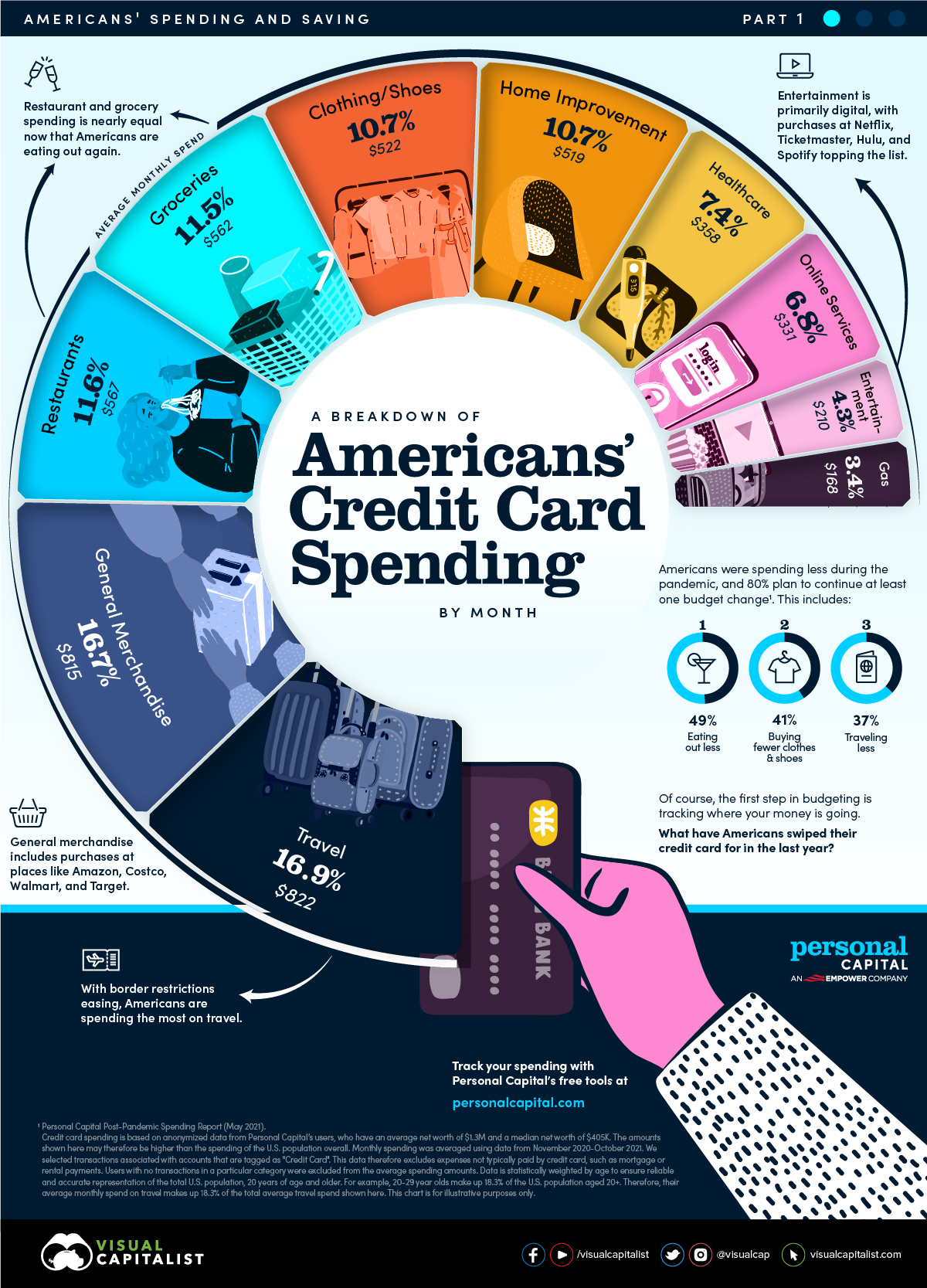

If you were fortunate enough to keep your job during the pandemic, you probably noticed a financial benefit: you spent less. Amid restrictions, credit card spending on fun activities—like going out for dinner—became less frequent. Looking ahead, the majority of Americans plan to continue at least one budget change post-pandemic, including eating out less (49%), buying fewer clothes and shoes (41%), and traveling less (37%). Of course, the first step in budgeting is tracking where your money is going. In the graphic below from Personal Capital, we break down Americans’ monthly credit card spending by category.

What do Americans want to do with the extra cash? Over half plan to put it towards savings, and 16% aim to contribute more to retirement savings or investments. [What are you doing with yours?]

What do Americans want to do with the extra cash? Over half plan to put it towards savings, and 16% aim to contribute more to retirement savings or investments. [What are you doing with yours?] munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money