What Are Commodity Supercycles?

A “commodity supercycle” is commonly described as a period of consistent and sustained price increases lasting more than five years, and in some cases, decades…Supercycles occur because of the long lag between commodity price signals and changes in supply. While each commodity is different, the following is a rundown of a typical boom-bust cycle:

As economies grow, so does the demand for commodities, and eventually the demand would outstrip supply. That leads to rising commodity prices, but the commodity producers don’t initially respond to the higher prices because they’re unsure whether they will last. As a result, the gap between demand and supply continues to widen, keeping upward pressure on prices.

Eventually, prices get so attractive that producers respond by making additional investments to boost supply, narrowing the supply and demand gap. High prices continue to encourage investment until finally, supply overtakes demand, pushing prices down. But even as prices fall, supply continues to rise as investments made during the boom years bear fruit. Shortages turn to gluts and commodities enter the bearish part of the cycle.

In the investment world, when people point to a commodity supercycle, they’re usually referring to the bullish, or the upswing part of the cycle.

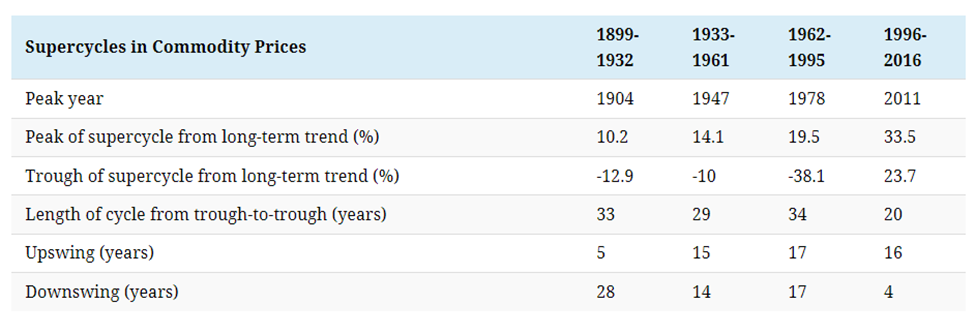

In the graphic provided by Visual Capitalist below, we can see that there have been multiple commodity supercycles throughout the course of history. Our most recent commodity supercycle started in 1996 and peaked in 2011, driven by raw material demand from rapid industrialization taking place in markets like Brazil, India, Russia and China.

The last cycle also ended with just four years of downswings, which meant prices would likely remain elevated relative to previous ones heading into the next one.

In fact, we may be right at the early stages of a new supercycle, as analysts have been predicting for years.

Dawn of a New Supercycle

A big proponent of the current “supercycle” talk other than AOTH is Goldman Sachs, which predicted back in October 2020 that commodities were beginning a supercycle that could last years, and possibly a decade.

Behind the bank’s supercycle call was the brutal decade for commodities in the aftermath of the 2008 financial crisis. By 2020, investors had all but abandoned the asset class in favor of equities.

“The lack of investment in commodities for tomorrow is startling,” Goldman said. “Without sufficient capex to create spare supply capacity, commodities will remain stuck in a state of long-run shortages, with higher and more volatile prices.”

In an interview with Bloomberg in January of 2022, Goldman’s global head of commodities research Jeff Currie stated that commodities are “the best place to be right now, particularly given the Fed pivot,” referring to the US Federal Reserve’s decision to begin hiking interest rates last year.

This year, the bank doubled down on its “commodity supercycle” take, citing growth in top consumer China and capital flight from energy markets and investment after concerns triggered by the US banking sector.

“As losses mounted, it spilled into commodities,” Currie told the Financial Times Commodities Global Summit in March 2023. “Historically, when you have this kind of scarring event, it takes months to get capital back,” he added.

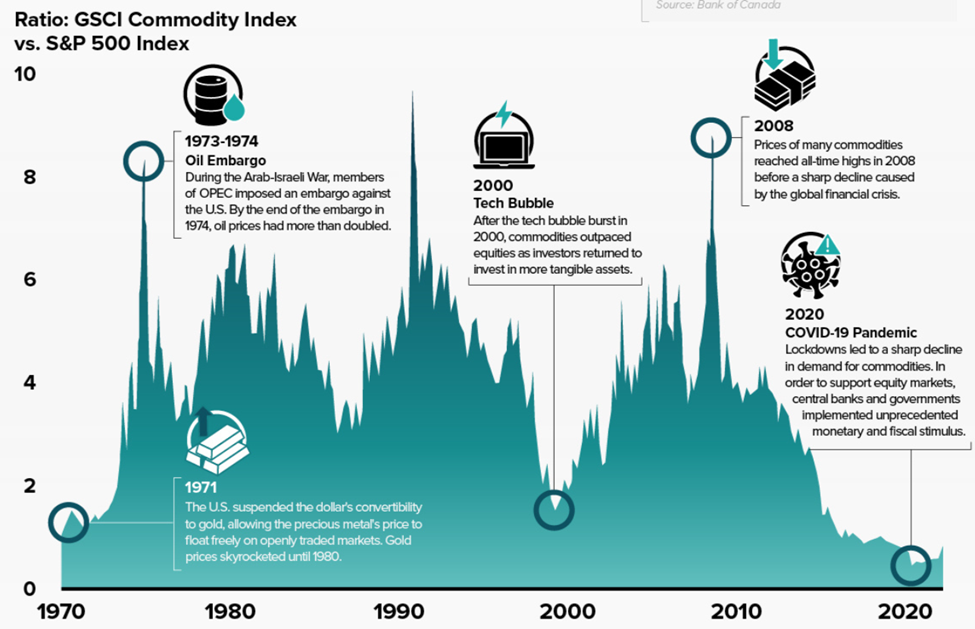

What’s interesting is that in past cycles, commodity prices and equity valuations have often been at odds with one another.

During the 1970s and early 1980s, for example, rising oil prices led to a significant decline in stock prices as higher energy costs hurt corporate profits. In contrast, during the first half of the 2000s, low oil prices were accompanied by a strong equity bull market that ended with the 2008 stock market crash.

The relationship, however, is not always straightforward and can be affected by various other factors, such as global economic growth, supply and demand, inflation and other market events.

As pointed out in Visual Capitalist’s infographic above, commodity prices have reached a 50-year low relative to overall equity markets over the Covid years. Perhaps the next supercycle is already up and running. Continue reading….

The most definitive, indicator of a commodity supercycle is rising prices, and historically, supercycles tend to create inflation, which is what has occurred over recent years. The head of real asset strategy at Wells Fargo recently told Kitco News that we’re already in the middle of a supercycle that kicked off in March 2020 and has at least six more years to go….and gold, acting as a safe trade for investors, should be able to perform as well as it has during previous cycles. The metal has been outperforming for nearly 3 years after hitting record highs in August 2020…[and,] based on historical analysis of commodity supercycles, Wells Fargo predicts that gold will at least double, and is looking at the $3,000/oz price target.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money