I think that the “Gold Forecaster” is a real game changer in the world of precious metals investors. It is  comprised of 5 economic indicators linked to the fundamentals of gold as a safe haven. This tool can predict the price movements in gold 1 year upfront and I invite precious metals investors to start using this tool.

comprised of 5 economic indicators linked to the fundamentals of gold as a safe haven. This tool can predict the price movements in gold 1 year upfront and I invite precious metals investors to start using this tool.

This version of the original article, by Alfred Sung, has been edited* here by munKNEE.com for length (…) and clarity ([ ]) to provide a fast & easy read. For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here)

This version of the original article, by Alfred Sung, has been edited* here by munKNEE.com for length (…) and clarity ([ ]) to provide a fast & easy read. For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here)

I, [Alfred Sung,] created my Correlation Economics website back in 2011 to gather a huge database of economic indicators. This is what they call “data mining”. By amassing large data sets, you can find patterns within the data and I believed that this would help me to predict the markets. I started to link different economic data sets with each other and tagged these as correlations which I posted on this page here.

Now, 8 years later, I have really begun to understand how different market indicators affect each other, and, of course, I also applied this to the precious metals market. After a lot of refinements and tweaks, I finally created a tool which can be used by precious metals investors to predict the price of gold.

I proudly present you the Holy Grail of gold forecasting: the “Gold Forecaster” index. This index looks at 5 fundamental indicators in the U.S. that all affect the movement in the gold price in terms of U.S. dollars:

1) The U.S. capacity utilization rate is a very nice leading indicator to predict price inflation. Whenever this index goes up, it means that businesses have a difficult time to produce their products within their capacity and need to start raising the prices of their goods.

2) The U.S. consumer price index is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. It is a means to measure inflation and as gold is typically used as a protection from inflation, I added this item in the “Gold Forecaster” index.

3) The 10-year U.S. Treasury yield is negatively correlated to gold. Whenever interest rates go higher, there is less incentive for investors to go into gold because they can put their money in an interest-bearing asset.

4) The U.S. trade balance is added to the index to give a certain weight on the fiscal position of the United States. Whenever trade deficits surge, this will have negative implications on the U.S. dollar and therefore, it will boost the gold price.

5) The Money Zero Maturity (MZM) money stock is one of the broadest measures to track the money supply. Whenever the Federal Reserve prints money, the money supply will grow. Inflation is an increase in the money supply and that’s why I included MZM in the index.

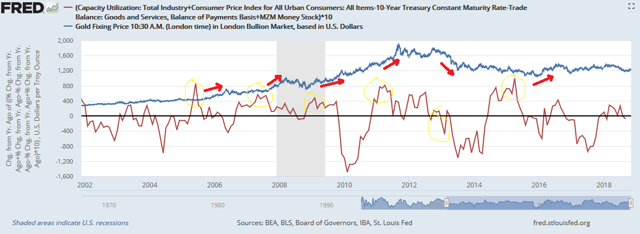

All of the 5 items listed above have been combined into the “Gold Forecaster” index and have been normalized. Then, the index was adjusted to look at the change in sentiment. The result can be seen in the chart below which is posted on Correlation Economics.

-

The red shows the “Gold Forecaster” index. The blue line is the gold price.

-

Whenever the index significantly rises above zero, the gold price will go up with a delay of 1 year.

-

Similarly, whenever the index significantly drops below zero, the gold price hasn’t been doing well with a delay of 1 year.

-

I have marked several time periods on the chart to show that the spikes in the “Gold Forecaster” index accurately predict these gold price movements. Today, we can see that the index is at zero, so the price of gold should be stable going forward.

Conclusion:

I think that the “Gold Forecaster” is a real game changer in the world of precious metals investors. It is comprised of 5 economic indicators linked to the fundamentals of gold as a safe haven. This tool can predict the price movements in gold 1 year upfront and I invite precious metals investors to start using this tool.

[Editor’s Note: The author is receiving compensation from Seeking Alpha for pageviews of his original article as posted there so please refer to it for the unedited version.]

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money