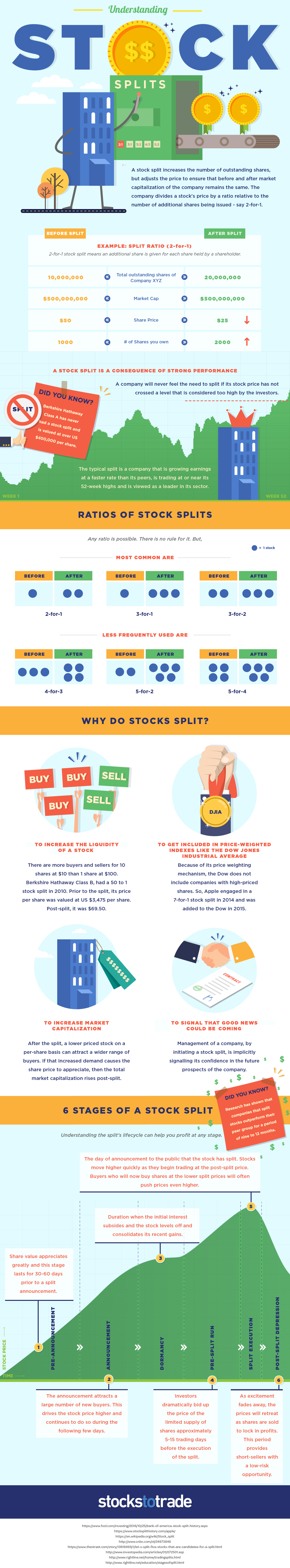

Imagine a shop window containing large pieces of cheese. If the value of that cheese rises over time, the price may move beyond what the majority of people are willing to pay. This presents a problem as the store wants to continue selling cheese, and people still want to eat it. The obvious solution is to divide the cheese into smaller pieces. That way, more people can once again afford to buy portions of it, and those who want more can simply buy more of the smaller pieces. The total volume of the cheese is still worth the same amount, it’s only the portion size that changed. As the infographic below illustrates, the same concept applies to stock splits.

This article is sponsored by Bill Manly. Go HERE to sponsor your own.

@$$4$If companies want their stock price to continue rising, why would they want to split it, effectively lowering the price? Here are a some specific reasons why:

1. Liquidity

As our cheese example illustrated, stocks can sometimes see price appreciation to the point where they are no longer accessible to a wide range of investors. Splitting the stock (i.e. making an individual share cheaper) is an effective way of increasing the total number of investors who can purchase shares.

2. Sending a Message

In many cases, announcing a stock split is a harbinger of prosperity for a company. Nasdaq found that companies that split their stock outperformed the market. This is likely due to investor excitement and the fact that companies often split their stock as they approach periods of growth.

3. Reducing Capital Costs

Stocks with prices that are too high have spreads that are wider than similar stocks. When spreads—the difference between the bid and offer—are too large, they eat into investor returns.

4. Meeting Index Criteria

There are specific instances when a company may want to adjust its share price to meet certain index requirements.

- The Dow Jones Industrial Average (DJIA), the well-known 30-stock benchmark…is a price-weighted index, which means that the higher a company’s stock price, the more weight and influence it has within the index…

- On the flip side, a company might decide to pursue a reverse stock split…[whereby] the existing amount of shares held by investors are replaced with fewer shares at a higher price…to keep the price above a certain threshold or…being delisted from an exchange.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money