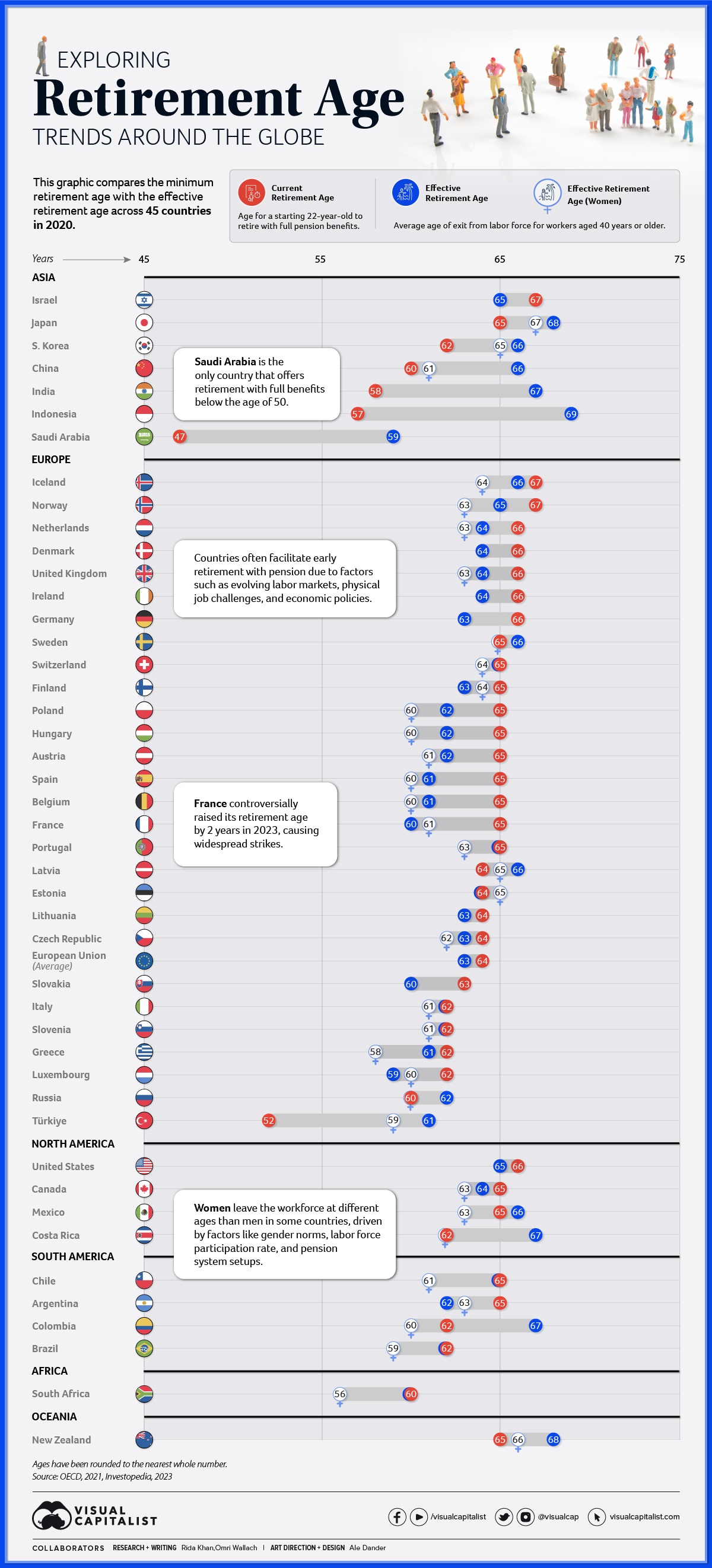

The retirement landscape can look completely different depending on what country you’re in and charting the retirement age by country reveals a lot of differences in the the makeup of a labor force, both for economic and cultural reasons and today’s infographic delves into the current and effective retirement ages across 45 nations in 2020, based on comprehensive data from the OECD 2021 report.

Before we dive into the numbers, however, let’s clarify the measurements used by the Organization for Economic Co-operation and Development (OECD):

- The current retirement age is the age at which individuals can retire without penalty to pension after completing a full career starting from age 22.

- The effective retirement age refers to the average age of exit from the labor force for workers aged 40 years or more.

Many countries have seen workers effectively retire earlier or later than the current retirement age. This variance can arise due to a multitude in factors including differences in career start ages, some industries offering earlier retirements or benefits for later commitments, or countries facilitating different workforce exits due to market demands and policies. Some people also choose to retire early due to personal reasons or a lack of available work, receiving a smaller pension or in some cases forgoing it entirely. Likewise, some people choose to stay employed if they are able to find work.

Three countries had the highest current retirement age at 67 years, Iceland, Israel, and Norway, but all had slightly lower effective retirement ages on average. On the flip side, Saudi Arabia had the lowest current retirement age at only 47 years with full pension benefits. Only Türkiye at 52 years was close, and notably both had much higher effective retirement ages on average.

Discrepancies between different regions are clear across the board. Many Asian countries including China, India, and South Korea have official minimum retirement ages in the early 60s and late 50s, but see workers stay in the workforce well into their late 60s. Meanwhile, most European countries as well as the U.S. and Canada have more workers retire earlier than minimum retirement ages on average.

Looking to the Future

In 2023, France sparked controversy by raising its early retirement age by two years. This decision triggered widespread strikes and riots and ignited debates about the balance between economic sustainability and individual well-being.

Given aging demographics in many developed countries and a continued need for labor, this isn’t expected to be the only country to reassess retirement. The OECD projects a two-year increase in the average effective retirement age by the mid-2060s.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money