“Follow the munKNEE” via Facebook or Register to receive articles via our Intelligence Report newsletter (Recipients restricted to only 1,000 active subscribers)

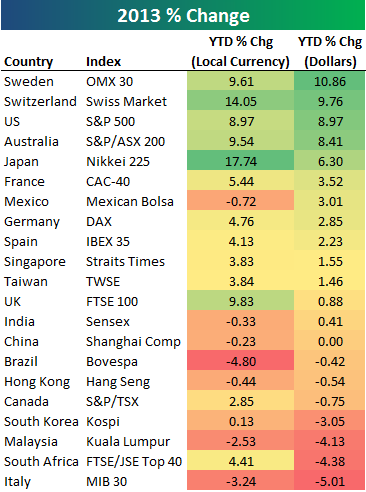

A lot has been made of strong stock market returns around the world so far this year, but adjusting for currency moves, the returns look a little less flattering. The U.S. dollar is up nearly 4% year to date, while currencies like the Japanese yen, the British pound and the euro are all down. Below is a look at the year-to-date stock market performance of 21 major countries around the world. For each country, we highlight its 2013 performance in local currency vs. U.S. dollar adjusted terms.

year, but adjusting for currency moves, the returns look a little less flattering. The U.S. dollar is up nearly 4% year to date, while currencies like the Japanese yen, the British pound and the euro are all down. Below is a look at the year-to-date stock market performance of 21 major countries around the world. For each country, we highlight its 2013 performance in local currency vs. U.S. dollar adjusted terms.

So writes Bespoke Investment Group (www.bespokeinvest.com) in edited excerpts from the original post entitled 2013 Country Stock Market Returns: Local Currency Vs. Dollar Adjusted.

This article is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say:

As shown in the table below:

- the U.S. stock market has been the 5th best performing in 2013 using local currency returns, but it has been the 3rd best when adjusted for the move in the dollar.

- Japan’s Nikkei 225 stock market is up a whopping 17.74% in local currency, but when adjusted for the big drop the yen has seen, it is up just 6.30%. Not bad, but not great either.

- The U.K.’s FTSE-100 stock market is also up significantly in local currency terms with a gain of 9.83%, but it is nearly flat (0.88%) when adjusting for the drop in the pound.

- South Africa is another country that has been impacted negatively by a drop in its currency. In local currency, South Africa’s stock market is up 4.41%, but it’s down nearly that much (-4.38%) in dollar terms.

While the dollar has gained against most currencies in 2013, there are a few countries that have better local currency returns for their stock market than dollar-adjusted. These include Sweden and Mexico, and to a lesser extent India and China.

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.bespokeinvest.com/thinkbig/2013/3/13/2013-country-stock-market-returns-local-currency-vs-dollar-a.html (Interested in running your portfolio through our trading range screen on a regular basis? Become a Premium Plus subscriber today! If you’re looking for additional analysis to stay on top of this gravity-defying market, become a Bespoke subscriber today and check out our popular weekly newsletter. You won’t be disappointed.)

Advertisement

China Calling!

We can establish your products there – we’ve already done it for others

Chinese market is 4x bigger than those of the U.S. and Canada combined

MAJOR need for:

– pollution treatment/prevention equipment (water & air),

– disease detection/treatments (diabetes & cancers),

– green energy products (heating & power).

Visit Global Linkages and then contact us to discuss opportunities

We’re off to Beijing & Shanghai again this month

Contact us today

Related Articles:

1. U.S. Events Suggest It’s Time to Further Internationalize Your Portfolio

With both the fiscal cliff and debt ceiling looming, US stocks beginning to trail stocks overseas and the much increased volatility of the US market compared to those outside the United States, it is getting difficult to argue that the United States is still the “safe port” in a storm. Given the changing dynamic, we continue to believe that this is a good time for investors to consider lowering their overweight position in US equities while raising the allocation to international stocks. [I explain my position more fully in this article.] Words: 711

I believe that the engine of global economic growth for the next five-year period will be China. I firmly also believe that it’s not only appropriate, but critical for investors, even those whose focus is trading rather than investing to now take a look at China equities based on long-term investment horizons. [This article does just that with some specific investment suggestions.] Words: 1581

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money