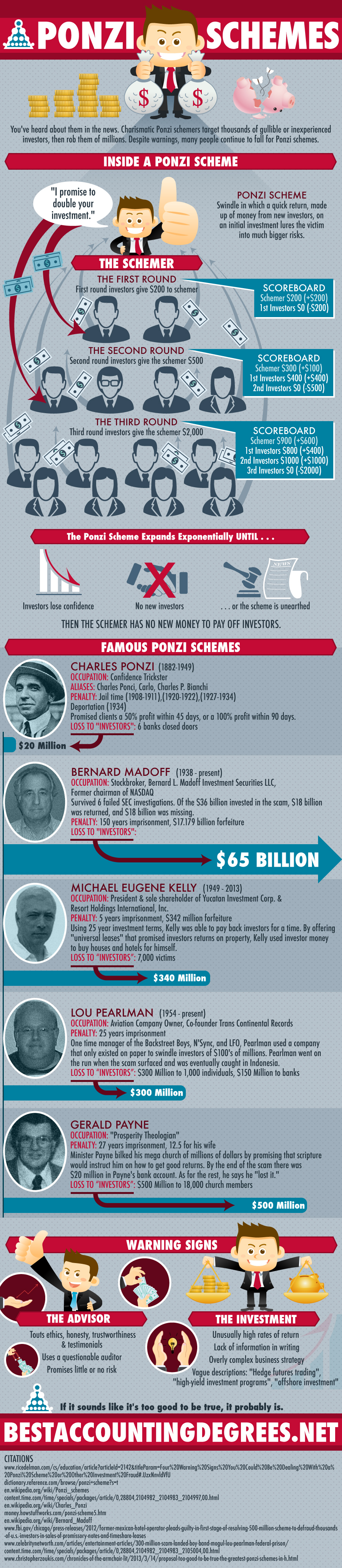

Ponzi schemes. You’ve heard about them in the news. Charismatic schemers make promises of outsized returns by providing early investors quick returns (made up of money from even newer investors) and then lure thousands of gullible or inexperienced investors into much bigger risks eventually robbing them of million Despite warnings, many people continue to fall for such schemes. This infographic presents the low down on Ponzi schemes.

The above comments are edited excerpts from an infographic* by Aniya Granato (bestaccountingdegrees.net) entitled The Low Down on Ponzi Schemes.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://bestaccountingdegrees.net/ponzi-schemes/ (Copyright Best Accounting Degrees)

Stay connected

- Subscribe to our Newsletter (register here; sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

Related Articles:

1. The Dow Jones Index is the Greatest of All Ponzi Schemes

I call on the financial community to take a critical look at the Dow Divisor. If it is retained investors will continue to be deceived with every new transition from one phase to another and the greatest of all Ponzi schemes will have major financial consequences for every investor. Read More »

2. World’s Financial System Is An Insane Ponzi Scheme – Here’s Why

I know a lot about the world’s financial system and how it works but you don’t have to be a technical wizard to understand that it’s financial insanity and ethically, financially, and socially wrong. . Read More »

3. Gold & Silver Are the Achilles Heel of the Largest Ponzi Scheme – Ever! Here’s Why

We are in a trench warfare with central bankers, hellbent on destroying capitalism, sovereign nations, currencies, all in the service of achieving world dominance, via deception, letting nothing and no one stand in the way. The importance of gold and, to a lesser extent, silver are the Achilles Heel of the Bilderberg Clan’s largest Ponzi scheme ever. Whatever one may think of the Mafia, they are bit players in contrast to the central banking clan, the most ruthless collection of individuals ever assembled. The Bilderbergers do not break legs or use baseball bats against their intended victims. No, they are far more sinister and lethal. They use money, instead. That’s it?! That’s all you got?! Yep. That’s all they need. [Let me explain.] Words: 960 Read More »

4. “Ponzi Finance”: What Must Happen To Bring It To An End?

The Boston Consulting Group has issued a paper that recommends 10 steps that developed countries must take to end what they refer to as ‘Ponzi finance’ and to return to a sustainable growth path but I believe their recommendations to be but theoretical and impractical constructs. While I believe we face – and will experience – interesting, speculative, fragile, and very challenging and very likely life-changing times going forward, I believe that the only thing that will force developed country politicians to work for common purposes is a further global financial crisis. This article provides an overview and assessment of said paper and the rationale for my position. Words: 600 Read More »

5. Your House: A Home, An Investment or a Ponzi Scheme?

In the past few decades, the concept of home ownership has been completely turned on its head. Previously, homes were considered a very long-term consumption good…[No one] ever considered tripling the value of their homes by retirement time and selling them to move beachside yet, somehow along the way, this became a reasonable investment expectation. Even today, home buyers still make their purchases with the hopes of escalating prices. [It begs answers to these questions: Is a house just a home? Should a house be expected to behave like an investment? Is the housing game nothing more than a Ponzi scheme where the end buyer before the market corrects becomes the “greater fool”? Let’s try and answer those questions.] Words: 935 Read More »

6. Economic System a Legal Ponzi Scheme on the Verge of Collapse!

8. It’s Time to Apply the “Greater Fool Theory” and Sell Your Winners to All Those Fools

The Dow has surpassed its all-time record high – set in October 2007 – and the S&P 500 is not far behind? Is this the early stage of another great bull market? Let’s look back at the two previous times when the S&P 500 set new all-time highs and see if we can learn something. Wait…first put your “this time it’s different” glasses on. OK, let’s go. Words: 430; Charts: 1 Read More

9. Is Gold a “Greater Fool” Asset?

I believe the terminology “investing in gold” is a misnomer. Speculation is a better fit for the argument to own gold than considering it an investment. [Let me explain.] Words: 606 Read More »

10. Fiscal Responsibility and the ‘Greater Fool’ Theory

Many households, financial and non-financial firms and government, may well spend the next decade in debtor’s prison having to tighten their belts to pay for the losses inflicted by a decade of reckless leverage, over-consumption and risk taking. What fools we have been for living beyond our means all these years and taking no fiscal responsibility for our future well-being in the false hope that there always would be a ‘greater fool’ out there than us. Words: 1230 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money