Soft landings, it has been said, are the holy grail of monetary policy, and as we look ahead to 2024, there are signs that we may be on the cusp of one. What does it mean for the economy to have a soft landing and, conversely, what constitutes a hard landing?

- Simply put, a soft landing occurs when the Federal Reserve raises interest rates to curb inflation and manages to do so without triggering a sharp increase in unemployment or pushing GDP growth into negative territory.

- A hard landing, on the other hand, is when interest rates rise and inflation decreases, but at the cost of a recession and high unemployment.

So says Lance Roberts (usfunds.com) in excepts from his year end article entitled Will The Fed Achieve A Soft Landing In 2024?. Roberts goes on to say:

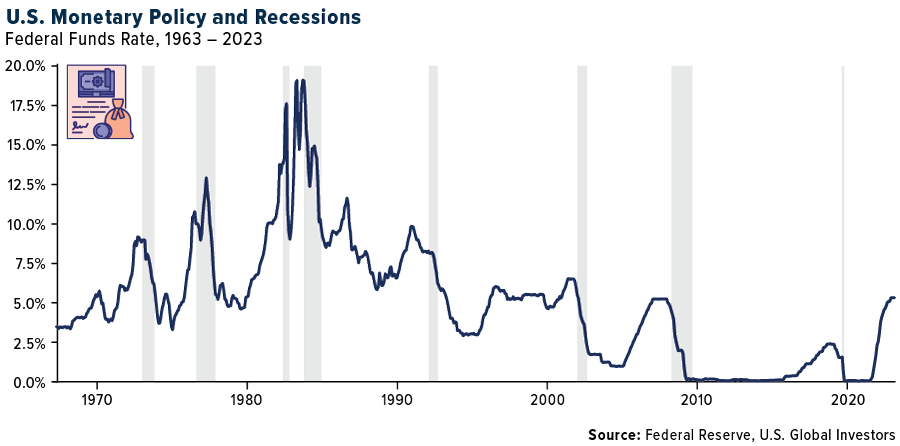

Achieving a soft landing is exceptionally challenging. Noted MIT economist Rudi Dornbusch (1942-2002) famously quipped: “None of the post-war expansions died of old age. They were all murdered by the Fed.” Indeed, out of nine tightening cycles over the past five decades, the bank successfully engineered a soft landing only twice. The other seven instances culminated in recessions.

Princeton economics professor Alan Blinder offers some hope. If the need to combat inflation is not too extreme, he writes in a recent article, the Fed has demonstrated its ability to orchestrate an economic landing that either avoids a recession or induces a relatively mild one. The central bank’s reputation for causing hard landings “derives mainly from conquering the 1970s inflation—which took three landings,” Blinder says.

The key to predicting the outcome in 2024 lies in economic indicators, especially as experts project the consumer price index (CPI) in the U.S. to decline to 2.7% while the Fed’s target rate is expected to reach 4.50% by the end of the year.

Gold’s Prospects In A Soft-Landing Scenario

In the context of a potential soft landing, historical trends suggest that gold may not perform as strongly. According to the World Gold Council (WGC), soft landing environments have typically resulted in flat to slightly negative average returns for gold. However, every cycle is unique, and 2024 may bring surprises.

Heightened geopolitical tensions in a key election year for many major economies, combined with continued central bank buying, could provide additional support for gold. Central banks and official institutions have played a pivotal role in boosting gold’s performance over the past two years, with the WGC estimating that excess central bank demand added 10% or more to gold’s gains in 2023. This trend is likely to persist, potentially providing an extra boost to gold prices in 2024.

Conclusion

It’s essential in 2024 for investors to remain vigilant, monitor economic indicators closely and consider the various possibilities that lie ahead.

While the prospect of a soft landing offers optimism, the financial landscape remains subject to change but by recognizing the strength of the U.S. in the global economy and staying attuned to market dynamics, investors can position themselves for success in 2024.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money