By almost any measure, gold stocks are undervalued but should we load up? Gold mining companies are earning record margins. Stock prices, however, have not responded in similar fashion but when the broader investing community begins to take notice, investors will snap up these highly profitable stocks and push prices higher. The “catch up” in gold stocks could be tremendous but the question, of course, is timing. We don’t know when gold stocks will begin to catch up and the data don’t suggest they must rise right now or that they’ve hit bottom so should we load up just now? Words: 590

companies are earning record margins. Stock prices, however, have not responded in similar fashion but when the broader investing community begins to take notice, investors will snap up these highly profitable stocks and push prices higher. The “catch up” in gold stocks could be tremendous but the question, of course, is timing. We don’t know when gold stocks will begin to catch up and the data don’t suggest they must rise right now or that they’ve hit bottom so should we load up just now? Words: 590

So asks Jeff Clark (www.caseyresearch.com) in paraphrased comments from an article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Clark goes on to say, in part:

Falling HUI:Gold Ratio

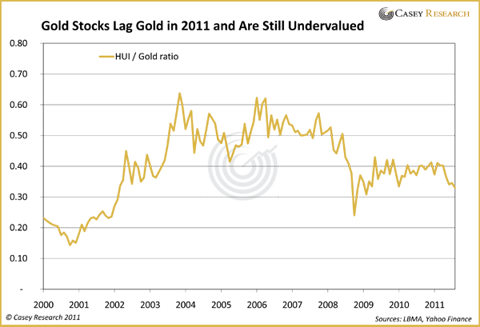

Gold accelerated higher last month, peaking around $1,900/ounce, while gold stocks lagged. Here’s a chart of the HUI-to-gold ratio (HGR). In a rising gold environment, a climbing HGR indicates that gold stocks are outperforming the metal; a falling HGR means they’re trailing gold.

Today’s 0.33 HGR means gold stocks as a group have not been this cheap, relative to their underlying metal, since January 2010 and a lower ratio hasn’t been seen since February 2009, when recovering from the 2008 global meltdown. Also consider that the GDX (Gold Miners ETF) is about the same price as last December, while gold is up 30%.

Soaring Margins

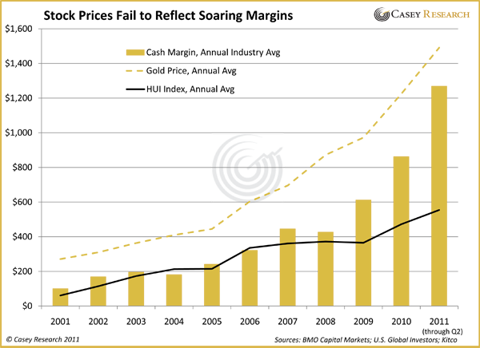

I think there’s a more compelling situation that demonstrates the undervalued nature of gold stocks. It’s hard to read a mining company’s quarterly report these days without hearing about “growing margins.” The gold price has risen faster than operating costs across our industry and lifted profit margins of the better-run producers.

Higher margins are key to growing earnings and cash flow, which in turn lead to rising stock prices. Have gold mining equities kept pace with ever-increasing margins?

Gold mining companies are earning record margins, averaging a whopping $1,268 per ounce last quarter. In both nominal dollars and percentage above costs, margins have never been this high for the gold producers. Stock prices, however, have not responded in similar fashion.

This is a potentially significant point, because margins of this magnitude will be ignored only so long. When the broader investing community begins to take notice, investors will snap up these highly profitable stocks and push prices higher. The “catch up” in gold stocks could be tremendous…

Conclusions

We’re in the right place but the question, of course, is timing. We don’t know when gold stocks will begin to catch up and the data don’t suggest they must rise right now or that they’ve hit bottom. Contributing to their price weakness is concern that the recent surge in the gold price isn’t sustainable. I can also tell you that we see the risk of another significant decline in the broader markets as a distinct possibility, and if one materializes, gold stocks could undergo a temporary swoon.

We’re convinced they’ll someday hit lofty levels, but for now we maintain the same refrain: keep one-third of assets in cash. This reduces risk and gives us a nice pile of funds to deploy during any selloffs…

*http://www.caseyresearch.com/articles/it-time-load-gold-stocks

Related Articles:

1. Is It Time to Nibble at Gold Miner Stocks?

The behavior of the stocks of the various gold miners in recent times warrants special attention. Let’s take a look at the GDX:GLD ratio, the Gold Miners Bullish Index and the volatility of the currencies and stock market indices of the emerging markets where most of these mines are located and determine what they suggest as to what we could well expect in the performance of such stocks in the months ahead. Words: 585

2. Gold to Bounce Back to $2,250 – $3,000; Silver to $52 – $62; HUI to mid-900s by Year End

A tsunami doesn’t start with a bang, but with a whimper. The first sign is a little hump in the water way out in the distance that is barely notable. Anyone who catches a glimpse of it simply continues to expect the day to be the same as the last many days – calm and beautiful waters along the shore. This is the point where we are, today in the Precious Metals sector. Many have seen the little roll of water out in the distance as Gold edged up in the first move of a more parabolic slope, yet most investors are mired in the same expectations of yesterday – a return for Gold to correct down into a lower base. Our analysis based on the fractal relationship to 1979 shows, however, that the mid 900s are a realistic target for the HUI by the end of the year or early in 2012; that $52 to $56 should be achievable for silver, with $58 to $62 as real possibilities; and that Gold should go the $2250 level followed by $2500 with the potential for $3,000, or a bit higher, now on the radar screen. Let me explain why that is the case. Words: 2130

