To hear Federal Reserve officials, politicians and mainstream financial media pundits tell it there is no inflation… but inflation defined correctly is rampant. In fact, it is at all-time record levels.

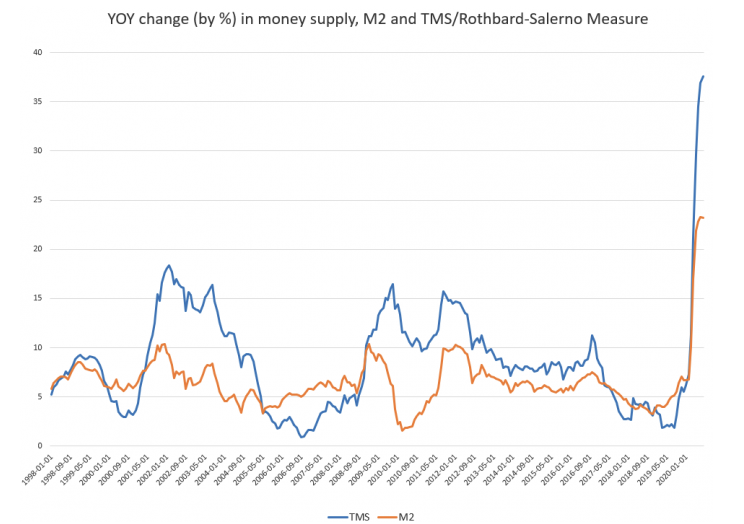

Strictly speaking, inflation is an increasing money supply, and by that measure, it has set records for five straight months. Last month, year-over-year growth in the the “true” or Rothbard-Salerno money supply (as measured by TMS) came in at 37.56%. That was up 36.92% from July’s record rate. In comparison, the August 2019 increase in the money supply was a paltry 1.86%. As measured by M2, the money supply grew by 23.23% in August, nearly the same rate as July’s record of 23.29%. [See the comparison between TMS and M2 in the graph below.]

The “true” or Rothbard-Salerno money supply measure (TMS)—is the metric developed by economists Murray Rothbard and Joseph Salerno, and is designed to provide a better measure of money supply fluctuations than M2. This measure of the money supply differs from M2 in that it includes Treasury deposits at the Fed (and excludes short-time deposits, traveler’s checks, and retail money funds).

Money supply growth has never been higher. The only period that came close was the stagflationary period of the 1970s….As Ryan McMaken explained in an article on the Mises Wire, this massive growth in the money supply comes in the wake of unprecedented quantitative easing, central bank asset purchases, and various stimulus packages….While this record inflationary binge by the Fed has not manifested in significant price inflation as measured by CPI – yet – it has shown up in asset prices – particularly equities. There is no other reason to see record stock market valuations in the midst of a massive economic contraction.

…The mainstream insists there is no inflation because it has shifted the definition…[to just] one symptom of actual inflation [but], in a nutshell, increases in the price level are not inflation. They are caused by inflation…

The common definition used today is nothing more than government propaganda….so it can pretend that it doesn’t cause it. Were the government to accept the real definition of inflation as an expansion of the supply of money then you would know exactly who’s to blame – the Fed – but if the government can fool people into believing that an effect of inflation is inflation, well then they can blame it on whoever is raising the prices.

Even if the inflationary policies never lead to rampant price inflation, they still have negative effects on the economy long term. They blow up asset bubbles that eventually pop, taking the broader economy down with them. Despite what the pundits tell us, there is inflation – lots of it – and it will not likely end well for Main Street America.

Editor’s Note: The original article by Peter Schiff has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

If you want more articles like the one above sign up in the top right hand corner of this page and receive our FREE bi-weekly newsletter (see sample here).

munKNEE.com – ” The internet’s most unique site for financial articles! Here’s why“

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money