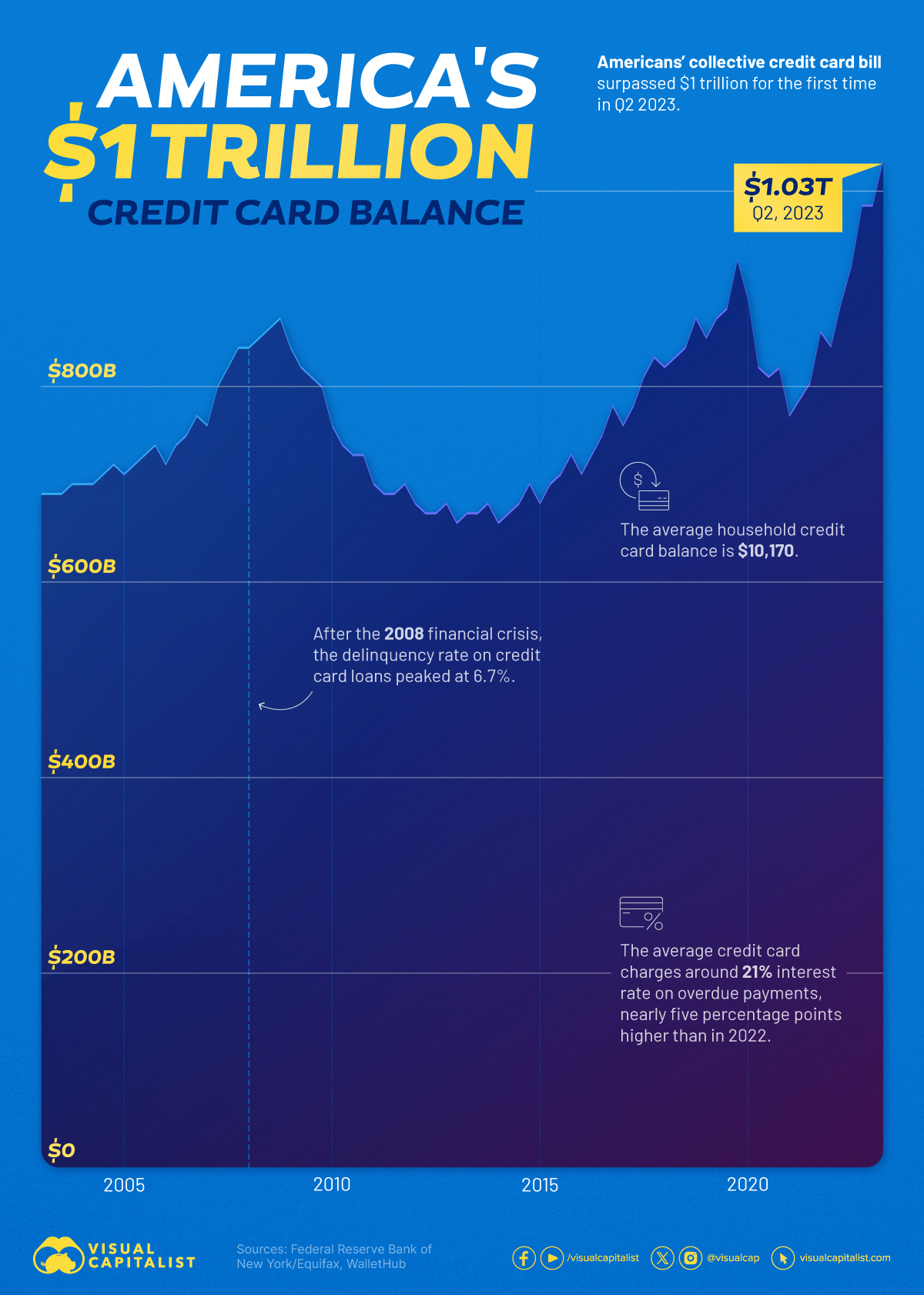

Americans’ collective credit card debt surpassed $1 trillion for the first time in Q2 2023 and the graphic below uses data from the Federal Reserve Bank of New York and WalletHub to illustrate the growing credit card debt in the United States.

This version of the original post by Miranda Smith of Visual Capitalist has been edited and abridged to provide a faster and easier read.

Credit cards stand out as the most prevalent form of household debt in the U.S. and this prevalence is on an upward trajectory. According to the Federal Reserve Bank of New York, credit card issuance has been steady over the last few years, averaging about 92 million newly issued cards each year between 2017 and 2019.

The pandemic caused a sharp contraction in new credit card issuance, but lending returned across all credit score groups in 2021. There are currently 70 million more credit card accounts open than in 2019. Approximately 69% of Americans now possess at least one credit card.

New York Fed researchers wrote that: “American consumers have so far withstood the economic difficulties of the pandemic and post-pandemic periods with resilience, but rising balances may present challenges for some borrowers, and the resumption of student loan payments this fall may add additional financial strain for many student loan borrowers.”

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money