There is some discussion in the blogosphere that the recent spike in gold reflects increased inflation expectations (possibly due to higher potential for Fed’s QE3). That may be true, but that assumption is completely inconsistent with inflation expectations implied by TIPS.

increased inflation expectations (possibly due to higher potential for Fed’s QE3). That may be true, but that assumption is completely inconsistent with inflation expectations implied by TIPS.

So say comments from an article posted in its original format* at http://soberlook.com.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

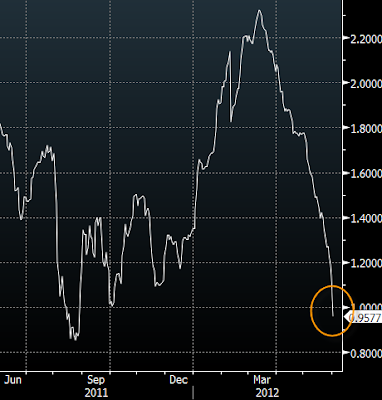

The 2×2 breakeven (2-year forward) inflation expectation has come down hard dropping below 1%. [As can be seen in the chart below] this is an extraordinary correction from the peak of 2.32% just 80 days ago.

Conclusion

The only explanation for the spike in gold is therefore “flight to quality”, as other “safe assets” such as bunds trade near zero yields or even negative.

*http://soberlook.com/2012/06/inflation-expectations-collapse.html?utm_source=BP_recent (To access the original article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. There Are 3 Reasons Why Gold and Mining Shares Are Starting to Firm Up

“The way precious metals are now diverging from global stock markets can only mean one thing. We are in the early stages of a fear event. As the fear of insolvent banks and broken government promises grows, people will increasingly move out of paper assets of all types and into physical gold and silver.”

2. If You Don’t Think Gold IS a ‘Safe Haven’ Then You Don’t Know the Meaning of the Term!

It would seem that there is a considerable lack of understanding about what the term “safe haven” actually means when it comes to gold. Let me explain just what it means – and does not mean. Words: 740

3. A Look Back at the Performance of Gold vs. Stocks in Times of Crisis

We are in the midst of turbulent times, and it seems inevitable that things can only get worse. Most investors are of the opinion that gold is one of a very few areas of safety…however, when we look at historical charts, it is obvious that gold doesn’t always behave in the way we would expect. [Let me explain.] Words: 541

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money