Is this the time to be buying gold mining stocks? Maybe, maybe not, but if you don’t own any at all, this is a good time to start thinking about them. Here’s why.

The above comments, and those below, have been edited by munKNEE.com (Your Key to Making Money!) for the sake of clarity [] and brevity (…) to provide a fast and easy read and have been excerpted from an article* as posted by Ian Bezek on SeeekingAlpha.com under the title Left For Dead: Gold Miners May Finally Be Worth Buying and which can be read in its unabridged format HERE.

The best investments are often the ones that are difficult to make – like make you nauseous when you’re thinking about it – and with that in mind, it’s time to think about one sector for which the word “hatred” fails to express the sheer level of investor disgust. That sector would, of course, be gold miners, which, as judged by the Market Vectors Gold Miners ETF (GDX) is now enjoying a cool 80% decline since its late 2011 peak.

Gold mining stocks offer excellent portfolio diversification at the 2 to 5% level with:

- near-equity returns (9.2% per annum vs. 10.7% for the S&P 500 between 1963 and 2004 – data from here),

- very little correlation to the broader stock or bond markets and with

- much (much!) higher real returns than the metal itself.

…[but] don’t fall in love with them – as gold miners rally, take profits repeatedly into the rise. It’s a boom and bust sector – the portfolio diversification effect works best if you rebalance your position regularly to capitalize on speculators’ whipsawing outlook.

If you already own some miners, as I do, I’d probably wait until December to buy more. Various sentiment and technical signs suggest there is a strong chance for another wave of selling. With companies such as Barrick selling near 24-year lows, you can be sure investors will take some of these companies back to the woodshed for more tax loss selling as the year closes. Basically, anyone long the stock has a loss on it – the temptation to liquidate it for tax reasons will be strong.

Precious metals as held by goldbugs – with gigantic 25, 50% or greater weightings of their portfolio – is a deeply flawed investment strategy.

- The low real returns and high volatility of the asset make that at best inefficient and at worst a good way to severely miss your retirement goals.

- That said, many goldbugs aren’t thinking about retirement – rather they’re worried about protecting themselves from complete political or financial apocalypse. In the unlikely event that such events occur, goldbugs will enjoy the last laugh. In all other circumstances, a vastly overweighted gold position in a portfolio is asking for trouble.

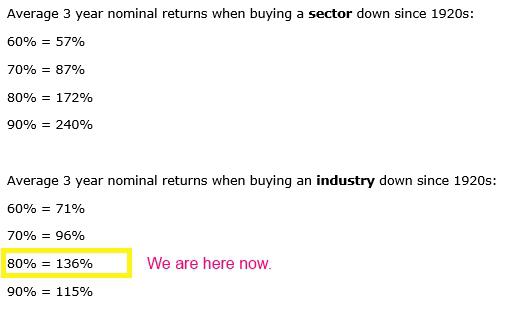

The optimal way to handle gold miners…is to buy once the industry has been pounded…[like it is now]. As Meb Faber shows in the table below, returns are very good for folks who buy sectors that are way down. There’s no guarantees, but the gold mining sector could easily throw off a triple-digit return in the span of a year or two.  Source: Mebfaber.com

Source: Mebfaber.com

Conclusion

…This is a good time to put the gold mining sector back on your watch list given precious metals mining’s:

- long history of producing near 10%/year average returns and…

- strong diversification as a small component of a balanced portfolio.

With gold miners’ vast underperformance to the metal in recent years, there’s a lot of catching up for GDX to do when it starts going to the upside again. As mentioned earlier in the article, while there are no guarantees, the gold mining sector could easily throw off a triple-digit return in the span of a year or two.

*http://seekingalpha.com/article/3431596-left-for-dead-gold-miners-may-finally-be-worth-buying?ifp=0

Related Articles from the munKNEE Vault:

1. 3 Signs That Gold, Silver & PM Stocks Have Finally Bottomed

Gold, silver and precious metals mining stocks are still nowhere near long-term or secular bottoms but I believe they could be approaching short-term tradable bottoms in the coming days or weeks based on the following 3 signals:

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money