While gold has traditionally been seen as a tactical way to help preserve wealth during market corrections, times of geopolitical stress or persistent dollar weakness, we think there is a case to be made for gold as a core diversifying asset with a long-term strategic role in multi-asset portfolios…as gold’s historically low or negative correlation with most other asset classes argues in its favor…This article looks at how gold-backed assets have behaved over time as a portfolio diversifier, tail risk hedge and inflation hedge.

market corrections, times of geopolitical stress or persistent dollar weakness, we think there is a case to be made for gold as a core diversifying asset with a long-term strategic role in multi-asset portfolios…as gold’s historically low or negative correlation with most other asset classes argues in its favor…This article looks at how gold-backed assets have behaved over time as a portfolio diversifier, tail risk hedge and inflation hedge.

The original article has been edited here for length (…) and clarity ([ ]).

1. Increase Portfolio Diversification

When building a multi-asset portfolio, investors must consider not only the potential or forecasted risk-return characteristics of a particular asset class, but also how that asset class behaves relative to other investments. While asset classes with high forecasted risk-adjusted returns are preferred, investors may want to broaden their search for asset classes that move differently relative to one another (low correlation).

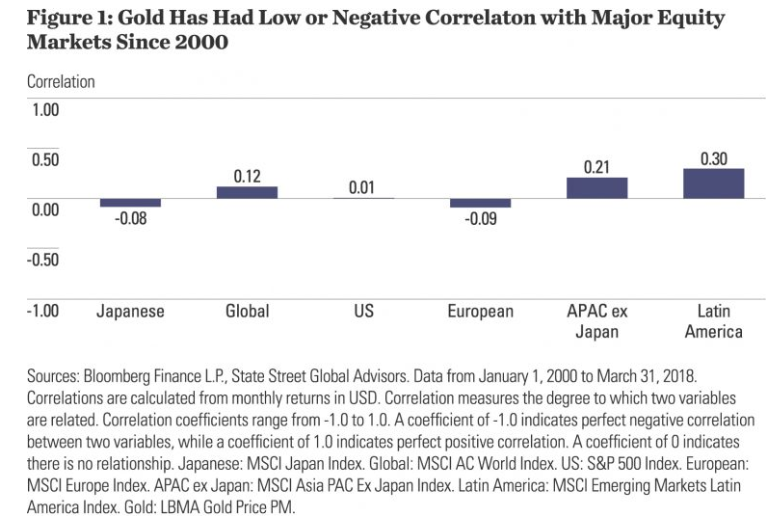

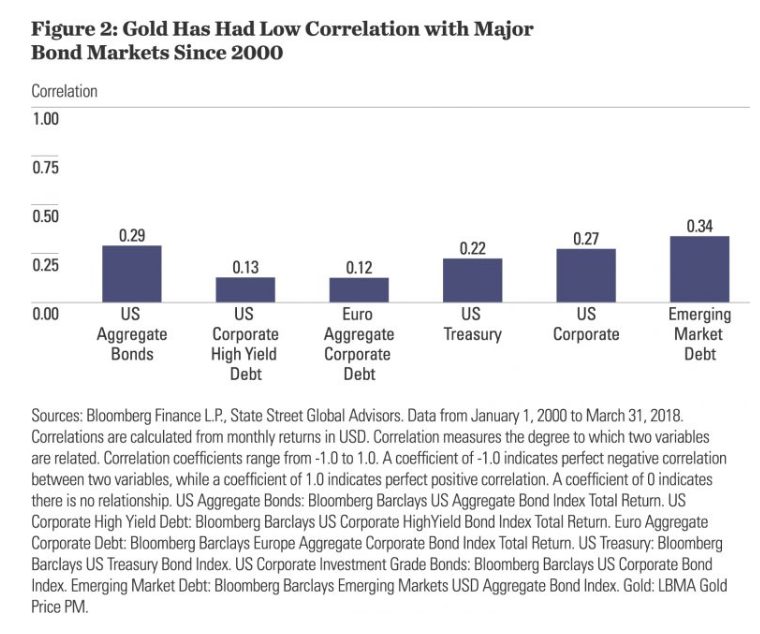

A low correlation between asset classes may lower portfolio volatility and, all else being equal, increase portfolio diversification and enhance the overall risk-adjusted return of the portfolio. Figures 1 and 2 depict gold’s historical correlation to major equity and bond markets. These very low or negative correlations highlight the potential long-term diversification benefits gold could bring to a multi-asset portfolio.

