I continue to see articles in the media claiming that Europe’s problems are solved. Either the folks writing these articles can’t do simple math, or they don’t bother actually reading any of the political news coming out of Europe [so let me present 3 data points that guarantee Europe will collapse at some point in the near future]. Words: 722

solved. Either the folks writing these articles can’t do simple math, or they don’t bother actually reading any of the political news coming out of Europe [so let me present 3 data points that guarantee Europe will collapse at some point in the near future]. Words: 722

So says Graham Summers (http://gainspainscapital.com/) in edited excerpts from his original article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Summers goes on to say, in part:

Below are 3 data points that guarantee Europe will collapse at some point in the near future:

Fact #1: EU Banks, as a whole, are leveraged at 26 to1

This is, of course, is based on the assets the banks are reporting. According to independent sources, the leverage levels are in fact far, far, greater than this – although 26 to 1 is already bordering on Lehman Brothers’ leverage levels.

As far back as September 2011, PIMCO’s Co-CIO, Mohamed El-Erian (one of the most connected of the financial elite) noted that French Banks were running REAL leverage levels of almost 100-to-1…”indicative of a BB rating, which is fundamentally inconsistent with sound banking operations”. He adds that bank equity now trades at a 50% discount to tangible book value on average, while the ratio of market capital to total assets has fallen to 1%-1.5%, compared with 6%-8% for “healthier banks.” [A such,] the “official” leverage level of 26 to 1 is definitely much, much lower than the REAL leverage levels…

Fact #2: One Quarter of the ECB’s balance sheet is PIIGS debt

As part of its moves to save the system the ECB has gorged on PIIGS debt. Today, one quarter of the ECB’s balance sheet is PIIGS debt. Care to take a guess at what these assets are valued at? I guarantee it’s nothing near their real market values.

The ECB managed to swap out its Greece debt into new debt that would not take a hit should Greece default – but it won’t be able to do this with the remainder of its PIIGS’ debts. Indeed, it’s not even going to try. Instead, the ECB plans on shifting any of the losses from these debts on to the 17 individual EU national banks according to their size which means that Germany’s Bundesbank would face the largest exposure.

Daily Delivery Available! If you enjoy this site and would like to have every article sent automatically to you then go HERE and sign up to receive Your Daily Intelligence Report. We provide an easy “unsubscribe” feature should you decide to opt out at any time.

Pass it ON! Tell your friends and co-workers about us. We think munKNEE.com is one of the highest quality (content and presentation) financial sites on the internet and our current readers seem to be confirming that. Visits have been doubling yearly and pages-per-visit and time-on-site continue to reach record highs.

Spread the word. munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

So the ECB goes over Germany’s head to gorge on garbage debts from the PIIGS… and then decides that should these debts prove worthless, it’s Germany’s problem. What could possibly go wrong here? Hint: Germany bails on the Euro…

Indeed, Germany has already put up a firewall that would allow it to walk on the Euro at any point. Obviously it doesn’t want to, but when the ECB tries to shift the losses from its PIIGS exposure (this will happen and they will be MASSIVE losses) onto Germany’s shoulders, Germany will have no choice.

Fact #3: Even after all of its interventions and purchases, the ECB is far too small to contain this mess (ditto for the Fed)

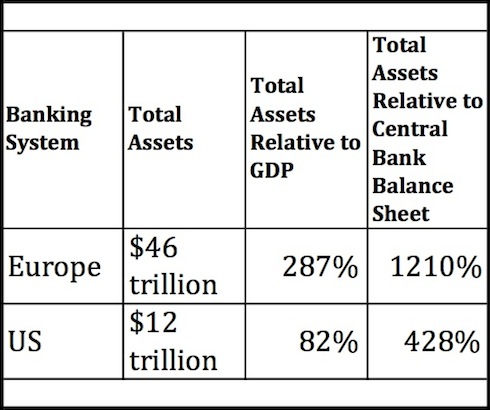

Have a look at the following chart and tell me that the ECB or Fed could contain this mess.

I know many of you are thinking “the ECB or Fed could just print money.” That answer is wrong. If the ECB chooses to do this, Germany will walk, end of story. They’ve already seen how rampant monetization works out (Weimar).

If the Fed chooses to monetize everything to hold things up, then the U.S. Dollar collapses, inflation erupts creating civil unrest, interest rates rise killing the banks, U.S. corporations and the U.S. economy… all during an election year. Good luck with that.

Remember, the Fed’s QE 2 program which was a mere $600 billion (to bail out Europe the Fed would need at the minimum $2 trillion) pushed food prices to all time highs and kicked off riots and revolutions around the globe. Imagine what $2+ trillion would do.

Again, Europe cannot be saved. It’s too big and too leveraged. End of story. The collapse will come and when it does the Central Banks will not be able to contain it. If you’re not already taking steps to prepare for the coming collapse, you need to do so now.

*http://www.zerohedge.com/contributed/2012-12-22/three-data-points-prove-europe-cannot-be-saved (To access the article please copy the URL and paste it into your browser.)

Editor’s Note: The above article has been has edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. The Coming Crisis in Europe Will Result in a MAJOR CRISIS in the U.S.! Here’s Why

In this article I lay out precisely why the coming Crisis in Europe will be THE Crisis I’ve been forecasting for the last 24 months, why it will have dire consequences on the U.S. and why the Fed can do absolutely nothing to stop it this time round. Words: 1334

2. Ongoing European Crisis to Result in Higher Inflation and Higher Gold Prices – Here’s Why

On the surface things may appear to be calm, but I don’t think the European crisis is anywhere near its conclusion. Losses still have to be taken from Ireland, Spain, Portugal and possibly even Italy…There are a number of ways out of Europe’s problems. One of them is higher inflation…[which] is going to be very positive for gold… because the central banks will be under pressure to print.

3. Alf Field’s 7 “D’s” of the Developing Disaster Revisited

When the supply of something is increased sharply relative to demand, the value of that commodity will decline. If the supply continues to increase rapidly and indefinitely, then that item will become worth less and less, with the potential to finally become nearly worthless. This is the Developing Disaster facing the US Dollar and the world. This is the factor that could become the single most important criterion in investment allocation decisions and possibly even for individual financial survival…[Let me explain this further by reviewing the 7 major problems facing the U.S. (and thus the world) and how they all will lead to problem #7 – devolution.] Words: 1520

4. Where Is This Unprecedented Global Financial Crisis Headed? A Retrospective from Alf Field

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money