…According to Bloomberg (“White House: Cohn-Led Tax Plan is Real and it’s Phenomenal,” February 10, 2017), Trump’s tax plan, to be released in two or three weeks, will be “the most comprehensive business and individual tax overhaul since 1986.” That’s saying something, since the landmark 1986 tax bill cut many deductions and reduced the top rate to 28% for the rich, 15% for the middle class, and 0% for the poor.

Phenomenal,” February 10, 2017), Trump’s tax plan, to be released in two or three weeks, will be “the most comprehensive business and individual tax overhaul since 1986.” That’s saying something, since the landmark 1986 tax bill cut many deductions and reduced the top rate to 28% for the rich, 15% for the middle class, and 0% for the poor.

The comments above and below are excerpts from an article by Gary Alexander (Navellier.com) which has been edited ([ ]) and abridged (…) to provide a fast & easy read.

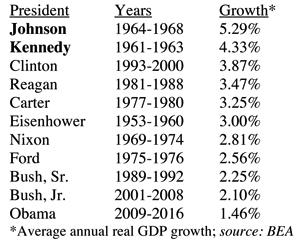

The fastest-growing economy of the last 70 years came in the Kennedy-Johnson years of the 1960s:

The Kennedy-Johnson tax cuts (“The Revenue Act of 1964”), signed into law February 26, 1964, cut the top rate from 91% to 70%, while all other rates fell and a standard deduction was added. Prosperity soon erupted: The jobless rate fell from 5.2% in 1964 to 3.8% in 1966 and 3.5% in 1969, the lowest rate in the last 50 years. Initial fears of a loss of revenue were forgotten when tax revenues increased each year.

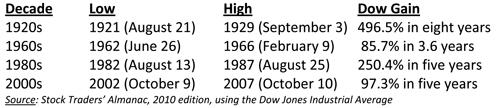

The major historical tax cuts of the 1920s, 1960s, 1970s, and 2000s each fueled rapid economic and stock market gains…

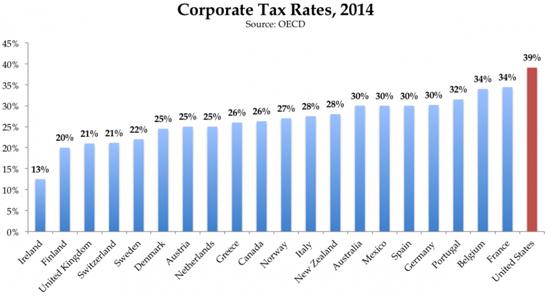

We could do just as well in the next four to eight years if we [were to] see major corporate tax rate cuts, including a token (10%) tax on corporate cash repatriated from lower-tax nations abroad. Too much corporate money is sitting in overseas bank accounts, since corporate profits are punished here at home. The U.S. has the highest corporate income tax rate in the developed world, at 39%, well above the OECD overage of 25%.

Ireland has staged a near-miraculous economic recovery by lowering its corporate tax rate to 13%. The U.S. would be far more competitive if our top tax rate were cut to 15%, near the Irish magic formula.

Corporate tax cuts are important for big business, but small businesses also need some relief on the regulatory front. This would help President Trump deliver on his promise of more jobs – specifically, 25 million new jobs in a decade! – since small and medium-sized businesses account for 90% of job growth…

If you want more articles like the one above: LIKE us on Facebook; “Follow the munKNEE” on Twitter or register to receive our FREE tri-weekly newsletter (see sample here , sign up in top right hand corner).

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money