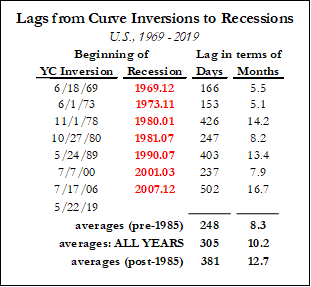

The yield curve’s forecasting record of U.S. recessions since 1968 has been perfect: not only has each of 7 yield curve inversions been followed by a recession, beginning roughly a year in advance, but no recession has occurred in the absence of a prior yield-curve inversion. The U.S. yield curve is again inverted – indeed, it has been since May. That signals trouble ahead for the U.S. economy and equities.

Those recessions, of course, have been closely associated with bear markets in stocks and bull markets in bonds. It matters a lot…for those who care about portfolios.

…[As noted above,] there’s even a strong correlation between the initial duration and depth of the curve inversion and the subsequent length and depth of the recession.

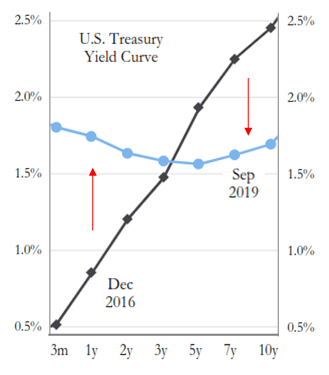

…The curve is best measured as the spread between the 10-year Treasury bond yield and the 3-month Treasury bill rate – what I call the “yield-curve spread”. A negative YCS depicts inversion.

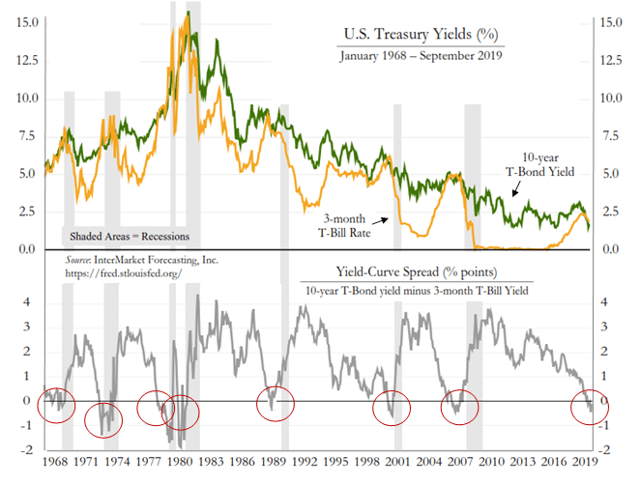

…The figure below depicts the U.S. bond yield, bill yield, and yield-curve spread since 1968.

Notice from the above graph that negative spreads preceded all recessions…It hasn’t mattered:

- whether yields generally have been high or low, or

- whether the yield curve’s inversion has resulted mainly:

- from short-term (bill) yields rising above long-term (bond) yields (due mainly to Fed rate hiking) or instead (and less frequently)

- from bond yields falling below bill yields.

…A few good reasons explain the undeniable forecasting power of an inverted yield curve:

- A sharp decline in bond yields means a sharp rise in bond prices, which suggests a big demand for a safe security, reflecting a desire by investors to immunize against trouble ahead.

- The longer the maturity at which one lends, the greater (normally) is the yield one receives (due to credit risk and/or inflation risk), so if bond yields are below bill yields it signals materially lower short-term yields in the future (i.e., Fed rate -cutting), which occurs during recessions.

- The essence of financial inter-mediation is institutions “borrowing short (term) and lending long (term).”

- If longer-term yields are above shorter-term yields, as is the normal case, there’s a positive interest-rate margin, which means lending-investing is fundamentally profitable.

- If, instead, longer-term yields are below shorter-term yields, there’s a negative interest-rate margin and lending-investing becomes fundamentally unprofitable or is conducted (if at all) at a loss.

- When market analysts observe credit markets “seizing up” before (and during) recessions, it reflects this crucial aspect of financial inter-mediation…

Economists, investors, and policymakers would do well to take seriously the predictive power of the yield curve, to study and comprehend not only its empirical but also its causal features.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money