2. Tail Risk Hedge

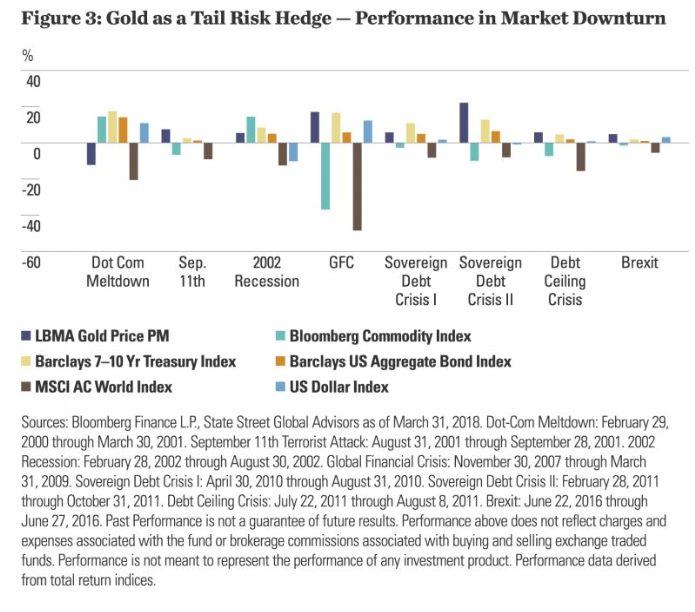

Gold has historically been used to provide potential tail risk mitigation during times of market stress, as it has tended to rise during stock market pullbacks. Figure 3 shows that gold was able to deliver competitive returns and outperformed other asset classes during a number of past black swan events. This demonstrates that including gold in a multi-asset portfolio might help investors moderate market volatility and reduce portfolio drawdowns.

3. Inflation Hedge

Our analysis of gold’s performance since 1970 shows that gold offers potential preservation of purchasing power in varying inflationary environments.

- During periods when the annual rate of inflation in the U.S. has been below 2%, the price of gold has risen at an average annual rate of 6.7%.

- During periods of moderate inflation — defined as an annual increase between 2% and 5% — gold has risen at an average annual rate of 7.4%.

- During periods when inflation has been running above 5% a year. During such times, the gold price has increased by an average annual rate of 15.2%.

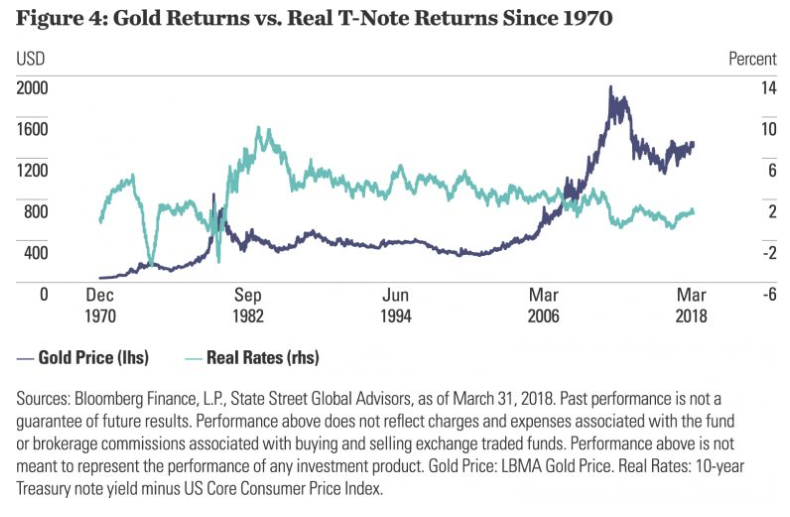

Historically, the price of gold has been influenced by real rates of return. One of the main reasons why gold did not appreciate during the 1980s and 1990s was because other asset classes performed so well. Conversely, gold has appreciated at times when real returns on assets like bonds have been low. We compared gold prices with real returns, with real returns calculated by subtracting the US core consumer price index (excluding food and energy) from the yield of US 10-year Treasury notes (see Figure 4).

In the 1980s, T-notes averaged a real rate of return of 4.50%, and 3.44% in the 1990s. Real returns continued to drop in the first decade of the new century, averaging 2.28%. Since the start of this decade, real rates have averaged 0.60% — the latest sharp drop relating to the Global Financial Crisis and the extraordinary central bank policies such as quantitative easing that followed. The last time real rates were so low was in the 1970s when they averaged 1.02%. Those low real rates were one of the major reasons why the price of gold appreciated from $43/oz. in 1971 to $512 at the end of 1979. Again, the disinflationary trend over the past 35-plus years and the low-to-negative real rates around the world that still prevail have been in gold’s favor, as Figure 4 shows.

Summary

While gold has traditionally been seen as a tactical way to help preserve wealth during market corrections, times of geopolitical stress or persistent dollar weakness, we think there is a case to be made for gold as a core diversifying asset with a long-term strategic role in multi-asset portfolios.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money