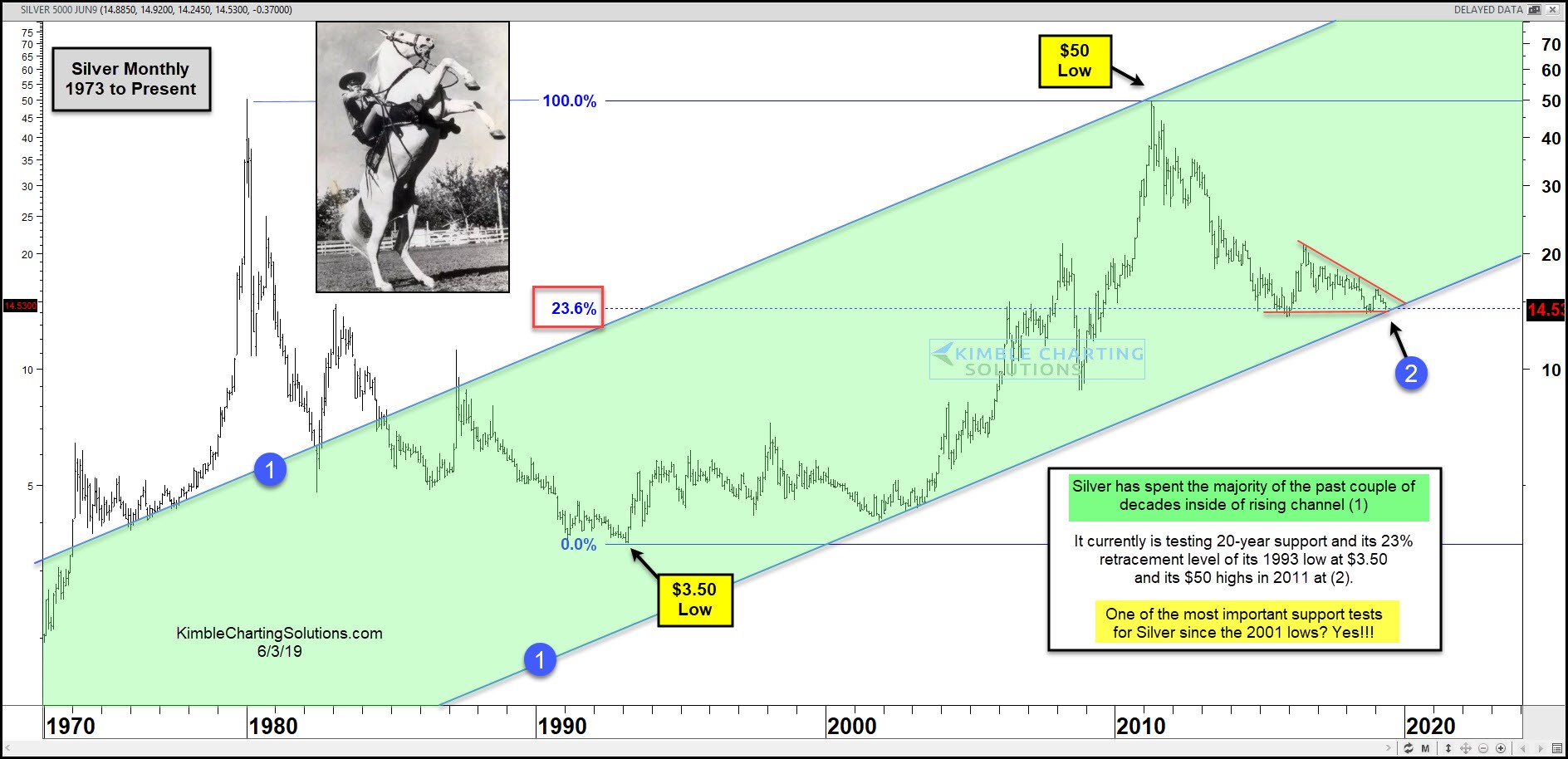

The 8-year decline in Silver has it currently testing the bottom of this channel and its 23% Fibonacci retracement level at (2). Is the bear market in Silver about to end?

What Silver does at (2) will go a long way to answering this question!

Editor’s Note: The above excerpts* from the original article by Chris_Kimble have been edited ([ ]) and abridged (…) for the sake of clarity and brevity. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

Related Articles from the munKNEE Vault:

1. Silver Will Soon Move Suddenly & Shockingly Higher – Here’s Why (+4K Views)

I am convinced that silver will soon explode in price in a manner of unprecedented proportions, both in terms of previous silver rallies and relative to all other commodities. By unprecedented, I mean that the price of silver will move suddenly and shockingly higher in a manner never witnessed previously, including the great price run ups in 1980 and 2011. The highest prior price level of $50 will quickly be exceeded.

2. Silver is Now Even More Precious Than Gold! Do You Own Any? (Almost 5K Views)

Silver is now rarer than gold and will be for all of eternity. From this point forth we work from current silver production alone and, from this point forth, demand will outstrip production without exception. Can you imagine what that means for the future price of this, indeed, precious metal? Forget about the popular expression: ‘Got gold?’ The much more important – and potentially more profitable – question to ask these days is, ‘Got silver?

3. Silver Could Hit $150 A Troy Ounce – Here’s Why (+2K Views)

A collapse of the U.S. dollar is inevitable. The U.S. Dollar Index has been bouncing off of four-year lows for the past several weeks but this cannot last much longer with a global trade war and U.S. equity correction looming….The U.S. dollar and fiat currencies are in trouble, hinting that gold and silver prices could again go screaming higher…[as] the two still generally trade inverse to each other and, while gold is perhaps the safest way to hedge against a falling dollar, the most profitable option is silver.

4. Silver Prices Are Way Too Low Any Way You Look At It

The graphs below show that silver prices are too low based on five decades of history and via comparisons to national debt, the S&P 500 Index and gold. Expect silver prices to rise far higher in coming years as the over-leveraged financial system resets and rebalances.

5. This Opportunity Is Being Handed to You On A Silver Platter!

Talk about having an opportunity handed to you on a silver platter! Whether it’s buying shares of SLV or purchasing physical bullion, there really isn’t much of a downside at this point. If you haven’t staked your claim, now’s a good time to do it.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Dear Mr. Lorimar Wilson,

I would like an opportunity to take your MunKnee website to the next level as an Associate Editor/Webmaster. I’m willing to take extra training courses and certifications to increase my skills to meet the needs of your current and growing client base .

Thank you for this opportunity and I look forward to your response.

Beatty London