Gold generally rises with uncertainty and desperation – two things in no short supply right now in Europe – yet gold can’t even make it back above the psychologically important $1,200-an-ounce mark. Why is that?

- Greece doesn’t matter nearly as much as the mainstream press would have you believe. The Greek economy is about the same size as the economy of Atlanta, Georgia.

- Since Greece won independence from the Turks in the 1830s – just under 200 years ago – it’s been in default for roughly 90 of those years so what is happening again is absolutely no surprise.

- Roughly $313 billion of outstanding Greek debt, only about $45 billion – or 14% – is owed to the International Monetary Fund, the European Central Bank, and Europe’s rescue fund, the European Financial Stability Facility and these public institutions can better absorb any losses.

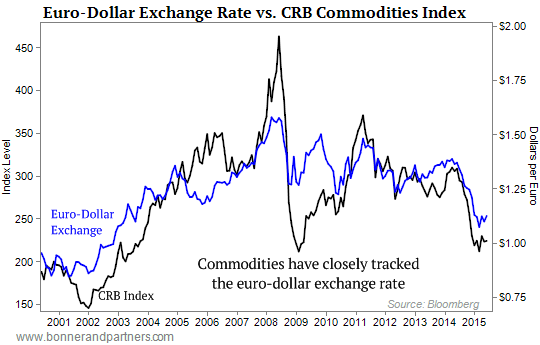

- Finally, and most importantly, the Greek crisis has kept the euro weak against the dollar. That’s a major problem for commodities because commodities prices have closely tracked the euro’s strength versus the dollar going back to the start of the single currency (see chart below). A strong euro tends to mean a weak dollar and a weak dollar tends to mean higher commodity prices. The reverse is also true, however, so as long as the euro remains weak against the dollar, commodities – including gold – will continue to suffer.

As such, as long as the Greek crisis keeps the euro weak… don’t expect fireworks from gold.

* http://bonnerandpartners.com/this-is-why-gold-is-weak/

Related Articles from the munKNEE Vault:

1. Relax! Greek Default NO Threat to EU Financial System – Here’s Why

True, the markets are nervous, but there is virtually no sign that an unpleasant resolution to the Greek crisis presents any threat to financial markets or even the Eurozone economy. Here’s why.

2. Careful! Gold’s Performance in Times of Crisis Often Not As Expected

We can devise logical scenarios as to what the price of gold should or should not do, but gold doesn’t always follow the plan. To paraphrase an old Jewish saying: “Man plans. Gold laughs.”

3. If Greek Financial System Implodes the Rest Of Europe Will Soon Follow

The Greek financial system is in the process of totally imploding, and the rest of Europe will soon follow. Why? Because neither the Greeks nor the Germans are willing to give in, and that means: there is very little chance that a debt deal is going to happen by the end of June; we will likely see a major Greek debt default and, potentially, even a Greek exit from the eurozone and, if Greece does leave the euro, we are going to see financial carnage happen all over Europe.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money