Commodity prices including those of…[gold and silver] tend to go through super- cycles…[which] last for many years. [Below is a review of the history of such cycles and the length of each. Where are we now in each? When will they go “boom”? When will they go “bust”? Let’s take a look.] Words: 165; Charts: 1; Tables: 3

cycles…[which] last for many years. [Below is a review of the history of such cycles and the length of each. Where are we now in each? When will they go “boom”? When will they go “bust”? Let’s take a look.] Words: 165; Charts: 1; Tables: 3

So writes David Hunkar (www.topforeignstocks.com) in edited excerpts from his original post* entitled On The Gold And Silver Price Super-Cycles.

This post is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds), www.munKNEE.com (Your Key to Making Money!) and the Intelligence Report newsletter (It’s free – sign up here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Hunkar goes on to say in further edited excerpts:

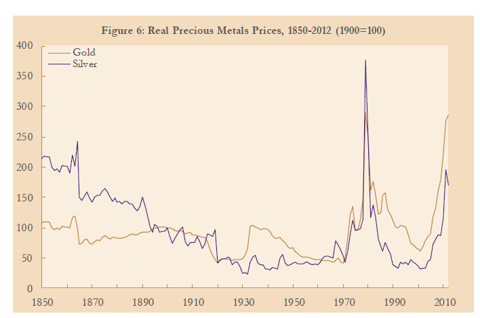

The following chart shows real gold and silver prices from 1850 to 2012:

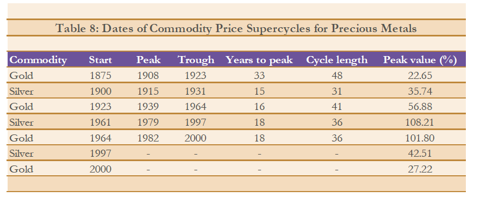

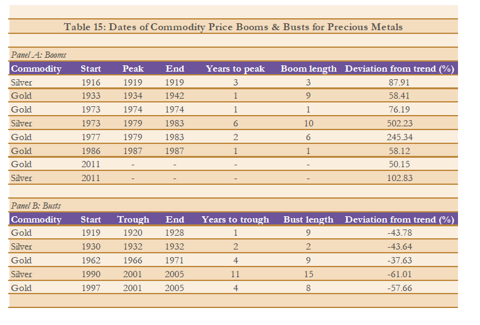

The tables below show the dates of super-cycles and dates of booms and busts:

It is interesting to note the boom and bust lengths for these two precious metals. During the depression of the 1930s gold had one of the long boom periods. The recent long boom lasted 6 years from 1977 through 1983.

[How long will the current boom periods last for each of gold and silver? Time will tell but the above analyses should give you some idea of when.]

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://topforeignstocks.com/2013/03/24/on-the-gold-and-silver-price-super-cycles/ – Copyright 2012 TopForeignStocks.com (Data Source: http://www.sfu.ca/~djacks/papers/workingpapers/w18874%20(typology).pdf by David S Jacks, Department of Economics, Simon Fraser University, Canada; NBER Working Paper No. 18874, March 2013 entitled From Boom to Bust: A Typology of Real Commodity Prices in the Long Run)

Advertisement

Want to do Business in China?

We can establish your products there – we’ve already done it for others

Chinese market is 4x bigger than those of the U.S. and Canada combined

There is a major need for:

– pollution treatment/prevention equipment (water & air),

– disease detection/treatments (diabetes & cancers),

– green energy products (heating & power).

Visit Global Linkages and then contact us to discuss opportunities

We’re off to Beijing & Shanghai again this month

Related Articles:

1. Gold Might Spike to $2,600 in June and $4,866 in January 2015

If similarities between the 5 major spikes in the price of gold since 2001 were applied to the 5th price spike (August, 2011) going forward it would not be unreasonable to expect a spike to $2,600 in June or July of this year and another spike – to somewhere between $4,700 and $5,050 – in January/February of 2015.

2. These 40+ Analysts See Gold Going to $5-6,000 (on average) By Late 2014/Early 2015

Analyst after analyst (in excess of 170 at last count) has been forecasting what the parabolic peak price for gold will eventually be. That being said, however, only 43 have been bold enough to include the year in which they think their peak price estimate will occur and they are listed below. Take a look at who is projecting what, by when and why. Words: 400

3. Coming Move In Gold Will See It Reach $3,200 by Late 2014 or Early 2015

The breakdown after the QE4 announcement, and now the extreme move into a yearly cycle low has, I daresay, convinced everyone that the gold bull is over. I would argue that it is impossible for the gold bull to be over as long as central banks around the world continue to debase their currencies [and that] gold is just creating the conditions – a T-1 pattern – necessary for its next leg up to what I expect to be…around $3200 sometime in late 2014 or early 2015. [Let me explain.] Words: 560; Charts: 3

Bubbles tend to follow the 80/20 ratio indicated in the Pareto Principle where approximately 80% of the price move occurs in the LAST 20% of the time. That being the case it would appear that gold and silver could conceivably top out around $9,000 per troy ounce and $250/ozt respectively .This is not a prediction of future prices of gold and silver; it is an indication of what could happen in a speculative bubble environment based on the history of previous bubbles. Words: 1280; Charts: 1

5. What Does a “Troy” Ounce of Gold Mean? What Does 18 or 24 “Karat” Gold Mean?

When the price of gold is mentioned as costing “x dollars per troy ounce” do you fully appreciate the signifance of the term “troy”? When looking to buy gold jewellery do you fully understand what the difference is between an item that is 10 “karat” gold and another item stamped 18 “karat” gold (other than that it is much more expensive)? Let me explain. Words: 587

