empirical evidence since SLV’s inception suggests investors may not be sufficiently compensated for pairing silver with gold. [I came to that conclusion by back-testing the performance of each using a variety of analytical approaches. Read on.] Words: 645

empirical evidence since SLV’s inception suggests investors may not be sufficiently compensated for pairing silver with gold. [I came to that conclusion by back-testing the performance of each using a variety of analytical approaches. Read on.] Words: 645So says Mark Motive (www.planbeconomics.com) in edited excerpts from an article* posted on Seeking Alpha which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited below for length and clarity – see Editor’s Note at the bottom of the page. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

Motive goes on to say, in part:

- Gold is a monetary asset, with supply and demand determined primarily by the condition of the currencies in which it is valued. Because gold has few industrial uses, it can be seen as a mirror that reflects the value of the global monetary system. When gold is rising in price, it usually means that confidence in monetary authorities is falling and currencies are being devalued.

- Silver, on the other hand, is both a monetary and industrial asset. Like gold, silver has been used for thousands of years as currency and as backing for paper money. However, because silver also has many industrial uses it is affected both by monetary conditions and changes in the business cycle. Moreover, because silver is used in various industrial processes, above ground inventories are continuously depleted. In contrast, almost all the gold that was ever mined is stored somewhere on the planet.

Clearly, they are quite different so there is an intuitive case for holding both – but is there an empirical case?

To evaluate the intuitive hypothesis, I back tested the performance of SPDR Gold Trust (GLD) and iShares Silver Trust (SLV) using the April 2006 inception date of SLV. (I could have conducted a similar evaluation using ETFS Physical Swiss Gold Trust (SGOL) and Sprott Physical Silver Trust (PSLV) or using actual silver and gold bullion prices dating back much further which, by the way, I will do in a follow-up article.) Below I show the graphic results of my back test based on a number of different bases:

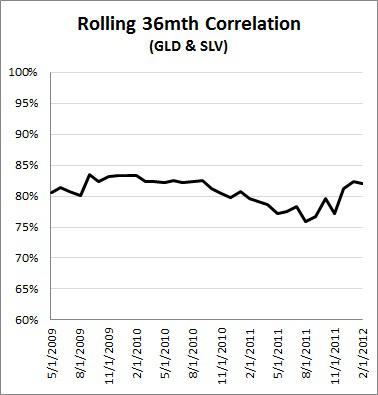

1. Rolling 36 Month Correlation

[Looking at the correlation between gold and silver over a rolling 36 month period one can see in the chart below] that the correlation is high and fairly constant across time, suggesting that the diversification benefit of holding both gold and silver is limited.

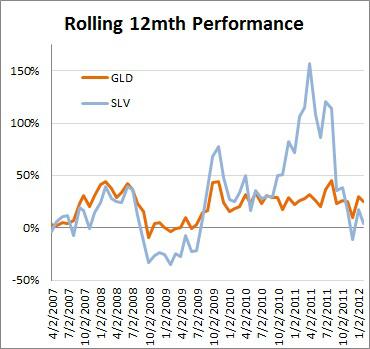

2. Rolling 12 Month Correlation

While gold’s rolling 12 month returns have remained somewhat steady during the analysis period, silver’s returns have ranged considerably [as can be seen in the chart below].

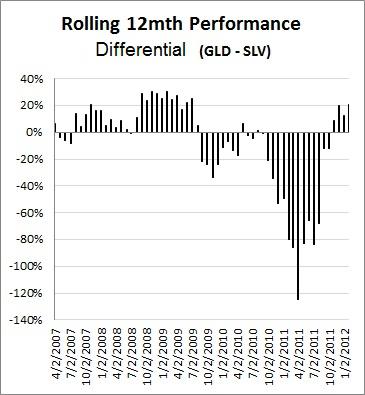

3. Rolling 12 Month Return Differential

The graph below displays the difference between the two returns in the previous graph. This simply highlights the huge differences in returns experienced by gold and silver [which is anything but] consistent and predictable.

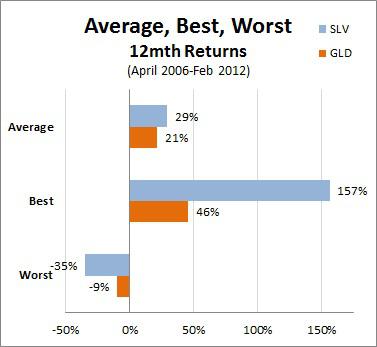

4. Average, Best, Worst 12 Month Returns

Again, the following chart displays the returns differential in another way. Clearly, SLV introduces a lot of volatility (upside and downside) to a portfolio.

