Investing is about risk and economic risk is today greater than at anytime in history whether we look at stocks, bonds or property. Fortunately, however, it is possible to insure against the risk of a banking collapse, the crash of most asset classes and the final destruction of the currency system. Here’s how.

The original article has been edited here by munKNEE.com for length (…) and clarity ([ ])

Embrace Uncertainty

Anyone who doesn’t follow this momentous maxim in coming years is likely to get one unpleasant shock after the next as the stable progression of the world economy since WWII is now coming to an end. What should have been a normal cyclical high in the next year or two is now going to be the most massive implosion of a bubble full of debts and inflated assets.

What happened in 2007-9, when the banking system was hours from a total collapse, will soon come back with a vengeance. This time central banks will not just throw $10s of trillions at the problem. They will create, out of thin air, $100s of trillions – and probably even quadrillions – as the global derivative bubble bursts.

As Ludwig von Mises once said:

Wealth Insurance

How can anyone offer insurance against the whole $ quadrillion financial system? The simple and obvious solution is physical gold.

The average gold investor and speculator is either getting out of gold or becoming very nervous. The wealth preservation investor, on the other hand, is not the slightest bit concerned as he is holding gold to protect against the massive risk in the system. We are currently seeing increased interest from this type of investor.

Investors who bought gold around the peak area in 2011 – 2012 are obviously not in the money currently but wealth preservation investors are not concerned. They know why they are holding gold and that it is only a matter of time before the gold price reflects the true value of worthless paper currencies.

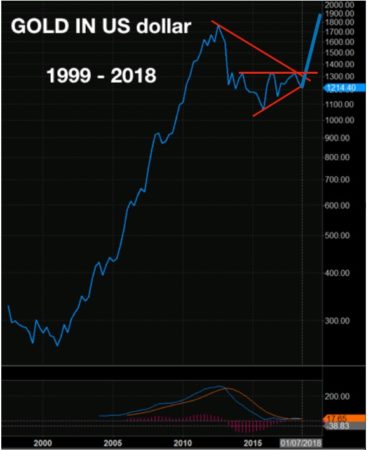

If we look at the quarterly chart of gold in dollars above, the uptrend is very clear. The correction finished at the end of 2015. Gold is poised for a major move up that should start between now and early autumn.

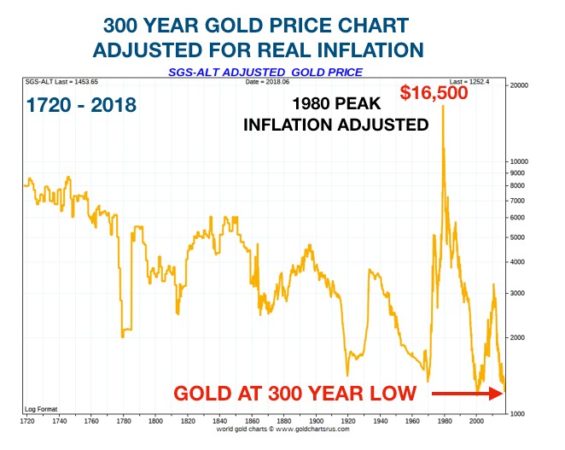

Gold at $1,220, adjusted for real inflation, is almost as cheap as it was in 1999 at the $250 low. More importantly, inflation adjusted gold is now very near the 300 year low of 1999 so – right now –

gold is again unloved and undervalued and therefore a bargain.

On an inflation adjusted basis, the 1980 high of $850 would today be $16,650. Long before we get hyperinflationary gold prices, that $16,600 level should be easily reached…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

A simple search for “Inflation Adjusted Dollar Calculator” will show that $850 in 1980 would equal $2,601 today (2018), not $16,500 as stated in your article . I agree with your assessment and analysis regarding the future of Gold prices, but get the math right. Too many people when they go to make a point over exaggerate their findings to make their point. This undermines your credibility. Stick to the facts. The low for Gold prices was in the year 2000-2004, not 300 years ago. Dollar inflation adjusted gold from 2000 would be $380 in todays money. That was the low of all time and certainly gold has moved up since then with some retracements along the way which is typical in a bull market. Long Cycles tend to be about 40 years so we have a long way to go in this current bull market. So hold on, enjoy the ride, and stop exaggerating.