If you are near retirement or already in retirement, there are many much better investment options [than gold or even]…recession resilient high-dividend stocks that generate consistent income in both good and bad times. [This article examines REITs and explains why they hold] the best bet against inflation.

REITs vs Gold

…There’s no investment that evokes as much passion as gold. Whether you are thinking about end of days or currency devaluations, gold always has been at the forefront of investment ideas. Gold also is known to be a rather strong protector against inflation. While we do believe that gold does have some inflation correlation, investors who like getting paid (vs. paying someone to store the metal), should ignore gold and focus on a much better investment class for inflation protection. Real Estate Investment Trusts.

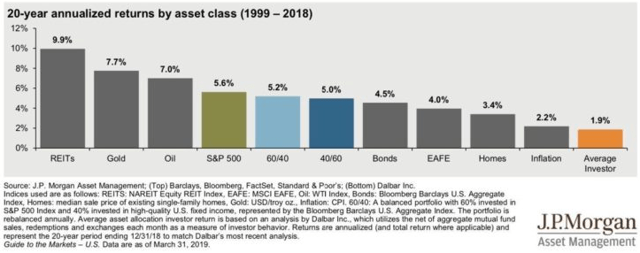

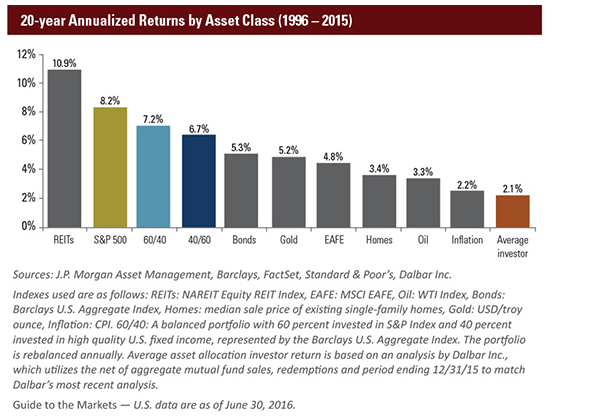

At a broader level REITs have done exceptionally well over large time frames. The 20-year period below shows REITs delivering the best performance among all asset classes.

Gold did come in second, but here’s the thing, if you shift the time frame back three years, things become rather different. REITs still come out on top while gold falls quite a bit.

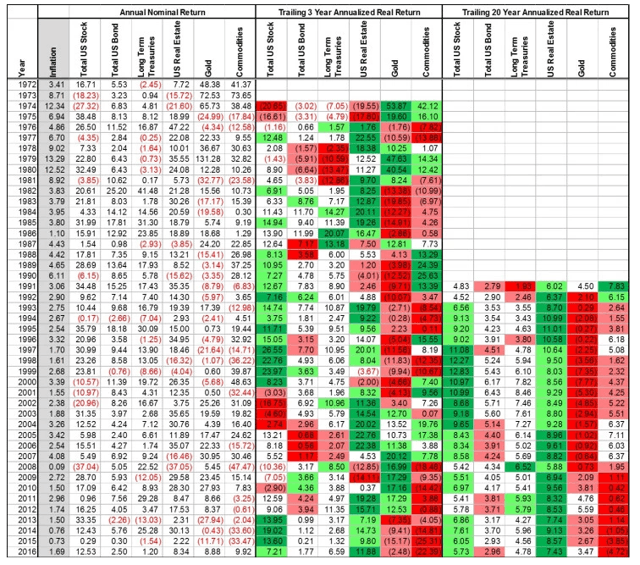

In fact…REITs are incredibly consistent and you can best see that by visualizing 20 year returns vs. gold.

Source: Engineered Portfolio

In fact if you bought gold in any year between 1974-1988, you had negative total 20 year returns… before counting storage costs. Let that sink in. REITs on the other hand were consistently a good performer regardless of your entry.

REITs vs Inflation

We bring up REITs today to show that it can actually be a decent hedge to inflation. Real estate in general appreciates alongside inflation. There are many reasons for this:

- Since nobody is building any more “land,” real estate goes up in value as the value of currencies decreases….

- Inflation increases the replacement cost value of assets as higher labor and raw materials are required to build similar assets…

- Rents are exceptionally well tied to inflation. [In fact, 63% of]…triple net lease REITs…actually use the official CPI measure in their annual rent adjustments for tenants.

At the same time, REITs use leverage and that leverage requires debt and interest payments. To the extent interest rates rise with inflation, it can dampen the increases from higher rents.

…We have three steps for finding the best REIT investments for inflation protection:

- Buy REITs in general when they are hated…

- [Buy]…long weighted maturities predominantly comprised of fixed rates.

- Fixing interest costs at today’s low levels is key in helping the REIT benefit from higher inflation.

- Buy REITs with moderate lease terms.

- …15-20 year leases are great for stability but they do reduce nimbleness if inflation averages are higher than expected. [Some]…REITs…have inflation-linked rent escalators…that max out at 2% or 3%. In that case, having a maturing lease is a big advantage to be able to reset rents significantly higher…

- Apartment REITs and Hotel REITs…have extremely short-term “leases” and can reset rents rather rapidly in response to changing conditions…

- Hotel REITs, however, have exceptionally strong beta to the economy makes them a less palatable option.

- Apartment REITs are fine, but most U.S. listed ones today are quite expensive and offer little value [at the present time]…

- Investors can find value in the broader REIT sector if they look for REITs that have moderate lease lengths.

Inflation, REITs and Gold

…Inflation is already here and quite robust and, should the economy dodge a recession, which is our base case today, we believe even higher inflation lies ahead [so] this is the time to look for hedges and find the right investments that will create a buffer over time…

[That being said, however,] most REITs are expensive today and most deserve a little correction before we would even wade into the waters.Gold, on the other hand, is a speculative asset class and one that has long periods of under-performance. The constant storage and insurance costs are a further drain and it produces no income. Even if your heart is set on holding some direct commodities, we would recommend looking outside of gold as it continues to be incredibly expensive vs. every other commodity out there.

Conclusion

If you are near retirement or already in retirement, consider REITs instead of gold…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money