6. Keep the Faith – This Bull Market in Gold STILL Promises to Be One for the History Books! Here’s Why

Seeing the S&P 500 outperform gold and seeing gold stocks get decimated…has been enough to create suicidal sentiment…in the precious metals (PM) sector…but, as the many calls for an end of the PM bull market…[are expressed,] the risk in the PM sector gets lower and lower. The bigger picture hasn’t changed and isn’t going to for some time [so] keep the faith and hold onto your PM sector items tight. Don’t let the short and intermediate-term noise distract you from what STILL promises to be a secular bull market for the history books. The Dow to Gold ratio will hit 2 and might even go below 1 this cycle. [Let me explain.] Words: 873

7. Gold Projected to Reach $4,000/ozt. Sometime Between Late 2015 & Mid 2017! Here’s My Rationale

< noscript>

< noscript> I am not predicting a future price of gold or the date that gold will trade at $4,000, but I am making a projection based on rational analysis that indicates a likely time period for gold to trade at $4,000 per troy ounce. Yes, $4,000 gold is completely plausible if you assume the following:

I am not predicting a future price of gold or the date that gold will trade at $4,000, but I am making a projection based on rational analysis that indicates a likely time period for gold to trade at $4,000 per troy ounce. Yes, $4,000 gold is completely plausible if you assume the following:

8. Alf Field: Once $1,800 Is Taken Out Gold Will See a Vigorous Climb to $4,500 Area

There is a high probability that the correction in the gold price that started in early October at $1797 has been completed. Once $1800 is taken out on the upside the gold chart will look tremendous. A beautiful “cup and handle” base would then provide strong support for a vigorous upward climb in the precious metal. At this stage there is no reason to abandon the rough target of $4500 for this coming upward wave. [Below is my analysis and some charts on the situation.] Words: 434; Charts: 2

The fact that nobody really knows with absolute certainty where gold will really go from today onward makes people try to make their own guesses about what can happen with the yellow metal. One of the methods to do that is to look back into past situations and try to estimate if what is happening now is somehow similar to those past events. The situation in the gold market today is different than the one in 1980 in a few important areas. Even if past patterns don’t give you any certainty, though, sometimes they can limit the uncertainty. Let us analyze that in more detail. Words: 1260; Charts: 2

The timing of this article may seem incongruous given the current weak performance of gold and gold stocks but that was the identical situation in each of the past manias – both the metal and the equities didn’t excel until the frenzy kicked in. The following documentation (exact returns from specific companies during this era are identified) is actually a fresh reminder of why we think you should hold on to your positions – or start accumulating them, if you haven’t already. (Words: 1987; Tables: 7)

11. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript> According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

12. The Future Price of Gold and the 2% Factor

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript> It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Furthermore, for every one percentage point real rates differ from 2%, gold moves by eight times that amount per year. So if the real rates are at 1%, gold will move up at an 8% annualized rate. If real rates are at 0%, then gold will move up at a 16% rate (that’s been about the story for the past decade). Conversely, if the real rate jumps to 3%, then gold will drop at an 8% rate. [Let me explain.] Words: 982

It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Furthermore, for every one percentage point real rates differ from 2%, gold moves by eight times that amount per year. So if the real rates are at 1%, gold will move up at an 8% annualized rate. If real rates are at 0%, then gold will move up at a 16% rate (that’s been about the story for the past decade). Conversely, if the real rate jumps to 3%, then gold will drop at an 8% rate. [Let me explain.] Words: 982

13. Nick Barisheff: $10,000 Gold is Coming! Here’s Why

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript>

< p>< p>< noscript> This is not a typical bull market. Gold is not rising in value, but instead, currencies are losing purchasing power against gold and, therefore, gold can rise as high as currencies can fall. Since currencies are falling because of increasing debt, gold can rise as high as government debt can grow. Based on official estimates, America’s debt is projected to reach $23 trillion in 2015 and, if its correlation with the price of gold remains the same, the indicated gold price would be $2,600 per ounce. However, if history is any example, it’s a safe bet that government expenditure estimates will be greatly exceeded, and [this] rising debt will cause the price of gold to rise to $10,000…over the next five years. (Let me explain further.] Words: 1767

This is not a typical bull market. Gold is not rising in value, but instead, currencies are losing purchasing power against gold and, therefore, gold can rise as high as currencies can fall. Since currencies are falling because of increasing debt, gold can rise as high as government debt can grow. Based on official estimates, America’s debt is projected to reach $23 trillion in 2015 and, if its correlation with the price of gold remains the same, the indicated gold price would be $2,600 per ounce. However, if history is any example, it’s a safe bet that government expenditure estimates will be greatly exceeded, and [this] rising debt will cause the price of gold to rise to $10,000…over the next five years. (Let me explain further.] Words: 1767

14. Goldrunner: What We ‘Know’ & ‘Don’t Know’ About Where Gold, Silver and PM Stocks Are Going

One never knows exactly where Precious Metals are going so I always try to keep in mind a list of items that are probable based on the facts that are evident. I call this “what we know” and “what we don’t know” so let’s take a look what we “know” and “don’t know” at this point in time. Words: 872

15. Startling Relationship Between Gold Price & U.S. Gov’t Debt Suggests What Price for Gold in 2017?

The price of gold, on a quarterly basis, is 86% correlated – yes, 86%! – to total government debt going back to 1975… and a shocking 98% over the past 15 years! [As such,] it would seem like a no-brainer investment thesis to buy gold… as a proxy for the not-otherwise-investable thesis that US total government debt will increase in the future. [But there is more – and it is disappointment for gold bugs – read on!]

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money