The once unthinkable might become policy: negative nominal interest rates. Investors should care as they may be increasingly punished for not taking risks yet masochistic investors believe they may be the prudent ones given the risks lurking in the markets. What are investors to do, and what are the implications for the U.S. dollar and currencies? Words:

Investors should care as they may be increasingly punished for not taking risks yet masochistic investors believe they may be the prudent ones given the risks lurking in the markets. What are investors to do, and what are the implications for the U.S. dollar and currencies? Words:

So says Axel Merk (www.merkfunds.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Merk goes on to say, in part:

When investors deposit money in a bank, they are giving the bank a loan. Some investors aren’t so sure whether zero or close to zero percent interest compensates them for the risk of lending money to the bank, although FDIC insurance where applicable may alleviate that concern.

Negative Yields Abound

Nevertheless, there are plenty of deposits that are not FDIC insured, such as money market funds which must invest in risky assets to cover their expenses and pay any yield and, as such, are investing in U.S. dollar denominated commercial paper issued by European banks….This flight to “safety” is taking on pandemic proportions -[and now government bills are being offered at negative interest rates by the following European countries:]

- Germany: 6-month bills at -0.122%,

- Switzerland: 6-month bills at -0.1%,

- France: 3-month bills at -0.005%,

- Netherlands: 3.5-month Treasury Certificates at -0.041% and 6.5-month Treasury Certificates at -0.029%,

- Belgium: 3-month bills at -0.016%,

- the European Financial Stability Facility (EFSF), let’s call it a precursor to Eurobonds, 6-month bills at -0.0113%.

In the U.S., inflation protected securities (TIPS) have sold with negative yields at auction for some time:

- 5-year TIPS at -0.635%, a negative yield for the first time at a U.S. debt auction as investors bet the Fed may be successful in sparking inflatiion,

- 10-year TIPS at -0.046%, with investors willing to pay a premium to guard against the threat of rising consumer prices.

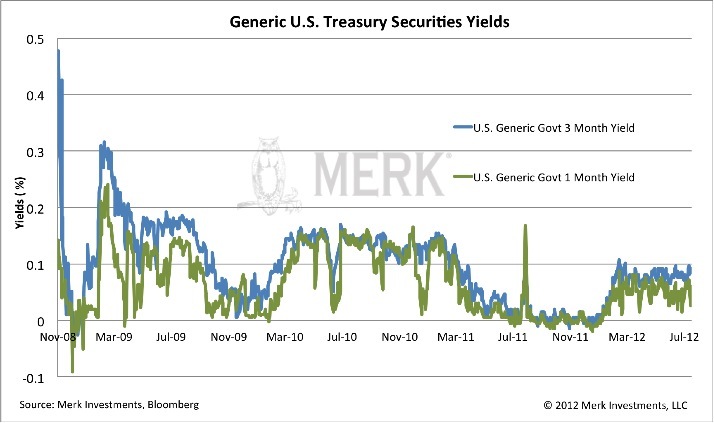

What is noteworthy about these is that the negative yields were auction results. In the secondary market, Treasury securities have flirted with negative yields periodically throughout the crisis:

|

Negative yields late last year were, in our assessment, directly linked to the flight of U.S. money market funds out of European commercial paper, causing funding strains for such European financial institutions. The world’s policy makers were alarmed as European banks in turn have been the primary players in providing U.S. dollar denominated funding to emerging markets.

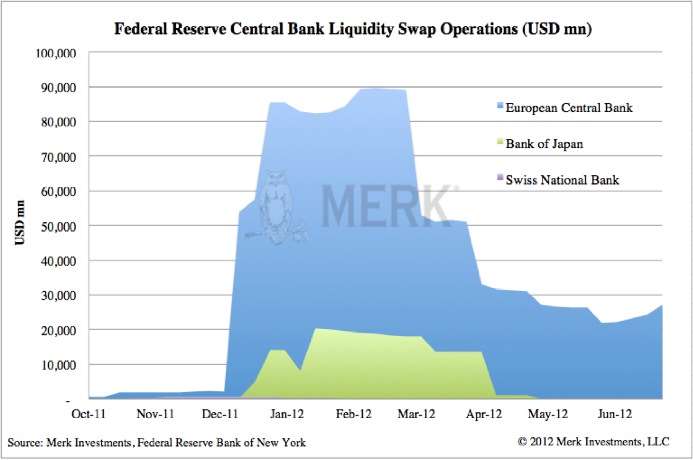

Confused? It’s an illustration of the “contagion,” how a crisis in Europe can affect the globe. Always eager to lend a friendly hand, the Federal Reserve opted to open a “swap line,” making cheap U.S. dollars available to central banks around the world, most notably the European Central Bank:

|

The negative yields on U.S. Treasuries dissipated once the Federal Reserve provided the loans to the ECB (there was one dissent at the time at the Fed, arguing that such swap lines are fiscal, not monetary policy and ought to be authorized by Congress).

Where Should One Hold Their Cash?

When “investors” hold the U.S. dollar, do they:

- hold cash on hand (good luck doing that with larger amounts)?

- deposits in a bank?

- in money market funds?

- in U.S. Treasuries?

Similarly, when “investors” hold the euro, do they place it in

- a German, Spanis or Greek bank?

- a Spanish, German or Dutch Treasury bill?

Should the euro break apart, one could buy a longer dated German security in the assumption that such security will be converted to a new Deutsche Mark and appreciate in value versus the current euro.

