Lately, nearly every piece of economic data is judged based on the degree to which investors perceive it will encourage/discourage central banks from embarking on a new round of quantitative easing (QE). Generally, bad data and subdued inflation is good because it means the Fed has both cause and room to ease, while good data and higher inflation are bad as they eliminate the need for easing and increase the chance that any asset purchases may contribute to already rising prices. That tendency to judge economic data in such a way is wrongheaded. [Let me explain why that is the case and more.] Words: 755

investors perceive it will encourage/discourage central banks from embarking on a new round of quantitative easing (QE). Generally, bad data and subdued inflation is good because it means the Fed has both cause and room to ease, while good data and higher inflation are bad as they eliminate the need for easing and increase the chance that any asset purchases may contribute to already rising prices. That tendency to judge economic data in such a way is wrongheaded. [Let me explain why that is the case and more.] Words: 755

So says Colin Lokey (http://blog.lokeyisstreetsmart.com/) in edited excerpts from his article* as posted on Seeking Alpha.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Lokey goes on to say, in part:

The tendency to judge economic data this way is wrongheaded for two reasons:

- The original intent of QE was to spark economic growth so the fact that market participants are wishing for bad data in the name of QE is perverse.

- QE’s effectiveness regarding the stimulation of the economy is diminishing and approaching zero, so hoping for more of it is just asking the central banks of the world to print money on which they will get no return (when ‘return’ is measured by economic growth).

Nonetheless, the market is addicted and until the addiction is curbed, investors will continue to judge every data point and every development by reference to the effect they have on central banks’ decision about whether to further stimulate the worlds economies.

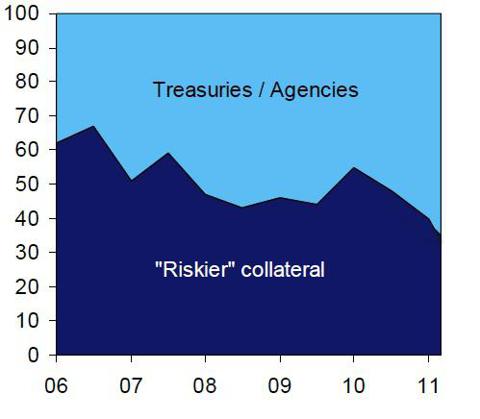

The market needs to understand that this trust in QE is misplaced. First consider that when central banks purchase government debt they are sucking senior collateral out of the system at a time when good collateral is in high demand and short supply (hence the ECB’s continual relaxation of collateral standards). The following chart shows collateral posted in U.S. triparty repos:

(click to enlarge)

Source: Fitch

Clearly there has been an increasing demand for high quality collateral since 2010. In Europe, the ECB is being forced to accept a greater and greater amount of low quality collateral in order to keep the region’s banks afloat. This cuts deep in two ways:

- it hurts the ECB’s balance sheet and

- the haircuts on the pledged ‘assets’ reduce the amount of cash that ends up in the hands of the banks who pledged it.

Taking good collateral out of the market will only serve to impair its functioning. As Phoenix Capital Research puts it:

How would buying Treasuries or other sovereign bonds… thereby sucking collateral out of the system… help an already insolvent banking system (the world’s $700 trillion derivatives market is backstopped by Treasuries and other senior assets)?

In order to get around this, U.S. banks for example could simply:

- take the new cash (reserves) they receive from the Fed in the QE ‘asset swap’ and buy Treasury bonds with it.

Thanks to the multiplier effect, the banks would in theory be able to buy many times as many Treasury bonds as the amount they turned over to the Fed by simply creating demand deposits in the Treasury’s name and keeping just enough of the new money parked to cover the reserve requirement. This way, the banks would have many times as much good collateral as they had before.

This sounds too good to be true precisely because it is. The obvious problem with this… is that:

- not only has the money supply been expanded, but

- the Fed would be indirectly funding the deficit.

Technically, the Fed would only have exchanged cash for previous deficits (that’s what existing Treasury bonds are after all) but in reality, if the banks go buy new Treasury bonds with the levered-up cash they received from the sale to the Fed of their old Treasury bonds, the deficit is indirectly being funded by the Fed and the money supply has been increased in the process.

Conclusion

In sum then, QE either:

- sucks collateral from a collateral-starved system or, if the receiving financial institutions seek to replace that collateral, QE

- risks funding the deficit in an absurdly circular scheme.

At the very least, the money supply expands and thereby increases inflation just when interest rates are low and investors cannot afford to give-up any real rate of return they have left. Eventually this policy must be abandoned.

