How much does the typical American family make? This question is probably one of the most central in figuring out how we can go about fixing our current economic malaise. In this article we break down the U.S. household income numbers. Words: 464

So says an article* posted on www.mybudget360.com.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

The article goes on to say, in part:

Median Household Income: $46,326; Median Dual-earner Household Income: $67,348

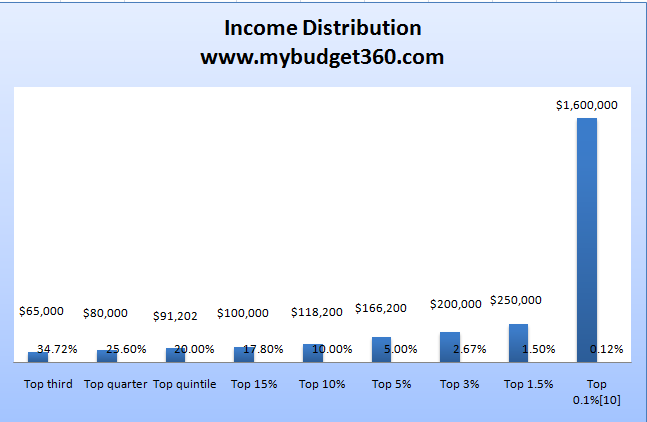

The median household income in the United States is $46,326….[while] dual earner households have a higher median income at $67,348. To highlight the massive discrepancy I’ve put together a chart showing the household income distribution:

17.8% of Households Make More Than $118,200; Only 2.7% Make More than $200,000

As you can see from the above chart, only 17.8% of all U.S. households make more than $118,200 a year. Only 2.67% make more than $200,000. The fact that only 34% make more than $65,000 is astounding given how expensive other cost of living items have gotten over the past decade. That is why the middle class is feeling squeezed from all different sides.

0.1% of Household Incomes Exceed $1,500,000

What is even more fascinating, is how even amongst the super wealthy income is not distributed evenly. There are approximately 146,000 (0.1%) households with incomes exceeding $1,500,000 a year. Even at that, the top 0.01% of households had incomes of $5,500,000 and accounted for 11,000 households. The 400 highest tax payers in the nation brought in a stunning $87,000,000 a year. Now that is wealth.

55 Million Households Living on $46,000/yr. – or Less

For us mere mortals, it is important again to focus on that chart. $46,000 does not go a long way. In a recent Census report there are 110,000,000 households in the United States. What this data tells us is that 55,000,000 households are living on $46,000 or less a year. Let us assume this is a married couple with 1 child. Let us run the numbers:

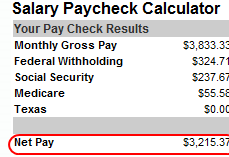

I ran the numbers for a state with no state income tax, Texas. A family at this level is only bringing in $3,215 a month. The national median home price peaked around $200,000. So let us assume this family purchased the median home:

- 5% down payment: $10,000

- Mortgage 30-year fixed (6.5%): $1,200

- Taxes and Insurance: $333

- Total PITI: $1,533

Right off the bat, this family is spending 47% of their net pay on a median priced home…The bottom line is [that] the average American family is being squeezed from every angle.

Conclusion

What we need is a focus on jobs and our economy, not bailing out banks. That defeats the entire purpose. The average American family is struggling getting by and when they hear about these billion dollar handouts, they can’t help but to feel left out.

*http://www.mybudget360.com/how-much-does-the-average-american-make-breaking-down-the-us-household-income-numbers/

Editor’s Note: The above article has been has edited ([ ]), abridged, and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Have your say on the subject via:

We’d like to know what you have to say.

Related Articles:

1. Life Insurance: a Pot of Gold or Ready Cash?

A life insurance policy is intended to provide your family with a sizable amount of money should you meet an untimely death and, as such, can be said to be a something of a an ultimate bonanza – a pot of gold, if you will. Most people, however, think the only way to get money from a life insurance policy is to die but there is another way should your circumstances change and that is called a life settlement. In this article I provide you with some insider insights on how to go about negotiating the maximize payout on such a settlement. Words: 851

2. Do You Have What It Takes to Become Filthy Rich?

Saving money isn’t all about whether or not you know how to score screaming bargains. It has more to do with your attitude toward money. Many millionaires, in fact, have frugal ways and understanding how personal traits can influence your finances is an essential ingredient for building wealth. Do you have the 10 key traits to become rich let alone very, very rich? Words: 815

3. Are You a Millionaire? 10 Reasons You May Not Be and What to do About It

The reason you are not a millionaire (or even on your way to becoming one) is really quite simple. You probably assume it’s because you aren’t earning enough money but the truth is that, for most people, it does not matter how much money you make… [but, rather,] the way you treat money in your daily life. [Let me explain.] Words: 875

4. More Reasons You May Not be a Millionaire – Yet

Many people assume they aren’t rich because they don’t earn enough money. If I only earned a little more, I could save and invest better, they say. The problem with that theory is they were probably making exactly the same argument before their last several raises. Becoming a millionaire has less to do with how much you make, it’s how you treat money in your daily life. The list of reasons you may not be rich doesn’t end at 10. [Here are 10 more.] Words: 842

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money