HAVE YOU SIGNED UP YET?

Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com.

It’s FREE and includes an easy unsubscribe feature should you decide to do so at any time.

Sign up. SAVE TIME searching for today’s best articles. They are all here!

All articles are also available on TWITTER and FACEBOOK

We have argued since 2006 that there may not be such a thing anymore as a safe asset and investors may want to take a diversified approach to something as mundane as cash….

This analysis might be most relevant for the countries not mentioned, Japan, [where]…the Bank of Japan scrapped a 0.10 percent yield floor for government bond purchases, opening the door to the possibility of buying debt with negative returns….

Investors not interested in negative yields should:

- look at other currencies…of countries with higher rates…[that] may be more removed from the crises and thus able to focus on sound monetary policy rather than subsidizing governments, banks or consumers….

- buy riskier assets, such as equities or

- invest in property, plant & equipment.

The above are the types of activities central bankers would like to encourage us to do.

[Interestingly, however,] there’s also a good reason to accept the negative yields…In a crisis the winners are those that lose the least and, as such, investors may have good reason to be on the sidelines in the belief that better prices may be available for riskier assets down the road.[Unfortuneately, central bankers are…[so] afraid of deflation…they may be tempted with even lower rates, [thereby] punishing savers. As such, get prepared for a negative ( nominal, not real rates after inflation is taken into account) interest rate environment….

*http://www.merkfunds.com/merk-perspective/insights/2012-07-25.html (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above posts may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

Natixis, the French investment bank and asset manager has determined that the safest country – the country whose bonds are really risk-free – is Sweden, the only one to score a perfect 5. Where do the U.S., Canada, the U.K., Australia and other major countries rank. Take a look.

2. And the Winners & Losers in the Current Global Banking Crisis Are…

The global market turmoil in the European Union with Greece, Spain and Italy and the slowing growth in China and other Asian markets has been monopolizing the headlines lately….You could very well have the attitude that it doesn’t directly affect you. Like it or not, however, the United States is tied to other economies….and, since the financial markets facilitate trade and business all over the world, problems in other countries can severely impact your investments, your job and even how much you pay for everyday items. Therefore, you cannot afford to ignore the health or strength of other countries’ financial systems and their banks. [Let’s take a look.]

3. Low Real Interest Rates = Continued High Prices for Gold – but For How Long?

Why is it that the demand for gold moves inversely to interest rates – that the higher the rate of interest the lower the demand for gold, the lower the rate of interest the higher the demand for gold? [Let me explain why and what the future seems to hold.] Words: 1053

4. The Future Price of Gold and the 2% Factor

It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Furthermore, for every one percentage point real rates differ from 2%, gold moves by eight times that amount per year. So if the real rates are at 1%, gold will move up at an 8% annualized rate. If real rates are at 0%, then gold will move up at a 16% rate (that’s been about the story for the past decade). Conversely, if the real rate jumps to 3%, then gold will drop at an 8% rate. [Let me explain.] Words: 982

5. Short-term Interest Rates Are Behind the Price Of Gold – Here’s Proof!

Some gold bugs say that this is only the beginning and gold will soon break $2,000, then $5,000 and then $10,000 per ounce but the question is, “How can anyone reasonably calculate what the price of gold is?” For stocks, we have all sorts of ratios. Sure, those ratios can be off . . . but at least they’re something. With gold, we have nothing…. [or more correctly, had nothing, until the development of my very own model for doing just that. Let me explain.] Words: 945

6. What Do Rising Interest Rates Mean for the Price of Gold?

The return of the Euro debt contagion and drop in the bond markets across the world is pushing interest rates higher and it has investors concerned and rightly so – and nowhere has the concern been more prominent than in gold. [Let me explain.] Words: 759

7. Low Real Interest Rates Say Gold Bull Still Has Legs! Here’s Why

Many agree that the United States’ massive budget deficits and global monetary inflation support the gold bull market. I don’t see this changing in the near future. Still, sentiment is not enough upon which to rely. I need a yardstick and, for me, that yardstick is U.S. real interest rates. [Let me explain why that is the case.] Words: 1600

8. Foreigners Beware: U.S. Treasury Maturity Dates are Alarming

While many investors want to believe that U.S. treasuries are a safe haven, I will use this article to debunk that myth with plain hard evidence…[to support my contention that] holding U.S. bonds is the worst investment going forward. Words: 500

9. Gold Bullion, Stocks or Bonds: Which Have More Long-term Investment Risk?

In proclaiming buy-and-hold investing to be dead, the pseudo-experts masquerading as financial advisors have abandoned the fundamental principle of investing: buying undervalued assets – and then giving those assets the time necessary to mature. Instead, these charlatans have forced their clients to become short-term gamblers. Worse still, they are now consistently steering their clients toward the worst possible asset-classes, stocks and bonds, rather than the best ones [simply because they do not] understand the fundamental conceptual difference between risk and volatility. In a market populated by panicked lemmings, we cannot avoid volatility. However, we can and must reduce risk – which begins by building an allocation of history’s true safe haven asset, precious metals. [Let me explain more about what risk and volatility are and are not.] Words: 1080

10. With Options So Limited Where Should We Invest?

The fear factor among investors is high with investors unsure just where to put their money. Let’s review the options and come to a conclusion as to where best to invest our cash at this point in time. Words: 402

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money