While there are definite diversification benefits to holding precious metals stocks in a portfolio [it  begs the question: “Can you handle the boom-bust nature of these highly volatile stocks?”]

begs the question: “Can you handle the boom-bust nature of these highly volatile stocks?”]

The comments above and below are excerpts from an article by Ben Carlson (awealthofcommonsense.com) which have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read.

- We believe the prices of many commodities will rise in the decades to come due to growing demand and the finite supply of cheap resources.

- Public equities are a great way to invest in commodities and allow investors to:

- Gain commodity exposure in a cheap, liquid manner

- Harvest the equity risk premium

- Avoid negative yields associated with rolling some futures contracts

- Resource equities provide diversification relative to the broad equity market, and the diversification benefits increase over longer time horizons.

- Resource equities have not only protected against inflation historically, but have actually significantly increased purchasing power in most inflationary periods.

- Due to the uncertainty surrounding, and the volatility of, commodity prices, many investors avoid resource equities. Hence, commodity producers tend to trade at a discount, and they have outperformed the broad market historically.

The team from GMO makes some good points here. If you’re looking to gain long-term exposure to commodities, it rarely makes sense to invest directly in the commodities themselves. You’ll get cash-like returns with stock-like volatility.

I wanted to look back at the performance history of these stocks to check out their other claims. The longest running fund I could find is the Vanguard Precious Metals & Mining Fund (VGPMX). It may not be a perfect match with what GMO is doing but it has a performance history going back to 1985.

There are definite diversification benefits to holding these types of stocks. I compared the return numbers to the Vanguard S&P 500 Fund (VFINX) and the Vanguard Total Bond Market Fund (VBMFX). The correlation to stocks was 0.13 and 0.03 for bonds…[which] means that there is basically no statistical relationship between these asset classes. This is a good thing in terms of diversification benefits, but correlation isn’t the end of the story when constructing a portfolio. You still have to earn a risk premium on those uncorrelated assets.

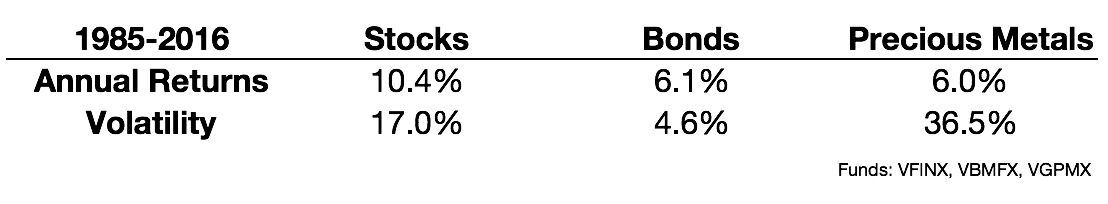

[Below] are the return and volatility numbers: Precious metals and mining stocks have seen lower returns than the overall market with much higher volatility. This volatility is one of the main reasons that you see the lack of correlation between these stocks and the more traditional asset classes.

Precious metals and mining stocks have seen lower returns than the overall market with much higher volatility. This volatility is one of the main reasons that you see the lack of correlation between these stocks and the more traditional asset classes.

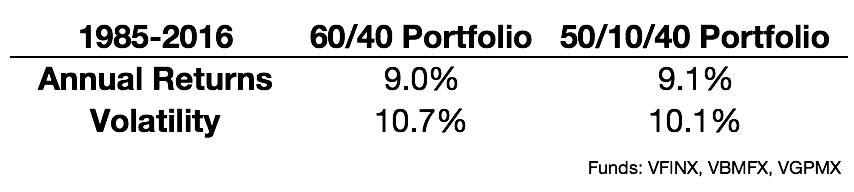

Investors love looking for uncorrelated investments but correlation only matters in terms of an overall portfolio, not just individual assets, so I took these same funds and created a simple 60/40 portfolio of stocks and bonds along with a 50/10/40 portfolio made up of stocks, precious metals stocks and bonds to see if further diversification improves a more traditional portfolio’s results:

The returns are roughly the same but the volatility is actually slightly lower with a 10% allocation to precious metals & mining stocks. This is one of the counterintuitive aspects of portfolio management. Adding a highly volatile, yet uncorrelated, investment to a portfolio can reduce overall portfolio volatility.

The returns are roughly the same but the volatility is actually slightly lower with a 10% allocation to precious metals & mining stocks. This is one of the counterintuitive aspects of portfolio management. Adding a highly volatile, yet uncorrelated, investment to a portfolio can reduce overall portfolio volatility.

