An article by Lorimer Wilson, Managing Editor of munKNEE.com – a site for sore eyes and inquisitive minds which was first posted on TalkMarkets.com under the title Another AI Category To Take Notice Of: High Band Memory Chip Manufacturers with 529 pageviews to date.

An Introduction

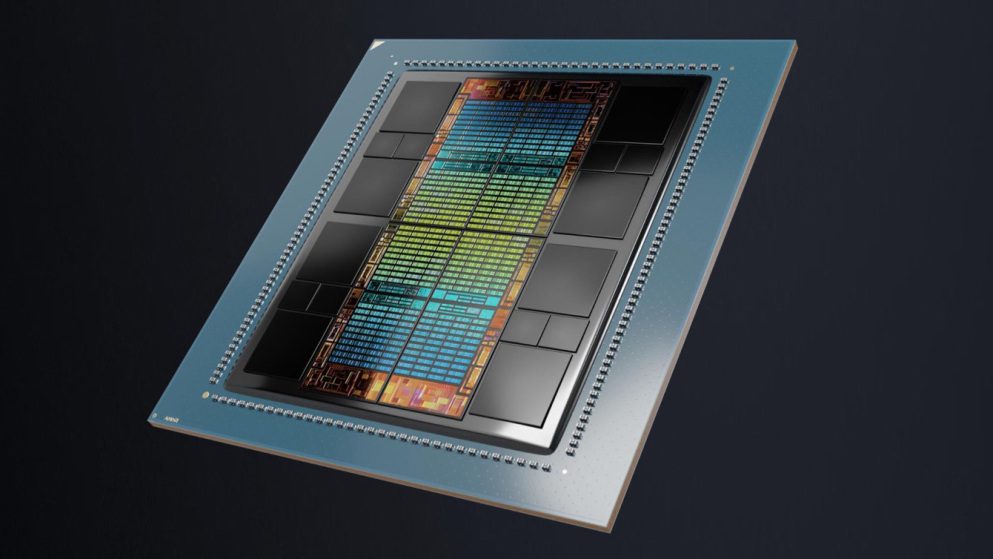

High Band Memory (HBM), in simple terms, is a certain number of conventional DRAM (direct random-access memory) chips stacked together to achieve greater performance and efficiency. It was first developed by SK Hynix a decade ago for use in video games and only recently came into its own with the advent of generative AI, which requires components that can handle massive amounts of data without lag time.

Market Size and Growth

According to Mordor Intelligence, the HBM market is forecast to grow at a CAGR of 25.86% between now and 2029.

Global Market Share By Company

For now, SK hynix is the clear leader, with more than half the global market share for HBM but compatriot Samsung Electronics (SSNLF) and Micron Technology (MU) of the U.S. are racing to catch up, competing not only on technology but on price and other conditions.

That being said, SK hynix is forecast to continue to be the HBM leader in 2024, with a market share of over 52%, Samsung at 42.4%, and Micron at a little over 5% of the market. Other companies in the field include Intel (INTC), Fujitsu (FJTSF) and Toshiba Corporation (TOSBF). SK hynix’’s shares are traded on the Korea Exchange, and its Global Depository shares are listed on the Luxemburg Stock Exchange.

The three big players are betting big on HBM because it commands a significant price premium, selling for about five times the price of DDR5, the most advanced type of DRAM used in computers. HBM’s share could account for more than 20% of the total DRAM market by value this year, and grow to +30% by 2025 thanks to growing AI computing demand.

North America is expected to have the largest share in the HBM market primarily due to:

- the major growth in high-performance computing (HPC) applications as a result of the increasing market for AI, machine learning, and cloud computing that require high-bandwidth memory solutions for fast data processing

- and the rapid advancement of technology and increasing usage of edge technologies in cars all of which supports the growth of high-bandwidth memory.

HBM Developments

Micron Technology, the only U.S.-based manufacturer of memory, plans to invest $40 billion through the end of the decade to build leading-edge memory manufacturing in multiple phases in the U.S. thanks to the anticipated grants and credits made possible by the CHIPS and Science Act. The Company expects to begin production in the second half of the decade, ramping up overall supply in line with industry demand trends. Micron President and CEO Sanjay Mehrotra believes this will enable Micron to grow domestic production of memory from less than 2% to up to 10% of the global market in the next decade.

Samsung Electronics has published a white paper, titled “6G Spectrum: Expanding the Frontier,” laying out ways to obtain the spectrum needed to achieve the Company’s vision for securing global frequency bands for 6G, the next generation communications technology. To that end, the Company reported back on February 20th that it has developed the industry’s first 12-stack HBM3E DRAM, making it a high bandwidth memory with the highest capacity to date. Nvidia has announced that it is currently in the process of qualifying Samsung’s HBM chips for its artificial intelligence processors.

SK hynix reported back on March 19th that it had started mass production of its next-generation HBM chips which come with a 10% improvement in heat-dissipation performance, compared with the previous generation.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money