As demonstrated by his previous market calls*…George Soros is an investor worth paying attention  to…He is currently buying gold hand over fist, as he believes that we are closing in on a bear market.

to…He is currently buying gold hand over fist, as he believes that we are closing in on a bear market.

The comments above and below are excerpts from an article by Oeistein Helle (intrinsicai.no) which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

*(Before I start to discuss George Soros’ bubble theory, I would like to give you a short summary of some of his accomplishments as an investor highly attuned to market cycles (the man himself does not need an introduction):

- In September of 1992, he made a USD 10 billion bet speculating that the British pound would depreciate. He was correct and reportedly profited USD 1 Billion in one day.

- He accurately predicted the 2008 crisis as the greatest financial crisis of his lifetime. I made a google search and found this article from early 2008 where he discusses the upcoming crash with a New York Times reporter five months before the collapse of Lehman Brothers.

- According to Gurufocus, his Quantum Fund returned an annual return of 32% between 1969 and 2000.)

Mr. Soros does not believe that financial markets are efficient and in equilibrium with the underlying fundamentals represented by “all available information.” Instead, he believes that markets slide from the fundamentals over time. He believes markets go through stages where they slide farther and farther away from the underlying fundamentals through a positive feedback loop (numerous individual investors reinforcing each other’s dissolutions over time).

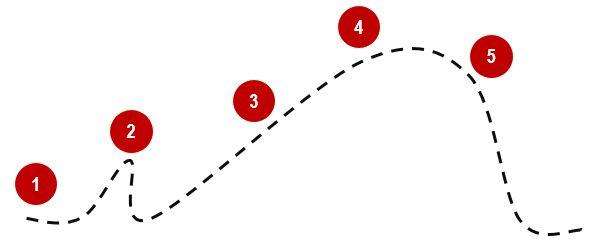

The 5 stages of Mr. Soros bubble theory [are as follows]:

1. At first, the market slides slowly upwards over time in a rational manner before the positive feedback loop accelerates the market.

2. [Then] the market goes through a test where it drops significantly. If the positive feedback loop is sufficiently strong, the market will overcome the test and continue its climb. At this point, the market will start to disconnect from underlying fundamentals in a big way.

3. The market will [then] continue its climb farther and farther away from the fundamentals. For an equity index, this may be represented by an increase in pricing multiples not warranted by probable future earnings growth.

4. At some point in time, the market will reach a twilight zone where more and more investors become skeptical and bearish. The disconnect between asset prices and fundamentals recognized by some investors will slow down the market appreciation rate (probably where the S&P 500 has been stuck the last couple of years).

5. [Finally,] at some point, for some reason, triggered by anything, the positive feedback loop will reverse and become a negative feedback loop. The negative feedback loop will quite swiftly develop into frantic panic.

(In October of 2009, Mr. Soros held a lecture at the Central European University where he discussed his market bubble theory. I recommend everyone to watch the lecture on YouTube.)

Illustration of Mr. Soros’ bubble theory:

Source: Oeistein Helle, CFA

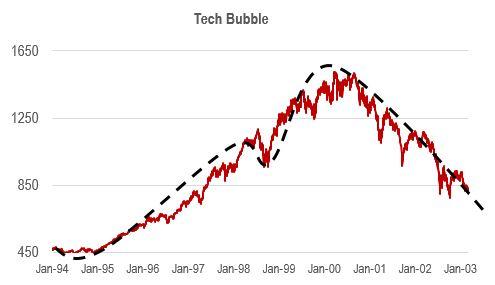

So how well does the above-illustrated theory perform in the real world? Let us fit the model on top of a graph of the S&P 500’s pricing action during the full-cycle tech bubble of the nineties. It fits quite well does it not? During 1999, the market pushed through the test before it started flying. Close to the top of the cycle, the market appreciation slowed before the index turned.

Source: Oeistein Helle, CFA

Mr. Soros’ bubble theory and the housing boom and bust cycle:

Let us test the theory for the more recent housing bubble that unraveled in 2008. For the 2002-2009 business cycle, the model fits. During 2003, the S&P 500 appreciated significantly before it was tested in 2004. The positive feedback loop driving the market was strong enough to break through the test and continued its climb. During 2007, the market reached the twilight zone before it tanked in 2008.

Source: Oeistein Helle, CFA

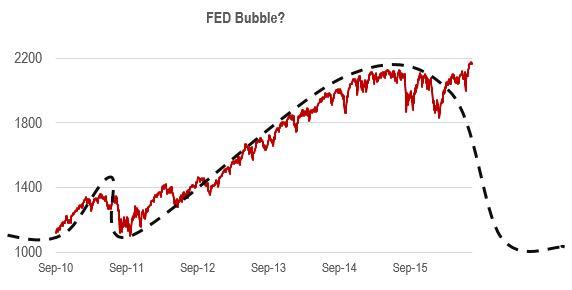

Mr. Soros’ bubble theory and the Fed boom and bust cycle:

What about the current business cycle? Does the theory fit? Yes, it may… The markets appreciated up until 2011 when the positive feedback loop was tested. When the market managed to break through the 2011 test, the feedback loop got stronger and kept on going.

Source: Oeistein Helle, CFA

As observed, we may currently be in the twilight zone…One of these days, we may reach the fifth and last stage of the model. The feedback loop will turn negative.

In conclusion:

The now 85-year-old Mr. Soros…is now buying gold and gold miners as he anticipates rough waters ahead. He is skeptical…[of] both the Chinese and European economies and finds the U.S. market to be overpriced [and] according to the Wall Street Journal, is currently shorting the U.S. market.

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money