The arguments for gold to rise dramatically are well known and highly publicized. The arguments for gold to remain flat or to decline are minimally discussed (and generally attacked vigorously when raised). [I do just that in this article and the conclusions will not be liked by the goldbugs.] Words: 285

So says an article* by StopAlerts (https://secure.stopalerts.com/) as posted on Seeking Alpha under the title Gold Price Plausibly $1,300 In A Deflation Scenario.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Edited excerpts from the article are as follows:

It would seem to us that inflation and debt repudiation are the two principal ways the developed world can get out from under its debts. That would create a long-term upward path continuation for gold.

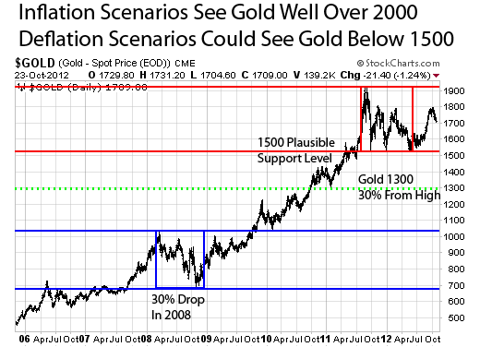

However, in the short term, there is a deflation scenario not too hard to imagine given the slowing of world GDP growth. That would create more downward pressure on gold prices, assuming the fear factor did not overwhelm the deflation concern.

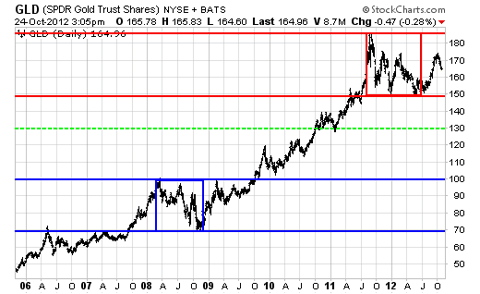

In 2008, when deflation was highly anticipated, gold declined about 30%. Today, deflation is being discussed, and gold is languishing.

If a 2008-like concern about deflation should recur, gold could conceivably repeat a 30% decline [like] it saw in 2008. That would put gold at around $1,300. Short of that, something more like $1,500 is a visible chart support level.

We are in a government actions and event driven world more than usual at this time, and anything could happen. Gold could spurt in either direction in the short term.

Conclusion

We expect gold solidly up long-term, but see the reasonable possibility of a significant decline from here if deflation concerns continue to rise among the investing public. The fiscal cliff could certainly cause that to happen.

*http://seekingalpha.com/article/949721-gold-price-plausibly-1-300-in-a-deflation-scenario

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. My Case Against the Case Against The Case Against Gold

All thing considered, it seems clear that the long-term real returns of gold have been poor (compared to stocks and bonds), and I see no reason to expect long-term price appreciation for gold to be above inflation. In fact, as with any non-income producing asset, it would be unreasonable to expect gold to provide significant positive real returns over an indefinite period of time…I would argue that buying gold is a short-term gamble that is completely dependent on the unpredictable vagaries of perception, market psychology and the “greater fool” theory…While it is true that gold can be a good short-term trade and offer superior returns over shorter periods (as has been the case in recent years) I believe that stocks will continue to substantially outperform gold over time. [Let me explain these less than popular conclusions further.] Words: 1258

2. Dr. Nu Yu’s Latest Analysis Shows Why Current Gold, Silver and HUI Levels Are No Surprise

Gold & silver have pulled back over the past two weeks after both faced strong resistance from the upper horizontal line of their respective trading ranges [and continue to flucuate within their] 12-month Trading Ranges of $1,540 – $1,800 and $26.50 – $36 respectively. HUI and XAU levels have pulled back and are testing the lower boundary of their rising wedges [but look likely to move upwards within their respective wedges (530 – 570 for the HUI and 200 – 215 for the XAU) before moving higher]. Check out my technical analysis below for details.

My previous article on gold & silver went viral with almost 30,000 reads on munKNEE.com alone and continues to be read by hundreds of goldbugs daily. Below is an updated chart and analysis suggesting that gold & silver have further to drop before they go parabolic. Take a look and share it with friends.

4. Why Isn’t Gold Hitting New Highs Given What’s Going On In the World These Days?

…[Y]ou may be curious why, despite continued money-printing and abysmal US economic reports, gold hasn’t been able to hit new highs. The answer is that gold is currently priced for collapse. Many investors believe the yellow metal has topped out and are selling into every rally. Treasuries have temporarily overtaken gold as the primary safe-haven asset [but, as I see it,] once that dynamic is broken the counterflow into gold will be tremendous. [Let me explain further.] Words: 797

Understanding what we are facing right now is critical to our survival…. [and to do so] we must embrace a global correlation approach to comprehend the true global implication of how capital moves. [Martin Armstrong provides a remarkable explanation of what is going on right now with the U.S. dollar, bond yields and the current price of gold. It would be well worth your time to read and reflect on what he has to say.] Words: 822

6. James Turk Interviews Robert Prechter: Which Will It Be – Hyperinflation or Massive Deflation?

James Turk believes hyperinflation is ahead. Bob Prechter believes massive deflation is coming. An interesting discussion between the two takes place in this audio. Ultimately, both lead to Depression. Only the route taken differs, but that is important.

7. Will the Current Whiff of Deflation Bring 2008 All Over Again?

You don’t need [actual] deflation—a reduction in the outstanding supply of money—to have markets react to a decrease in the rate of money supply growth…, anticipate the eventual deflation [and begin to price it into the market. Remember 2008?] Oil prices fell from $147 in July of 2008 to $33 per barrel by early 2009. The S&P 500 went into free-fall starting in September of 2008 and bottomed out in March of 2009—falling almost 50% in six months. This is what has already happened to the gold mining sector but, remember, central banks may be on a counterfeiting holiday right now but they have a history of taking very short vacations.

You don’t need [actual] deflation—a reduction in the outstanding supply of money—to have markets react to a decrease in the rate of money supply growth…, anticipate the eventual deflation [and begin to price it into the market. Remember 2008?] Oil prices fell from $147 in July of 2008 to $33 per barrel by early 2009. The S&P 500 went into free-fall starting in September of 2008 and bottomed out in March of 2009—falling almost 50% in six months. This is what has already happened to the gold mining sector but, remember, central banks may be on a counterfeiting holiday right now but they have a history of taking very short vacations.

8. It is VERY Important to Know Where the Inflation-Delation Pendulum Is to Invest Correctly – Do You?

Global investors are now being violently whipsawed by the decisions of central banks, as they switch between inflationary and deflationary policies. The choice governments now face is to allow a deflationary depression to finally purge the worldwide economy of its imbalances, or try to levitate real estate, equity and bond prices by printing massive quantities of their currencies.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money