3. Jeff Nielson: More of What to Look for When Investing in the Gold Miner Sector

With gold recently trading at its nominal high it is only natural that investor curiosity about precious metals mining companies should start to grow and the fact that relatively few investors know much about the various types of companies in this market sector is an indication that this market is many years away from peaking. [This article will change all that.] Words: 1912

While investing in gold mining companies is not quite as simple as novices to this sector might at first conclude, neither is it so overwhelmingly complicated as to make these companies inaccessible to individual, retail investors. Below are a number of things to look for when considering an investment in such companies. Words: 2745

5. Goldrunner: a Gold & Silver Tsunami is Approaching – Fast!

A tsunami doesn’t start with a bang, but with a whimper. The first sign is a little hump in the water way out in the distance that is barely notable. Anyone who catches a glimpse of it simply continues to expect the day to be the same as the last many days – calm and beautiful waters along the shore. This is the point where we are, today in the Precious Metals sector. Many have seen the little roll of water out in the distance as Gold edged up in the first move of a more parabolic slope, yet most investors are mired in the same expectations of yesterday – a return for Gold to correct down into a lower base. Our analysis based on the fractal relationship to 1979 shows, however, that the mid 900s are a realistic target for the HUI by the end of the year or early in 2012; that $52 to $56 should be achievable for silver, with $58 to $62 as real possibilities; and that Gold should go the $2250 level followed by $2500 with the potential for $3,000, or a bit higher, now on the radar screen. Let me explain why that is the case. Words: 2130

6. Gold Stocks: Get Ready, Get Set, GO!

Both gold and silver continue to trade well below their inflation-adjusted highs in nominal terms, and the market is now beginning to acknowledge the profit potential that precious metals equities offer at today’s bullion prices. We believe the equities will offer more upside than the bullion over time. Many of the smaller names are well priced and have momentum behind them. The prospects for gold stocks look extremely bright [for very good reasons. Let us explain.] Words: 2250

7. The Five “M’s” for Picking Gold Mining Stocks

With gold miners, in general, so attractively valued relative to the gold bullion price, the question becomes which stocks are the most compelling and have the best leverage to robust precious metals prices…In order to find the diamonds in the rough, I use what I call “The Five M’s” for mining stocks… Market cap, Management, Money, Minerals and Mine life cycle. [Let me explain each .] Words: 1146

8. Sell Your Gold Now – and Buy Its Producers Instead – for Greater Returns

I believe that the masses are stumbling over themselves to buy gold when the far better value is to own the companies that control so much of the supply. I will probably be pilloried for this by the gold bugs, but I’m going to hold my ground: now is not the time to buy gold and it may be a great time to sell it. Words: 435

9. Here’s How to Value a Junior Miner’s Gold in the Ground

At any given time, we know the international spot price for an ounce of refined gold but what about the gold an exploration or mining company has in the ground – how do we value that? [We have the answer. Read on.] Words: 833

10. Which Index is the Best to Use: the HUI, XAU or the GDX?

The number, market cap and currencies of the constituents of the HUI, XAU, GDX, XGD and CDNX indices differ considerably from each other and, as such, each index presents a different picture of what is really happening in the precious metals marketplace. This article analyzes the make-up of each index to reveal the biases of each to arrive at the answer to the question in the title. Words: 1026

So far in 2011 gold prices have increased [approx. 8] percent.. while the stocks of gold [mining] companies in the HUI have… declined 13%…[As such,] this year’s carnage has created a substantial opportunity to buy healthy gold mining companies at their second-cheapest level in nearly 30 years compared to gold bullion. [Let me explain.] Words: 1265

12. What’s the Difference Between 1 Gold Karat, 1 Diamond Carat and 1 Troy Ounce?

You have no doubt read countless articles on the price of gold costing “x dollars per ounce”, own a gold ring or some other piece of gold jewellery and/or wear or have bought/plan to buy a diamond ring but do you really understand exactly what you are buying? What’s the difference between 1 troy ounce of gold and 1 (regular) ounce? What’s the difference between 18 and 10 karat gold? What’s the difference between a .75 and a 1.0 carat diamond? Let me explain. Words: 1102

13. 9 Things to Look for When Choosing a Junior Mining Company to Invest In

In mining exploration, an “anomaly” is a geological formation that might attract a prospector’s interest. However, one rule of thumb is that you have to look at 1,000 anomalies to find one prospect and fewer than one prospect in a thousand turns into a mine. In other words, finding a mine is a million-to-one shot and that is one reason why junior mining stocks are highly speculative. Another reason is that it’s much easier to launch and promote one of these stocks than it is to build a profitable business. So junior mines attract more than their share of unscrupulous operators and stock promoters. Words: 504

14. Best Hedge Against Inflation Is Owning Gold and Silver Mining Stocks

We are about to encounter major inflation and the absolute best hedge against such inflation is by investing in the companies that mine gold and silver. You often get leverage of 2 to 4 times the price appreciation of gold or silver. If gold goes up by 50%, your miners may very well double or triple in value. Words: 1426

15. Why Invest in Junior Miners?

Leverage is the simple answer. It is not uncommon for junior mining companies to experience huge gains (10x or more) very quickly as news of a discovery is made known to the public. Words: 893

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money