Statistically speaking, silver is a very strong buy. With a recent selloff of 28%, the numbers strongly indicate that the bottom has been reached. In fact, if the past is to be even a slight guide to the future, silver may double over the next 2 years. This is what happens on average. In other words, it’s time to buy silver.

28%, the numbers strongly indicate that the bottom has been reached. In fact, if the past is to be even a slight guide to the future, silver may double over the next 2 years. This is what happens on average. In other words, it’s time to buy silver.

The above comments, and those below, have been edited by Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here) for the sake of clarity ([ ]) and brevity (…) to provide a fast and easy read. The contents of this post have been excerpted from an article* by QuandaryFX originally posted on SeekingAlpha.com under the title Buy The Bottom In Silver and which can be read in its unabridged format HERE. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

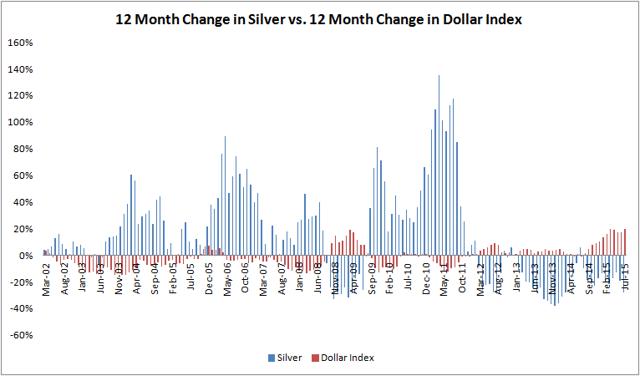

Silver Price vs. U.S. Dollar Strength

When the dollar falls, silver strengthens. This is based on simple economics which impact most commodities. Commodities are generally priced in dollars. As the dollar weakens, it takes a greater amount of dollars to purchase a commodity, thus naturally increasing the price. Again, this basic economic theory is substantiated by reality [as illustrated in the chart below].

As you can see, when the dollar weakens, silver strengthens. I believe the dollar is beginning to weaken and thus silver will begin to strengthen.

Silver Price vs. Product Demand & Supply

One of the many benefits of investing in commodities is that they are naturally self-correcting. With an individual stock, supply and demand for shares can be very difficult to gauge. However, with commodities, price is largely a product of the supply provided by producers matched against the demand from consumers. There is always as speculative factor which can cause market swings, but in general, price is a product of supply and demand.

You see, silver is a self-correcting commodity. When price declines, it typically only does so to a certain extent. When the price declines, miners are forced out of the business, decreasing supply. If demand remains relatively static but supply tightens, price eventually increases. The cool thing about this theory is that we can look to market data to see historically at what point this actually occurs [as illustrated in the chart below].

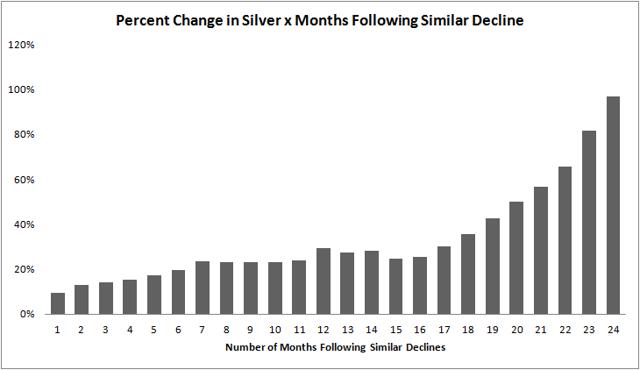

Future Price of Silver vs. Past Declines

Over the past year, silver has decline 28% – a move which has forced weak miners out of the market. Historically speaking, a decline of 28% – or even just a little more – is large enough to correct the price of silver through the supply/demand equilibrium mentioned above.

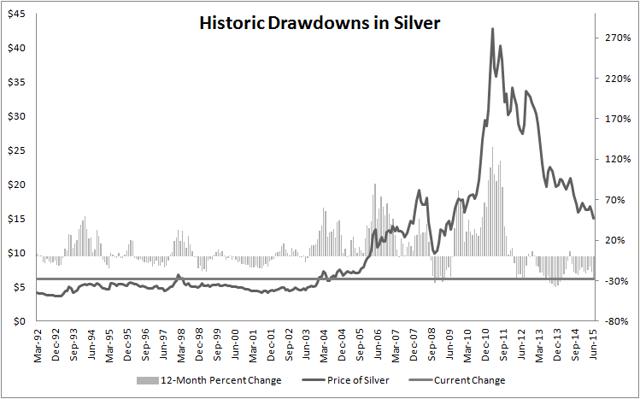

Silver Price vs. 12-Month % Change

The chart below shows what has historically happened to silver following every period of time in which price has fallen 28% or more over the last 29 years.

Statistically speaking, silver is a very strong buy. With a recent selloff of 28%, the numbers strongly indicate that the bottom has been reached.

Conclusion

If the past is to be even a slight guide to the future, silver may double over the next 2 years. This is what happens on average. In other words, it’s time to buy silver.

*http://seekingalpha.com/article/3500246-buy-the-bottom-in-silver?ifp=0

Related Articles from the munKNEE Vault:

1. Silver Price Is Artificially Depressed So Take Advantage – Begin Buying Now

The price of silver is significantly disconnected from its underlying fundamentals and, as such, is undervalued due to the actions of a handful of large speculators in the futures markets. This article identifies 3 such specific examples of such action.

2. Once Silver Finds Bottom It Should Rebound By 350% – Here’s Why

Spectacular bull markets in silver are not a fantasy and are not anomalies. In the last 35 years, silver has had a perfect record of strong bull markets after a bear market. A 350% gain is what can be expected once silver finds a bottom. Here’s why.

3. JP Morgan Is Stockpiling HUGE Amounts of Physical Silver – Why?

Why in the world has JP Morgan accumulated more than 50 million troy ounces of physical silver since early 2012, adding more than 8 million troy ounces during the past couple of weeks alone? Why are they doing this? What do they know that the rest of us do not? Could it possibly be that they are anticipating another great economic crisis? We are definitely due for one! Here’s what I think is going on behind the scenes.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money