There are 4 dirty little secrets about inflation you’re not supposed to know but we’re going to tell you anyway.

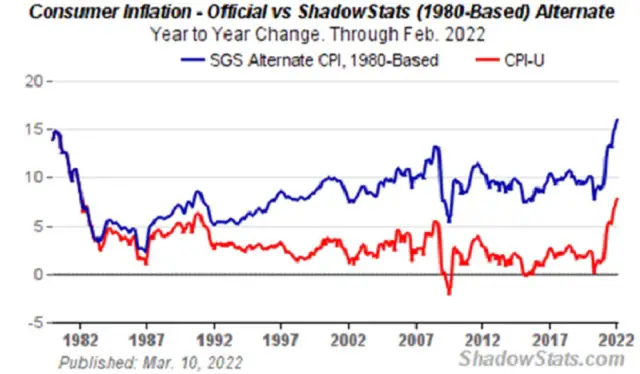

@$$4$If inflation today were measured the way it was in 1982, it would be about 16% annually; double the official rate.

Inflation can literally break a civilization because:

- Inflation makes it impossible for a person who relies on their labor to generate income to keep up with rising prices. Wages almost never keep up with inflation…

- It forces people to become greedy. It’s like the behavior of a group of hungry teenagers at a dinner party. Many of them take more than they can eat because they’re afraid the food will run out. It’s every person for themselves. Society be damned. That behavior magnified across an entire society leads to shortages, a phenomenon Americans under the age of 40 have never experienced personally.

- It drives political polarization. For instance, it’s easy to blame rich people for inflation, because they’re the ones who benefit from it the most. They can buy – or already own – productive assets whose yields rise with inflation. Their purchasing power is not affected like it is for wage-earners with no significant savings.

- This doesn’t go down well with liberals like Elizabeth Warren who blame inflation on “greedy corporations” and has proposed both higher corporate taxes and an “ultra-millionaire’s tax” on the wealthiest Americans…

- It leads to policies that ensure further inflation. For instance, as inflation ravages wage-earners’ purchasing power, political pressure builds for initiatives such as a “universal basic income” or a “living wage” – policies that themselves lead to higher inflation.

What people should really fight for is a return to sound money, which would end inflation altogether. Indeed, in an economy underpinned with gold or another commodity standard, deflation, not inflation, would be the norm…

Here’s another dirty little secret you’re not supposed to know. The Federal Reserve, our nation’s central bank and the entity responsible for taming inflation, is operating with its hands tied behind its back.

- Hiking interest rates is the core tool a central bank uses to fight inflation and protect its country’s currency from devaluation…but no matter how bad inflation gets – even as bad as the 14% it hit in 1980 – the Fed can never raise interest rates anywhere close to 20%. The reason is that Uncle Sam has a $30 trillion noose around its neck.

- Higher interest rates don’t just mean that you’ll pay more on your mortgage or receive higher yields in your money market account. It also means the Treasury pays more in interest on the $30 trillion national debt.

- With an average debt maturity of just over five years, a mere 1% increase in interest rates would add nearly $60 billion to the deficit the first year it was imposed, ballooning to $300 billion annually (1% of $30 trillion) by year five.

- A 3% increase across the board would eventually cost the Treasury an additional $900 billion per year. In reality, the numbers would be even higher since the national debt is increasing by trillions of dollars annually.

- Higher interest rates don’t just mean that you’ll pay more on your mortgage or receive higher yields in your money market account. It also means the Treasury pays more in interest on the $30 trillion national debt.

What can you do to protect yourself?

The obvious answer is to do what the wealthy do: buy productive assets that keep up with inflation, or passive assets such as gold that are traditional inflation hedges but accumulating productive assets and gold won’t be enough. As inflation splinters societies, it’s also important to build personal resiliency. For instance, if you have extra storage space in your home, we endorse the strategy of stockpiling real goods. Stockpiling is also a powerful inflation hedge, making this strategy more relevant than ever as prices surge…

The above excerpt from the original article by Mark Nestmann (nestmann.com) was edited [ ] and abridged (…) to provide you with a faster and easier read. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money