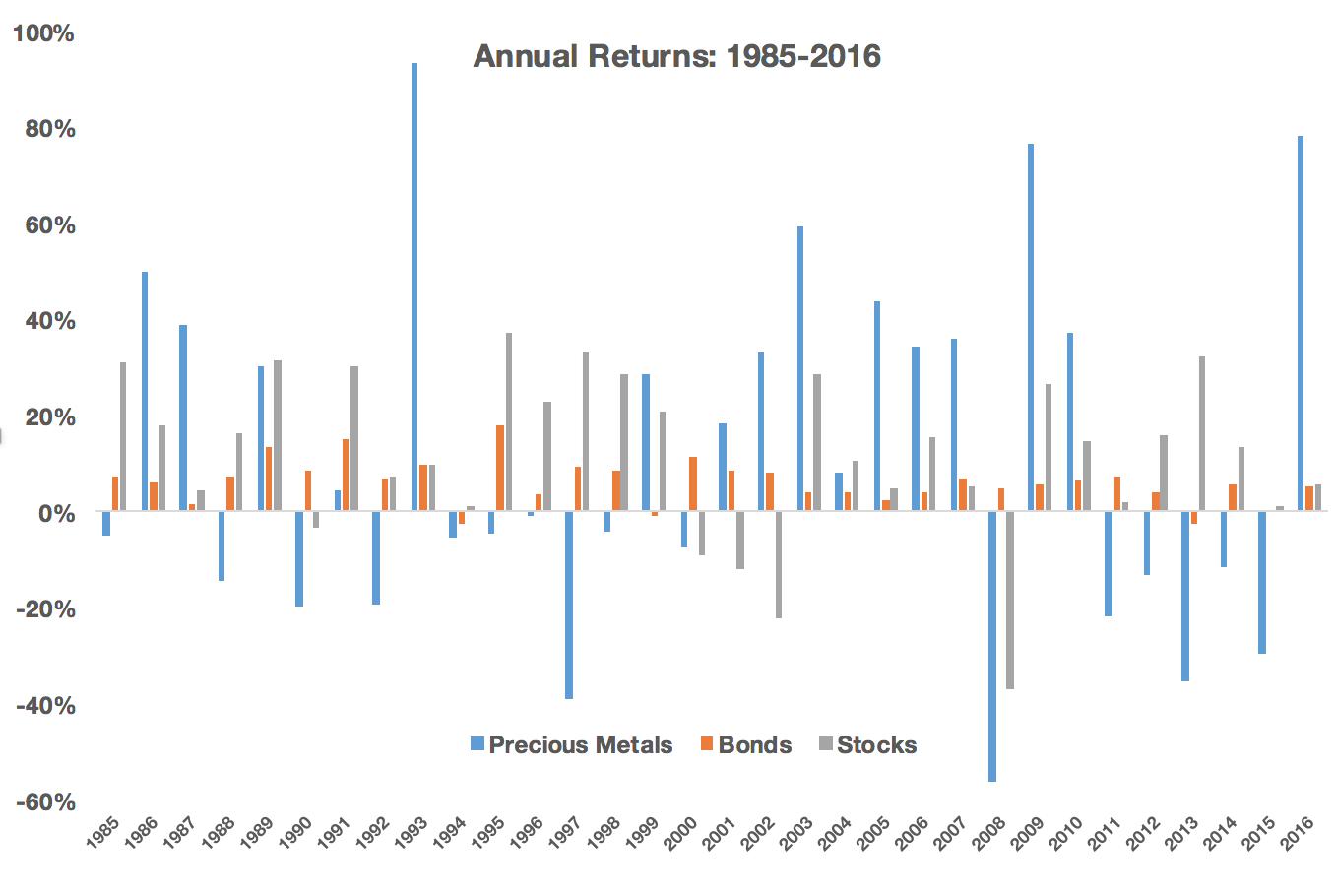

This seems like a good trade-off on paper, but dealing with volatility in a backtest is much easier than dealing with it in real life. There’s volatility and then there’s precious metals and mining stock volatility. Take a look at the comparison of their returns set against stocks and bonds:

You can see precious metals stocks in the blue and how wild some of the swings in returns can be from year to year. Commodities in general are volatile so this makes sense, but these gains and losses are far in excess of a typical stock market investment. In 2008, the Vanguard Precious Metals Fund was down 56%. Then from 2009-2010 it gained 143%. This was followed by a five year decline from 2011-2015 of 72%. Now this year so far it’s up 78%.

You can see precious metals stocks in the blue and how wild some of the swings in returns can be from year to year. Commodities in general are volatile so this makes sense, but these gains and losses are far in excess of a typical stock market investment. In 2008, the Vanguard Precious Metals Fund was down 56%. Then from 2009-2010 it gained 143%. This was followed by a five year decline from 2011-2015 of 72%. Now this year so far it’s up 78%.

It’s important for investors to go beyond buzzwords such as ‘uncorrelated returns’ and really dig deep to understand the risk/return profile of any investment or asset class they’re considering. The only reason the results were a touch better in the 50/10/40 portfolio numbers I ran is because it assumed an annual rebalancing policy. The hardest part about investing in uncorrelated return streams is the fact that they only work if you’re willing to not only stick with them, but continue to add money when they’re not working.

GMO could be wrong – predicting the movements of commodities prices is notoriously hard – but maybe they’re right. These stocks could be a great opportunity right now. The fact that they had a horrid 5 year stretch means it’s possible they still have some more room to run, even after a huge snapback rally this year. It’s hard to say because there are so many factors that affect these holdings.

Regardless of the prospects of the current opportunity, investors need to first make sure they’re able to handle the boom-bust nature of these highly volatile stocks. Some people just aren’t cut out for such large swings in price from year to year. There’s no shame in admitting that fact.

It makes sense to think about your portfolio in total instead of looking specifically at each individual fund or holding to gauge your success. However, you still have to be able to stay disciplined enough with each of your holdings to ensure that you gain the benefits of diversification and intelligent portfolio construction. The efficient frontier isn’t going to save you when you see your holdings get cut in half or worse.

Natural resource stocks could make for a nice diversifier in a portfolio but I wonder how many investors have the intestinal fortitude to take advantage of that diversification. That’s the question investors need to answer before diving in.

****

Follow the munKNEE – Your Key to Making Money! “Like” this article on Facebook; have your say on Twitter; register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money