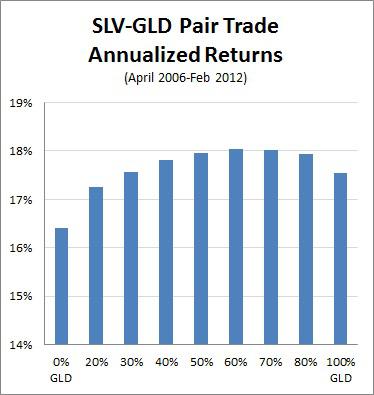

5. Annualized Pair-Trade Returns

The next two graphs look at the actual results of a back-tested pair trade.

The first graph shows the annualized returns of multiple weightings ranging from 0% GLD to 20% GLD to 30% GLD and so on. There doesn’t appear to be a dramatic shift in returns, but the highest returns range around the 60% GLD/40% SLV weighting. (Note: the annualized return for the 100% silver portfolio is lower than the average 12 month return for silver. This difference occurs because of the effects of compounding.)

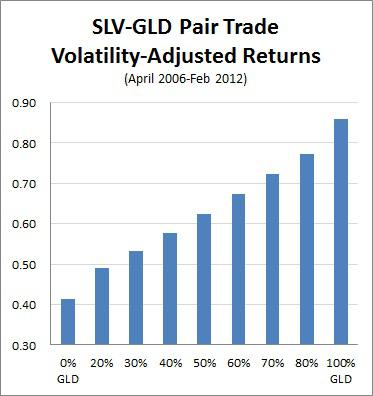

6. Volatility-Adjusted Pair-Trade Returns

The final graph really sums up the story. There is a distinct indication that, since SLV’s inception, investors have not been compensated for adding silver to a gold portfolio.

Conclusion

Based on the limited back test using SLV and GLD, in my opinion investors have been better compensated for risk by investing in 100% gold.

*http://seekingalpha.com/article/404861-the-gold-silver-pair-trade?source=email_macro_view&ifp=0

Editor’s Note: The above article has been has edited ([ ]), abridged, and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

Do we really honest-to-God no-fingers-crossed cherry-on-top believe that the powers-that-be will simply allow us to mosey up to the cashiers cage and redeem or convert our Gold for whatever monetary unit reigns supreme or is created [should our current financial system and currencies collapse? As such,] IF there comes a time when the best move forward is to sell most of our Gold and switch to another asset class, one more likely to survive the transition intact, will we be able to see this as obvious and a no brainer? [Let me explain what could well happen and the effect such a development would have on all things Gold.] Words: 3037

2. Gold & Silver Warrants: What are They? Why Own Them? How are They Bought & Sold?

With all the interest in physical gold, silver and other commodities these days, and the large/mid-cap companies who mine the metals and the juniors who are exploring for them, it begs the question: “Why is no one writing about the merits of investing in the long-term warrants associated with a few of those companies?” Merits? Absolutely! Here is a primer on virtually all that you need to know about warrants and how to invest in them for major profits. Words: 3278

3. Do Recent Gold & Silver Correlation/Return Comparisons With S&P 500 Refute Their Safe Haven Status?

The past few years have seen the development of the notion that GLD and SLV represent uncorrelated plays on the market, making them safe haven bets for your portfolio. Looking at historical trends (aside from 2011), [however,] one would have to go back to 2007 to find a year where these two metals weren’t highly correlated to the S&P 500. For all of 2011, both ETFs have featured low correlation, but as recent trading weeks have shown, old habits die hard, as the two ETFs have fallen back into a highly correlated trend. Let’s take a look at the particulars.] Words: 672

4. Where Do Gold & Silver Rank in Vulnerability to a Recession Among Other Commodities?

A Barclays Capital research [report] notes that gold prices are vulnerable to a recession – more so than some of the other commodities. In the last recession of 2008, gold prices appreciated the least among precious metals. Below is a table that ranks 30 different commodities. Words: 571

5. History Says Silver Could Become the Next 10-Bagger Investment! Here’s Why

If you concur with the 159 analysts (see below) that maintain that physical gold is going to go parabolic in price in the next few years to $3,000, $5,000 or even $10,000 or more then you should seriously consider buying physical silver. Why? Because the historical gold:silver ratio is so way out of wack that silver should appreciate much more than gold as it goes parabolic in the years to come. Indeed, silver could easily reach $100 – $200 per troy ounce, maybe even $300 and conceivably in excess of $400 depending on how high gold goes. The aforementioned may be hard to believe but an analysis below of the historical price relationship between silver and gold suggests that such will most likely occur if gold does, indeed, go parabolic. Take a look. Words: 1423

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money