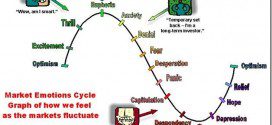

There’s no fear anymore - anywhere - and I’m talking about the type of fear that overwhelms investors – and, in turn, the market. The surest indication of this can be found in the following chart.

Read More »Search Results for: economic collapse

Your Money Is Not Safe: Successful Cyber Attacks Against Banks & Businesses Increasing (+2K Views)

When it comes to the Internet, nobody is ever entirely safe. Every major website & company is being targeted - big banks are being hit "every minute of every day" - with sophisticated cyber attacks which have increased 42% in the past year. The amount of money being stolen is absolutely staggering. At some point it going to cause some major league problems. It is just a matter of time.

Read More »Kunstler: Positive Talk About U.S. Economy Is Nothing But Horse…!

It appears that the American economy — capital management division — has found the long-wished-for magic alternative energy source: horseshit. It is fueling the conversation all over the Web and over the senile mainstream media megaphones. [Let me explain.]

Read More »10 Ominous Warnings Of What Will Happen IF There Is An Extended U.S. Debt Default

If the debt ceiling deadline (approximately October 17th) passes without an agreement that would be extremely dangerous - and if the U.S. government is eventually forced to start delaying interest payments on U.S. debt (which could potentially happen as soon as November), that would be absolutely catastrophic.

Read More »We’re Heading Toward Another Nightmarish Financial Crisis! Here’s Why

We have not seen so many financial trouble signs all come together at one time like this since just prior to the last major financial crisis in 2008. It is almost as if a "perfect storm" is brewing, and a lot of the "smart money" has already gotten out of stocks and bonds. Could it be possible that we are heading toward another nightmarish financial crisis?

Read More »Talk of “Bright Future” for Real Estate Just a Bunch of Nonsense – Here’s Why

All of this talk about a "bright future" for real estate is just a bunch of nonsense. The yield on 10-year U.S. Treasuries is starting to rise aggressively again and, because mortgage rates tend to follow such increases, mortgage rates are going up. As monthly payments go up less people will be able to afford to buy homes at current prices and this will force home prices down. As such, another great real estate crash is inevitable. Let me explain further. Words: 995 ; Charts: 1

Read More »U.S. in Terminal Phase of Unprecedented Debt Spiral

Anyone that thinks that the U.S. economy can keep going along like this is absolutely crazy. We are in the terminal phase of an unprecedented debt spiral which has allowed us to live far, far beyond our means for the last several decades. Unfortunately, all debt spirals eventually end, and they usually do so in a very disorderly manner.

Read More »Believe It Or Not: 147 Financial Institutions Control 40% of the Global Economy

Are the big banks really as powerful as some people say that they are? Do they really control the global economy? If you asked most people, they would tell you that governments control the global economy but the fact is that the campaigns of our politicians are funded by the ultra-wealthy, the big banks and the large corporations that they control. Others would tell you that the Federal Reserve and the rest of the central banks around the world control the global economy but the truth is that the Federal Reserve was established by the bankers and for the benefit of the bankers. As you will see below, at the very core of the global economy there exists a "super-entity" of financial institutions that control an almost unimaginable amount of wealth and power. These financial institutions, and the ultra-wealthy individuals behind them, are really the ones that are pulling all the strings.

Read More »These 20 Cycle Theories Suggest Stock Markets, Gold & Bonds To Severely Correct (+4K Views)

Unsustainable trends can survive much longer than most people anticipate, but they do end when their “time is up” – at the culmination of their time cycles...In an effort to bring clarity in how and when these trends could change direction we analyzed more than 20 different cycles. They almost unanimously point to tectonic shifts in the months and years ahead … starting now. We have been warned. At this point, we have enough confirmation to accept that the gold and silver crash – starting in April of 2013 – was the first shot across the board of what is to come. Read on!

Read More »A Stock Market Crash Followed This Occurrence In 1929, 2000 & 2007 – It’s Happening Again! (+3K Views)

What do 1929, 2000 and 2007 all have in common? Those were all years in which we saw a dramatic spike in margin debt. In all three instances, investors became highly leveraged in order to "take advantage" of a soaring stock market but, of course, we all know what happened each time. The spike in margin debt was rapidly followed by a horrifying stock market crash. Well guess what? It is happening again.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money