Gold has long been viewed as the “safe-haven asset” – one that can protect investors against the ravages of stock market crashes – but does gold’s safe-haven reputation still hold up? Can gold actually protect your portfolio from a tumbling stock market?

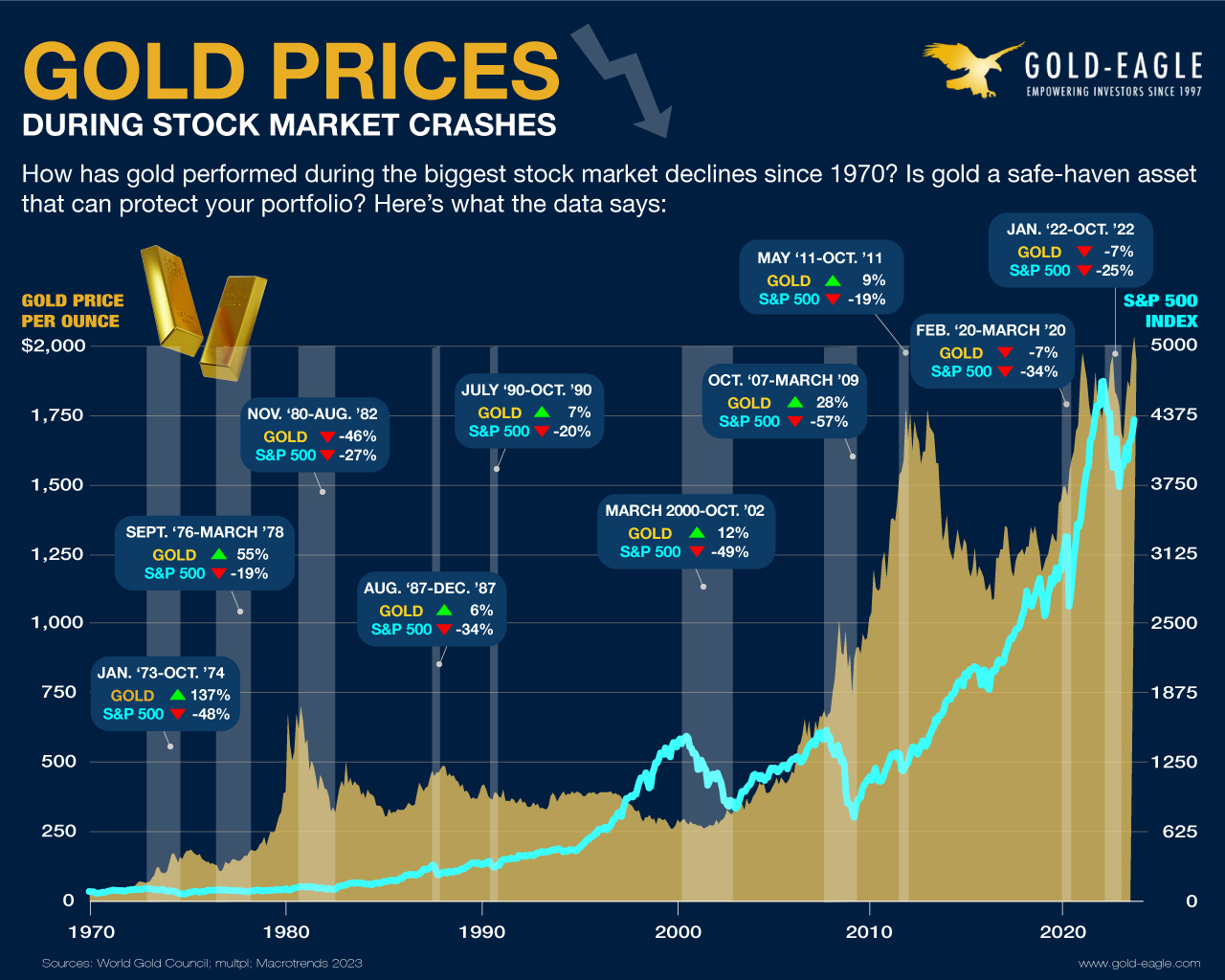

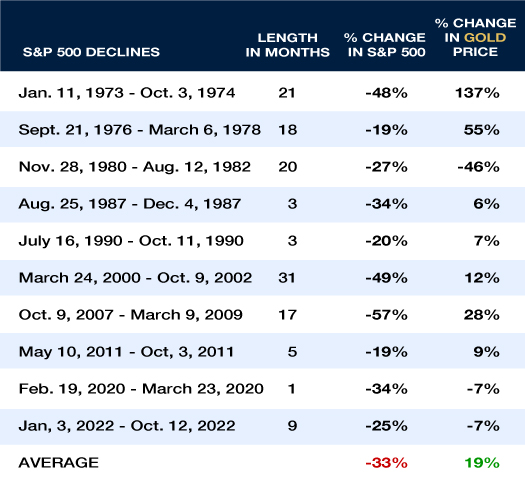

The infographic below (source) shows the 10 biggest declines in the S&P 500 since 1970 and compares them with gold price movements during the same time.

The data clearly shows that gold has significantly gained in value during most of the crashes since 1970. In fact, during the worst crash of the past 50 years, October 2007 – March 2009, gold gained 28% while the S&P 500 declined by 57%! This alone is a shining example of the potential of gold as a hedge against significant market declines.

Gold’s best performances occurred during the two large S&P 500 market declines of the 1970s, with huge price increases of 137% and 55%. As you can see below, there were 3 instances where gold prices declined along with the S&P 500. Even here, however, gold significantly outperformed the S&P 500 in 2 out of the 3.

The anomaly was the 1980 – 1982 bear market where gold declined 46% versus S&P 500’s decline of 27%. This occurred just after the largest gold bull market in modern history where the yellow metal skyrocketed 2,300% from its low in 1970.

Looking at the averages of the 10 market declines, however, further affirms gold’s status as a safe-haven asset that can protect your investment portfolio from the perils of a falling stock market – while the S&P 500 declined an average of 33%, gold increased an average of 19%.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

iNFORMATION THAT HAS LONG BEEN NEEDED….AND FINALLY REMOVES ALL DOUBT ABOUT THE SUSTAINED AND SUSTAINING VALUE OF PRECIOUS METALS.