markets. The current evolution of our US behavioral indicator suggests that we are in a cycle very much like 1986-1987.

Home Delivery Available! If you enjoy this site and would like to have every article sent automatically to you then sign up to receive Your Daily Intelligence Report. We provide an easy “unsubscribe” feature should you decide to opt out at any time.

Pass it ON! Tell your friends and co-workers about us. We think munKNEE.com is one of the highest quality (content and presentation) financial sites on the internet and our current readers seem to be confirming that. Visits have been doubling yearly and pages-per-visit and time-on-site continue to reach record highs.

Spread the word. munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

Below is an evolution of the S&P 500 price index during three periods. The starting point of the index is at a bottom in September of 1986, August of 2010, and October of 2011. Hypothetically, let us assume we are in April of 2011. Just by looking at the overlay it would suggest that 2010-2010 was tracking 1986-1987. However, the similarity ended in April of 2011. The S&P 500 topped out in April/May of 2011 whereas in 1987 the S&P 500 kept climbing.

The important point is that our U.S. indicator did not suggest a similarity with 1987 but [with]another year that signaled a bottom in August…This year, however, our indicator is signaling a similarity with 1987…[and,] therefore, the overlay is more meaningful today.

Figure 1: S&P 500 Price Index for Three Periods

X-axis is the number of days. S&P 500 index price is benchmarked to 100.

Conclusion

Based on our analysis a pullback between 5-7% will occur sometime in April/May. It may be already here or it may occur in May. [As such,] we suggest that one take the opportunity to buy more SPY at any 5% pullback [and then wait until late summer/early fall] to sell…

*http://seekingalpha.com/article/487321-sell-in-may-and-go-away-no-buy-in-may-and-sell-away?source=email_macro_view&ifp=0 (To access the article please copy the URL and paste it into your browser.)

Editor’s Note: The above article has been has edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. S&P 500 Should Continue Climbing Until October and Then Decline 15-30%! – Here’s Why

At the end of November 2011 the U.S. behavioral indicator for the U.S. stock market, based on insights on investor psychology, touched the crisis threshold for the fifth time (1971,1979, 1986, 2006) since 1970. If the current case follows the four prior cases, we expect a similar positive return from November 2011 to the end of October 2012 as in the four prior periods followed by a decline somewhere between 15% and 30%. [Let me explain.] Words: 317

2. Charles Nenner: Dow to Peak in 2012 and Then Decline to 5,000!

Charles Nenner has been accurately predicting movements in the liquid markets for more than 25 years, and his most recent cycle analysis predicts that the current stock market rally is going to last through Q2 and then begin a major descent in 2013 – with the Dow eventually reaching 5,000! Read on to learn how Nenner’s unique system works and what he forecasts for commodities, currencies, bonds, interest rates and more. Words: 400

3. What Does 2012, as an Election Year, Mean for Stock Market Returns? Here Are the Facts

Next year is a Presidential election year, and the stock market is almost always positive in election years. Right? At least that assurance has been a supposed truism for many decades, and repeated as fact each year in numerous interviews and financial columns. [Let’s explore just how correct those assumptions really are.] Words: 367

4. What Do the Presidential and Decennial Cycles Infer Will Happen in 2012?

Should we jump into the market now? [Let’s take a look at the 178 year history of the 4-year Presidential Cycles and the Decennial (10-year) Cycles and see what they suggest might well unfold in 2012.] Words: 1174

5. Market & Economic Cycles Suggest We’re in the Fall Season in More Ways than One – Here’s Why

The key to long term success in investing is understanding the difference between the “seasons” in the markets and the economy. [Let me explain the four “seasons” and why we might very well be in the “fall” season and, if that is indeed correct, why] it is time to pack away the summer allocations and break out the winter coats to hunker down for what may be a chilly 2012. Words: 1016

6. David Dreman More Accurately Forecasts Market Trends Than Most Anyone Else – Here Is His Record

We evaluate here the commentary of David Dreman at Forbes.com regarding the stock market via his archived articles since the beginning of 2001 [and what an accomplished record it is. He is tied for second place with Ken Fisher with a 64% accuracy rating which is well above the 46% rating of a list of 36 of his peers. Jack Schannep is the most accurate at 66%. Below are his market forecasts on specific sectors of the market over the years compared to how well said sectors actually did.] Words: 1706

7. Jeremy Siegel: 50% Chance of Dow Reaching 17,500 By The End Of 2013! Here’s Why

Last month, Wharton Professor Jeremy Siegel boldly claimed that there was a 70% chance that the DOW could reach 15,000 this year [and that] there’s a 50% chance that it could reach 17,500 by the end of 2013. [Here are his reasons]. Words: 291

8. Which Will It Be: Gold is About to Go Way UP or the Dow is About to Go Way DOWN?

It is very understandable why investors believe America’s engines are ready to roar again because economic indicators in America are turning up even though bad news barrages us from all sides… [That being said,] I believe the Dow Jones Index has not bottomed when viewed from an historical perspective with gold. We have further to go down in the Dow/gold ratio before the next big bull market begins. [Let me explain.] Words: 1250

9. Fractal Analysis Suggests Dow Could Drop to 6,000 in 2012 and Gold Take Off Like In 1979

[While] I do not prescribe to the 2012 end of the world or end of an era phenomenon, my recent fractal (pattern) analysis of the Dow suggests that it is forming a similar pattern to that which was formed in the late 60s to early 70s and if this pattern continues in a similar manner…the Dow could indeed have an annus horribilis (horrible year) in 2012. Let me explain. Words: 141610. NOW Is the Time to Get Out of the Stock Market! Here’s Why

With the S&P 500 at its highest level since the summer of 2008, investors previously sidelined by reoccurring fears of a double dip recession and nagging worries about a disorderly Greek default may now be tempted to hold their noses and dive into the market where, presumably, they will be swept along to the land of outsized profits by the Dow 13,000 wave. Having said this, it is worth noting that often the best time to sell is when everyone else is buying. Now may be that time. [Let me explain.] Words: 885

11. Ride the Market Waves With These 6 Momentum Indicators

It is hard to know what to buy or sell let alone just when to prudently do so. Thank goodness there are indicators available that provide information of stock and index movement of a more immediate nature to help you make such important decisions. This article describes the 6 most popular Momentum Indicators. If ever there was a “cut and save” investment advisory this is it! Words: 1234

12. Here’s How to Time the Market!

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on! Words: 974

13. Yes, You Can Time the Market – Use These Trend Indicators

Remember, the trend is your friend and now you have an arsenal of such indicators to make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a “cut and save” investment advisory this article is it. Words: 1579

14. Understanding the Patterns, Trends, Indicators and Formations of Technical Analysis

Technical Analysis is the discipline of finding reliable patterns, trends, indicators and formations, mainly in price, for buying and selling assets…To a large degree, technical analysis is a self-fulfilling prophesy [in that] it is effectively an unofficial agreement amongst market participants to impose more order on what would otherwise be more random. The key is to understand which patterns, formations and indicators are widely adhered to, so as to become useful predictors of price action [and this article does just that. Let me explain.] Words: 470

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money