One moment stock prices rejoice on bailout news for the eurozone… the next moment they collapse….but steering clear of European stocks and bonds doesn’t mean you’re completely safe. In fact, your portfolio could be loaded with ticking time bombs, set to detonate once second-quarter earnings reporting season begins. Here’s why. Words: 611

next moment they collapse….but steering clear of European stocks and bonds doesn’t mean you’re completely safe. In fact, your portfolio could be loaded with ticking time bombs, set to detonate once second-quarter earnings reporting season begins. Here’s why. Words: 611

So says Lou Basenese (www.WallStreetDaily.com) in edited comments from his original article* as posted on Seeking Alpha.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Basenese goes on to say, in part:

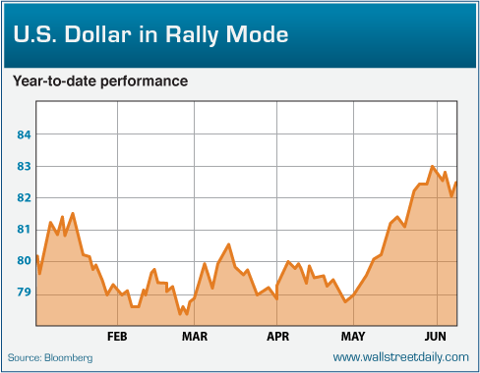

The U.S. dollar’s feeling rather mighty again….[up] 5% [see chart below] over the last six weeks [but] these gains aren’t the result of robust economic data coming out of the United States.

To the contrary, much of the relative strength can be attributed to the relative weakness in the euro. Since peaking in late February, the euro is down 7.2% [see below] in relation to the U.S. dollar.

Why You Should be Concerned

We need to be concerned about the latest developments because:

- U.S. companies don’t book sales exclusively in the United States. They also book sales in international markets– a meaningful amount. Case in point: Standard & Poor’s estimates that 46% of revenue for the companies in the S&P 500 Index came from overseas in 2010. In some sectors, like technology and materials, more than 52% of sales came from overseas.

- Since U.S. companies report results in U.S. dollars, they have to convert profits overseas into dollars at quarter’s end – and if the currencies in those foreign markets depreciate against the dollar, like they’re doing now, it cuts into profits. The greater the percentage of international sales, the greater the potential for foreign currency translation losses. (If you don’t think international sales exposure can sap stock market returns, think again. According to Bespoke Investment Group, over the last year, stock prices for companies with at least 50% of sales from overseas fell 8.5%. Compare that to a 1.4% rise for companies with close to 100% of sales in the United States.)

Take Note: If you like what this site has to offer go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com. It’s FREE! An easy “unsubscribe” feature is provided should you decide to cancel at any time.

Bottom Line:

Weaker-than-expected fundamentals combined with foreign currency translation losses, could lead to a nasty slide for individual stocks headed into second-quarter earnings season. I suggest you check your holdings (particularly any companies you own in the technology and materials sectors) for these invisible risks before it’s too late.

*http://seekingalpha.com/article/658571-international-exposure-this-invisible-risk-could-zap-your-portfolio-starting-july-1?source=email_macro_view&ifp=0 (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Article:

[While] it is true that the US economy is doing much better than Europe’s, and especially southern Europe’s, from my perspective, the trajectory of the U.S. economy and the U.S. stock market are very much tied to eurozone events. Here are four reasons why U.S. investors should not underestimate the potential impact of events in Europe. Words: 450 munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money