What isn’t at all clear is what happens to equities when the printing presses go silent. One can only think the results would not be pretty. All of this points to one thing in terms of an actionable idea: buy gold.

HAVE YOU SIGNED UP YET?

Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com.

It’s FREE and includes an “easy unsubscribe feature” should you decide to do so at any time.

Join the crowd! 100,000 articles are read monthly at munKNEE.com.

Only the most informative articles are posted, in edited form, to give you a fast and easy read. Don’t miss out. Get all newly posted articles automatically delivered to your inbox. Sign up here.

All articles are also available on TWITTER and FACEBOOK

*http://seekingalpha.com/article/813701-qe-is-a-flawed-lose-lose-strategy

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Further QE Would Amount to _issing in the Wind! Here’s Why

“… those who are waiting for the Fed cavalry to ride over the hill and rescue the economy are doomed to disappointment….The banks are awash in loanable funds, businesses are cash-rich and opportunity-poor, and interest rates are already so low that lower still will not attract borrowing….More liquidity is unlikely to impart more impetus to the sluggish economy…. Congress and the President should not count on the Fed to bail them out of their mistakes…. Central banks are unable to help in the face of persistently flawed economic policies.”

2. Bernanke’s Actions – or Inactions – Won’t Prevent Coming Collapse! Here’s Why

By threatening to drop money out of helicopters to fight deflation – to leave a paperweight on the “print” button if you will – Bernanke convinced the market and all of Wall Street that the Fed would always be there to step in and save the day. [In fact, however,] the whole thing was a bluff meant to prop up the markets – the famed Bernanke Put – and it was a lie. The markets will be realizing this in the coming months, if not sooner, and when they do, we’ll see the REAL Collapse: the one to which 2008 was just a warm-up. [Let me explain.] Words: 444

3. The $64 Trillion Question Is: “When and How Does the Debt Death Spiral End?”

We are in the latter stages of the debt death spiral where debt and interest payments can only be made by adding more debt. This process has a sure ending. Like the flush of a toilet, the spiral goes faster and faster until it finally ends. [Let me put forth just how serious the problem is.] Words: 431

4. What Will the Outcome of All the QE Mean for the U.S. (and the World)?

At the risk of looking/sounding like some crazed religious fanatic usually seen carrying a sign or proclaiming: “Repent, the end is near,” I shall avoid the word “repent”. To me, the rest of that proclamation appears accurate and reasonable, at least with regard to our economic condition. [Let me explain:] Words: 1896

This short video – on the unsustainability of government spending – should be watched by everyone, including those not yet old enough to vote. It should be shown in every high school and college classroom. Anyone that cannot understand this presentation should not be allowed out without a guardian.

6. Richard Duncan: IF Credit Bubble Pops Civilization Won’t Survive the Depression that Follows

Our civilization would not be able to handle such a transition from an expansionary credit based economy where goods and services were readily available into a paradigm of credit contraction, supply shortages and destitution and this is what is coming. There is no way to prevent it – only to defer it until a later date – and that day will soon be upon us. Words: 590

The outcome of the election of 2012 will [only] determine the rate of speed at which we approach the [financial] cliff [because] neither political alternative is willing to change course, to steer away from the cliff. The cliff is so high that whether we go over it at 200 mph (Obama) or whether we merely slip over the edge (Romney), the end result is the same — fatal for the economy and perhaps our entire political system. It is the fall that will kill us. [This article explains why that is going to be the case.] Words: 1135

8. U.S Likely to Hit the Financial Wall by 2017! Here’s Why

The deficits aren’t going to stop anytime soon. The debt mountain will keep growing…Obviously, the debt can’t keep growing faster than the economy forever, but the people in charge do seem determined to find out just how far they can push things….The only way for the politicians to buy time will be through price inflation, to reduce the real burden of the debt, and whether they admit it or not, inflation is what they will be praying for….[and] the Federal Reserve will hear their prayer. When will the economy reach the wall toward which it is headed? Not soon, I believe, but in the meantime there will be plenty of excitement. [Let me explain what I expect to unfold.] Words: 1833

9. This Will NOT End Well – Enjoy It While It Lasts – Here’s Why

…The US Government and its catastrophic fiscal morass are now viewed by the world as a ‘safe haven’. This would easily qualify for a comedy shtick if it weren’t so serious….[but] the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramifications that few are paying attention to and are getting almost zero coverage from traditional media. [Let me explain what they are.] Words: 1150

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money